Bitcoin (BTC) is showing renewed strength after weeks of volatility and uncertainty, reclaiming the $115,000 level. Bulls are looking to gain momentum on the upside of the underlying impulse, with the aim of confirming a sustained bullish structure after the recent consolidation phase.

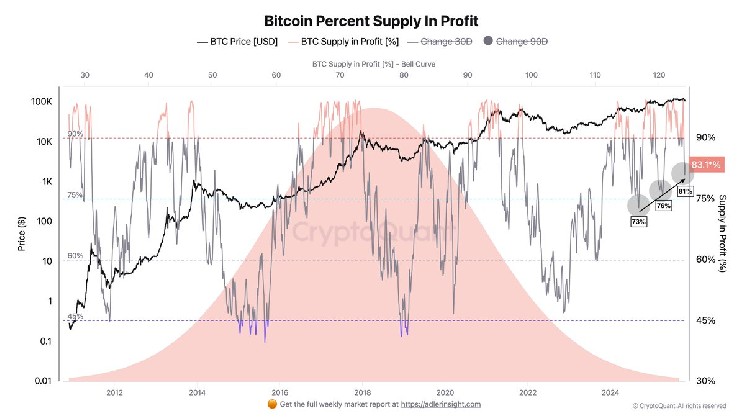

On-chain data continues to reveal clear repeating patterns related to investor behavior and market cycles. Historically, when Bitcoin supply as a percentage of profits exceeds 95%, the market tends to enter an overheating phase, often leading to a sharp correction. These declines act as natural cooling-off periods, resetting sentiment and liquidity before the next significant rally.

Interestingly, each correction cycle shows a consistent bottom zone around the 75% threshold where long-term holders re-accumulate and market confidence begins to rebuild. More specifically, the data highlights a recovery in earnings supply from lows of 73% in September 2024, 76% in April 2024, and 81% recently, suggesting a possible mid-cycle recovery phase.

Bitcoin supply as a percentage of profits rises to 83.6% — momentum rebuilds ahead of key threshold

According to top analyst Dirkforst, the share of Bitcoin supply in profits has started to rise again, now at 83.6%. This steady rise indicates that a proportion of Bitcoin holders are once again holding unrealized gains, a trend that often reflects improving sentiment and a return to market confidence.

Dirkforst notes that this level can be interpreted as encouraging, suggesting that investors are willing to hold on to BTC in exchange for realizing profits and expect further upside in the short term. Historically, such behavior has been characteristic of mid-cycle recovery phases when fear begins to fade and accumulation resumes in both the retail and institutional sectors.

This stage of the cycle is considered healthy for rebuilding momentum as it can stabilize the market after a major correction. Previously capitulated holders often re-enter at this stage, with long-term participants consolidating their positions and creating a more resilient market structure.

However, Dirkforst warns that when the supply of profits exceeds 95%, it usually indicates overheated market conditions, and that euphoria tends to replace rational certainty at this point. In situations like this, Bitcoin has historically faced increased volatility and sharp corrections as overleveraged traders and short-term speculators take profit.

BTC retests $115,000 resistance: bulls regain momentum

Bitcoin (BTC) is showing fresh bullish momentum, trading near $115,443, successfully reclaiming a key short-term support level after weeks of consolidation. The daily chart highlights a strong recovery structure, with BTC above both the 50-day and 100-day moving averages, indicating a change in market sentiment in the short term.

The next important test lies at $117,500, a historic resistance zone that previously rejected multiple attempts in September and early October. A clear breakout and daily close above this level would likely confirm the continuation of the impulse towards $120,000-125,000 and open the door to a more sustained uptrend.

Momentum indicators suggest strong buying pressure, while the recent rebound from the 200-day moving average near $107,000 underscores the market’s resilience. This level serves as the starting point for the current rally and is consistent with the broader accumulation pattern seen on-chain where investor profitability is steadily rising.

However, BTC is still in a range-bound structure and a rejection at $117.5,000 could trigger a consolidation towards $111,000-112,000 in the short term. Overall, Bitcoin’s technical outlook appears to be constructive. If the bulls sustain above $115,000 and confirm strength above $117,000, the market could move into a new bull market supported by improving investor sentiment and on-chain health.

Featured image from ChatGPT, chart from TradingView.com