BTC$109.503,67 It’s just finished what was historic largest cryptocurrency week, with a above average drop of 5%. Week 38 effectively concludes the third quarter and September, which are up about 1%.

The numbers match the historical reputation of the era as one of the weakest seasons of the year, but some catalysts may have contributed to a decline in performance.

On Friday, more than $17 billion in options expired, with the biggest pain price (the strike price where option owners most money and option writers most profitable is $110,000, which served as a gravity center for spot prices.

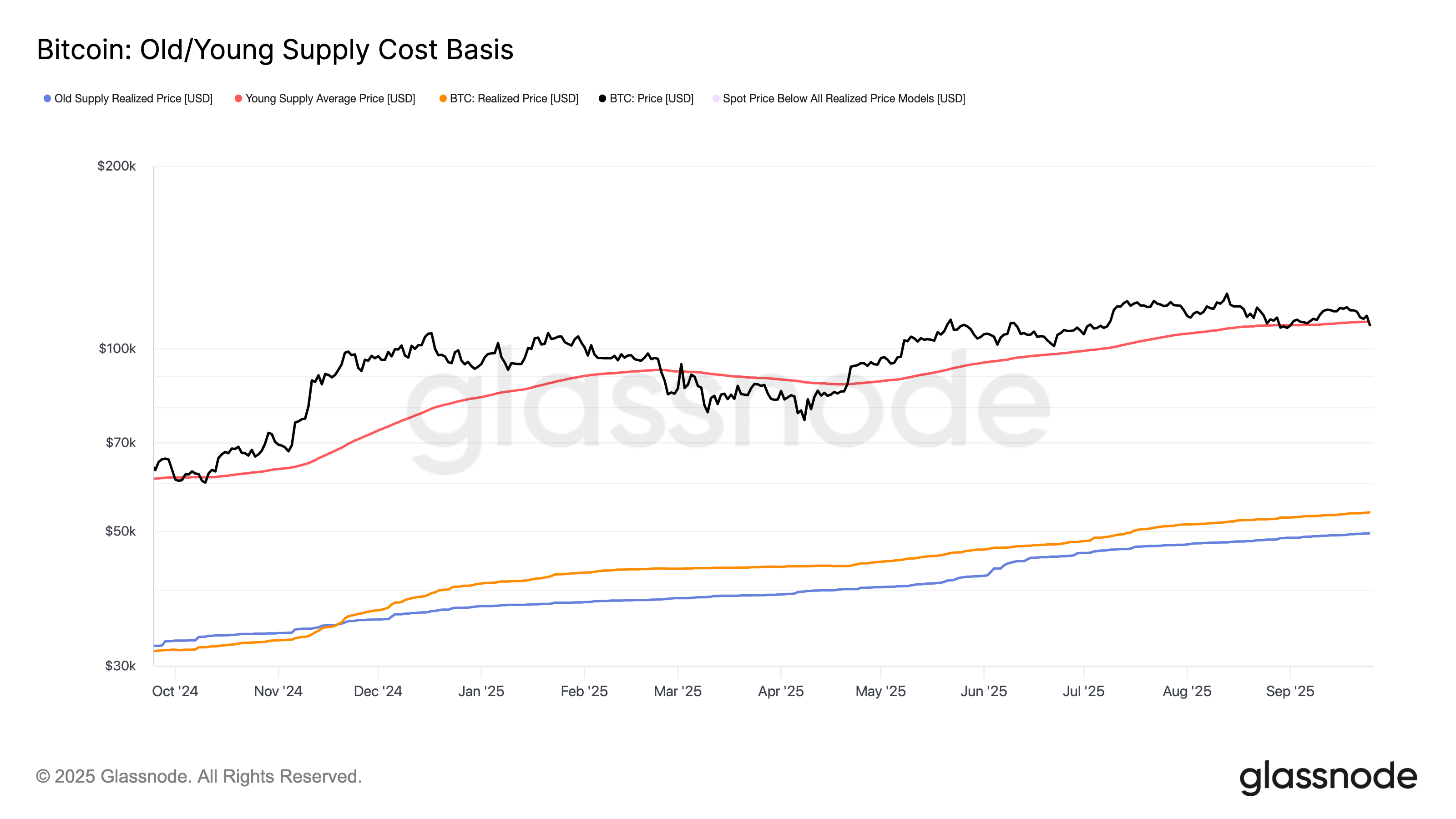

The key technical factors remained at the short-term holders’ cost basis of $110,775, reflecting the average on-chain acquisition price of coins moved over the past six months.

Bitcoin tested this level in August, and at Bull Market, it usually moves towards this line multiple times. This year, it’s only been below that level once.

Zooming out, it’s important to assess whether Bitcoin remains on an uptrend featuring higher and higher lows to see if the rally is sustainable.

Analyst Caleb Franzen highlights that Bitcoin has fallen below the 100-day Exponential Moving Average (EMA), with a 200-day EMA sitting at $106,186. The previous significant low was around $107,252 on September 1, and Bitcoin needs to exceed that level for the broader trend to remain intact.

Macro background

The US economy grew at a rate of 3.8% per year in the second quarter, far surpassing its 3.3% estimate and its strongest performance since the second quarter of 2023. Early unemployment claims fell from 14,000 to 218,000, down from expectations since mid-July, reaching the lowest level. The spending data was in line with market expectations. The US Core PCE Price Index is a favourable measure of the Federal Reserve on fundamental inflation excluding food and energy, up 0.2% from the previous month in August 2025.

The 10-year U.S. Treasury yields have bounced back from 4% support and are currently trading nearly 4.2%. Dollar Index (DXY) continues to provide long-term support at 98. Metal, meanwhile, is leading the action, with silver approaching around $45 at the highest level ever seen in 1980 and 2011.

Bitcoin remains an outlier that is more than 10% below its peak.

Stocks exposed to Bitcoin

Bitcoin finance companies continue to face severe multiple asset value (MNAV) compression. Strategy (MSTR) has been barely positive since the beginning of the year. At one point it fell below the 2025 negative return of $300.

The Strategy and BlackRock Isshares Bitcoin Trust ETF (IBIT) ratio is at a minimum of 4.8 since October 2024, indicating that the largest Bitcoin finance company has been performing Bitcoin in the last 12 months.

MSTR / Google GO (TradingView)

Strategy’s Enterprise MNAV is currently 1.44 (as of Friday). Enterprise Value here sells all the basic stocks that are publicly available.

The silver lining of the MSTR means that all lifetime returns are present as three of the four permanent preferred stocks, STRK, STRC and STRF, are looking to buy more BTC through these vehicles.

The growing problem in MSTR is the lack of volatility in Bitcoin. The implicit volatility of cryptocurrencies – a measure of market expectations for future price fluctuations – fell below the lowest 40 in the year.

This is because Saylor often assembles MSTR as a volatility play on Bitcoin. For comparison, the implicit volatility of MSTR is 68. The annual standard deviation of daily log returns over the past year was 89%, but has dropped to 49% over the past 30 days.

In the case of stocks, a decline can serve as a headwind, as higher volatility often attracts speculators, creates trading opportunities and attracts investors’ attention.

Meanwhile, Metaplanet (3350), the fifth largest Bitcoin financing company, holds 25,555 BTC and still has around $500 million left to deploy from international products. Despite this, its stock continues to struggle at 517 yen ($3.45), falling 70% below its all-time high.

Metaplanet’s MNAV has dropped sharply from 8.44 in June to 1.12. The market capitalization is currently at $3.94 billion compared to the $2.9 billion Bitcoin NAV, with an average BTC acquisition cost of $106,065.