Bitcoin (BTC) price volatility has skyrocketed over the past two months, suggesting the market could return to options-driven price action that causes large moves in both directions.

Since Bitcoin ETFs were approved in the U.S., Bitcoin’s implied volatility has never exceeded 80%, said Jeff Park, a market analyst and advisor at investment firm Bitwise.

However, the chart shared by Park shows that Bitcoin’s volatility has gradually returned to around 60 as of this writing.

Historical BTC volatility levels show a significant spike ahead of Bitcoin exchange-traded funds being approved in the US market in 2024. source: jeff park

Park cited Bitcoin’s explosive price action in January 2021 and the beginning of the 2021 bull market, which took BTC to a new all-time high and cycle high of $69,000 in November of the same year, as the last major options-driven meltup. he said:

“Ultimately, it is option positioning, not mere spot flows, that will create the decisive move that will propel Bitcoin to new highs. For the first time in almost two years, the volatility surface may be flickering, an early sign that Bitcoin may once again become options-driven.”

This analysis refutes the theory that the presence of ETFs and institutional investors permanently smoothed out Bitcoin’s price fluctuations, shifting the market structure to reflect a more mature asset class, reinforced by passive inflows from investment vehicles.

Related: ‘Volatility is your friend’: Eric Trump isn’t bothered by Bitcoin or crypto carnage

Volatility rises amid market carnage, raising concerns of prolonged economic downturn

According to Binance CEO Richard Teng, the increase in volatility in the BTC market is consistent with levels across all asset classes.

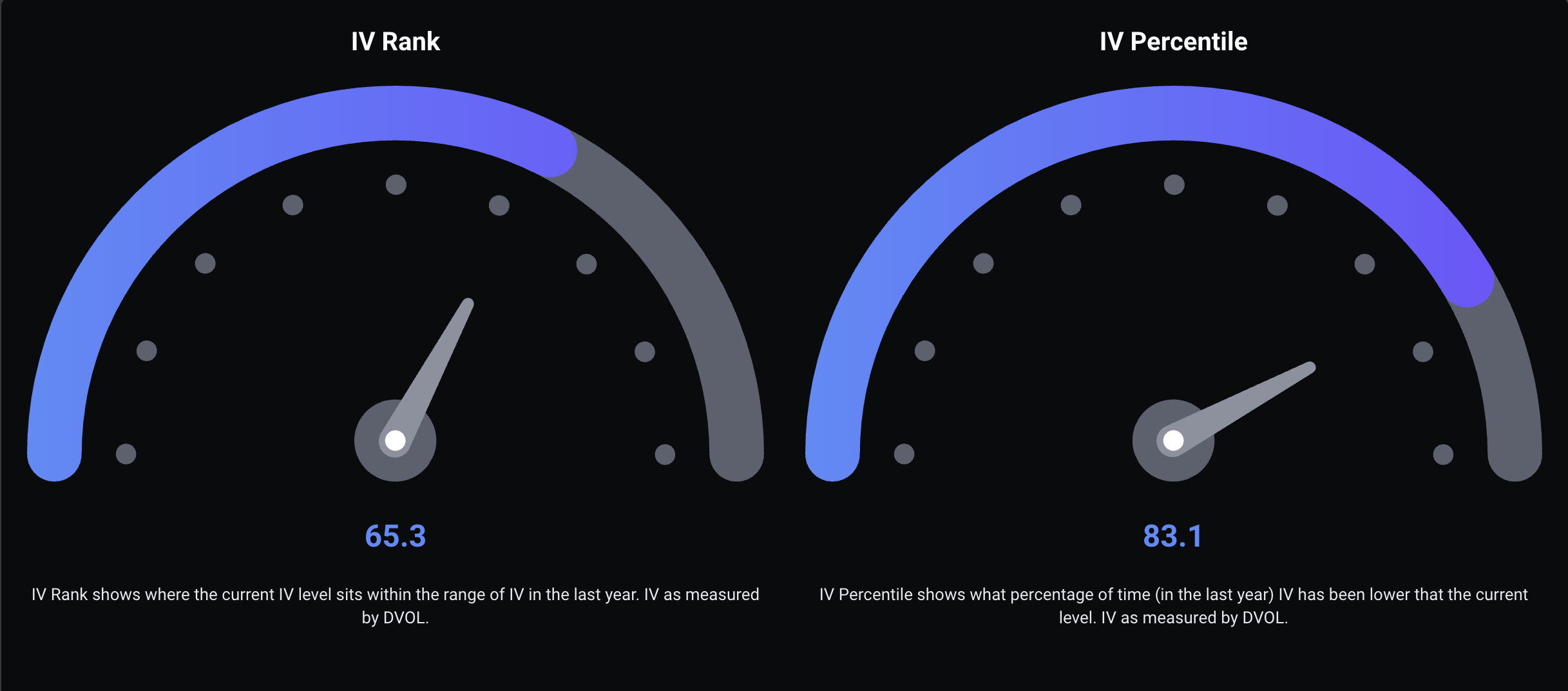

Rank and percentile of Bitcoin’s implied volatility compared to historical levels. sauce: will be ridiculed

Bitcoin crashed below $85,000 on Thursday, sparking fears that it could fall further in the coming weeks and start another Bitcoin bear market.

Analysts have offered several theories as to the cause of the economic downturn, including the liquidation of highly leveraged positions in derivatives markets, long-term BTC holders cashing out, and macroeconomic pressures.

Analysts at crypto exchange Bitfinex say Bitcoin’s continued decline is due to short-term factors, suggesting a “tactical rebalancing” rather than a flight of institutional investors or a lack of demand.

Analysts said this does not derail Bitcoin’s long-term fundamentals, price growth, or institutional adoption trends.

magazine: Bitcoin “another big push” to $150,000, ETH pressure increases: trade secrets