The BTC (Bitcoin) financial company faces a somewhat important market premium for BTC Holdings’ basic market premium due to a decrease in volatility and a rapid slowdown in new purchases.

In particular, these companies’ monthly BTC purchases have reflected very careful market approach in recent months with 97% collapse since November 2024. But recent data in Cryptoquant suggests the need for immediate strategy changes.

Bitcoin volatility falls threaten the value of the Bitcoin Treasury.

In general, Bitcoin Treasuries is traded as a premium. In other words, the market value exceeds the actual value of their BTC. Investors believe that these companies can increase their stakes, manipulate volatility, and play a safe role in the best cryptocurrency. Therefore, the market net asset value (MNAV), which compares the company’s stock price with NAV owned by Bitcoin, is always greater than 1.

However, Julio Moreno, Cryptoquant Research Director, has removed the main driver of the premium because the Treasury’s volatility has fallen to the lowest level of many years every year, and the Treasury has reduced the opportunity to utilize price fluctuations and justify the value of the basic BTC.

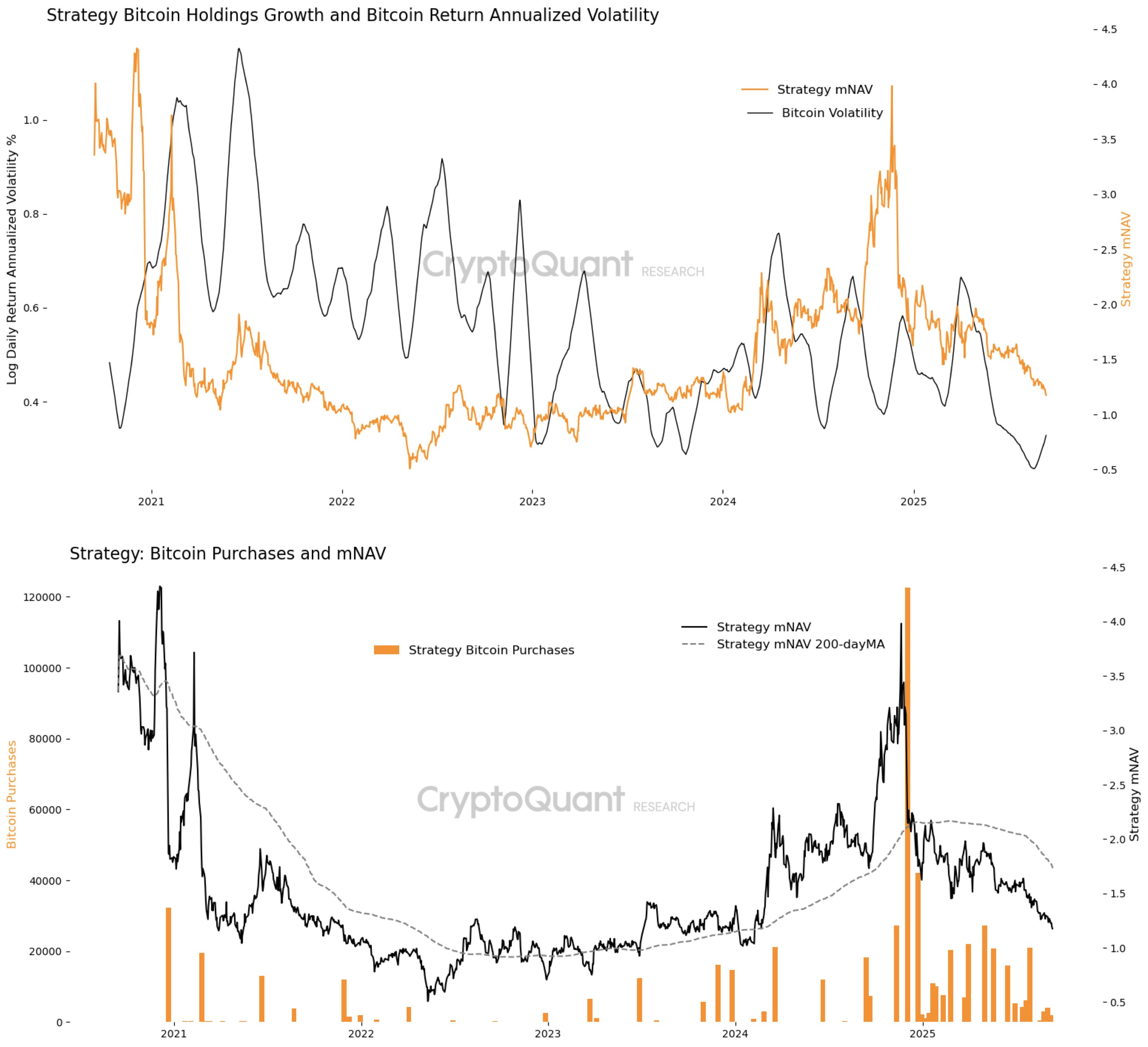

When analyzing strategic market data, the largest company BTC owner, it can be observed that MNAV has produced a surge in MNAV in early 2021, especially in mid -2024, especially in mid -2024, especially in mid -2024. In these windows, financial companies were able to generate volatility, raise capital or liabilities with premiums, and place the proceeds in a quick BTC purchase.

However, the current volatility has reached the lowest level since 2020, compressed into less than a daily return of 0.4 logs annually. The flat volatility curve has fallen to 1.25 in line with the steady decline of MNAV. This narrow premium suggests that investors no longer see the financial company as simply providing a meaningful leverage for owning Bitcoin.

Demand weakening weakens the problem of the Complex Treasury.

If there is no “fuel” of the price swing, Bitcoin Treasury Company is trying to expand its stake by justifying premium evaluation. In the late 2024 and early 2025, there was an isolated rupture of the purchase, but the overall activity was still muted.

As a result, the MNAV of the strategy has been down since early 2025, despite the fact that BTC itself has been traded in a relatively high price range in recent years. The data suggests that when the Treasury is actively purchasing, the investor’s passion pushes the MNAV higher to strengthen the premium issue and the BTC accumulation.

Julio Moreno explains that in order for the MNAV premium to continue, demand is needed immediately through the rebound of BTC volatility and large -scale purchases. Until then, financial firms are getting more and more difficult to justify more than Bitcoin net asset value, so investors can force them to be directly exposed to Bitcoin for profits, not corporate strategies.

Bitcoin is $ 115,810 in the press time, reflecting a 4.72%profit last week.

PEXELS’s main image, TradingView chart

Editorial process focuses on providing thorough research, accurate and prejudice content. We support the strict sourcing standard and each page is diligent in the top technology experts and the seasoned editor’s team. This process ensures the integrity, relevance and value of the reader’s content.