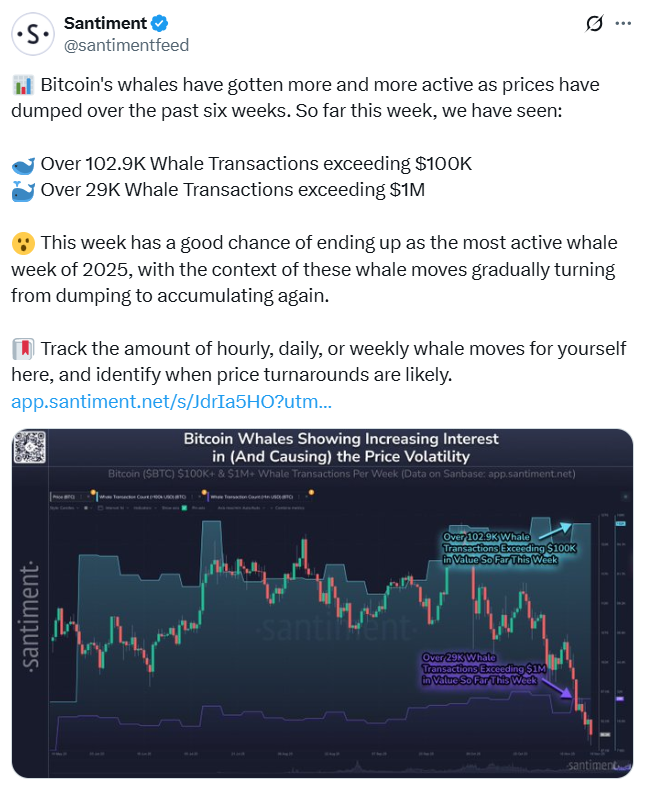

According to market intelligence platform Santiment, Bitcoin whale activity has experienced the highest spike in weekly trading this year, potentially pushing Bitcoin below $90,000.

Santiment said in an X-Post on Wednesday that the increase in whale activity is expanding in tandem with the slump in crypto prices.

Bitcoin (BTC) fell below $90,000 this week for the first time in seven months. Santimento said it has already tracked more than 102,000 whale transactions over $100,000 and is tracking an additional 29,000 transactions over $1 million.

“This week is likely to be the most active whale week of 2025, with whale movements gradually changing from discarding to reaccumulation.”

sauce: Saintly

Some analysts speculate that part of the reason for the crypto market decline is whale sales.

However, according to data from analysis platform Glassnode, the number of large holders has been increasing since late October, and the number of whale wallets holding more than 1,000 Bitcoins has increased significantly since last Friday.

Whales are gaining attention

Pav Hundal, principal analyst at crypto trading platform Swyftx, said in an interview with Cointelegraph that he believes the news cycle has been driving the spike in whale activity over the past year, with a large amount of Twitch trading related to U.S. geopolitical events.

“BTC is rising on the back of Nvidia’s strong results, suggesting that both whales and retailers are stepping in and buying,” he said, adding, “The buy-to-sell ratio across Swyftx’s own order book in early trading was at an all-time high at 10 buys to 1 sell, compared to an average of 3:1. Investors are buying the dip.”

“The market is irrational at the moment. We’ve seen an unprecedented shakeout of short-term holders in recent weeks. Looking at the data, I think this is a mechanical shakeout. This looks like a much-needed washout and reset for the market.”

Bradley Duke, managing director and head of European Bitwise Asset Management, said in an X post on Wednesday that the company has noticed whales buying on the spurts as fear and panic dominate the market.

sauce: bradley duke

“Fear and panic have plagued many investors, but the number of BTC whales has surged recently. Large holders are staying calm and buying at a discount from panic sellers. Stay strong,” he added.

Pattern suggests large-scale forced sale: Multicoin exec

Meanwhile, Tushar Jain, co-founder and managing partner of investment firm Multicoin Capital, said in an X post on Wednesday that he sees a pattern in the sell-off and believes it could end soon.

“It feels like there is a large-scale forced sell-off in the market. We are seeing organized sell-offs at certain times, probably as a result of the 10/10 liquidation. It is hard to imagine a forced sell of this magnitude continuing much longer.”

Bitmine Chairman Tom Lee and Bitwise Asset Management Chief Investment Officer Matt Hogan predicted on Monday that Bitcoin could bottom as soon as this week.