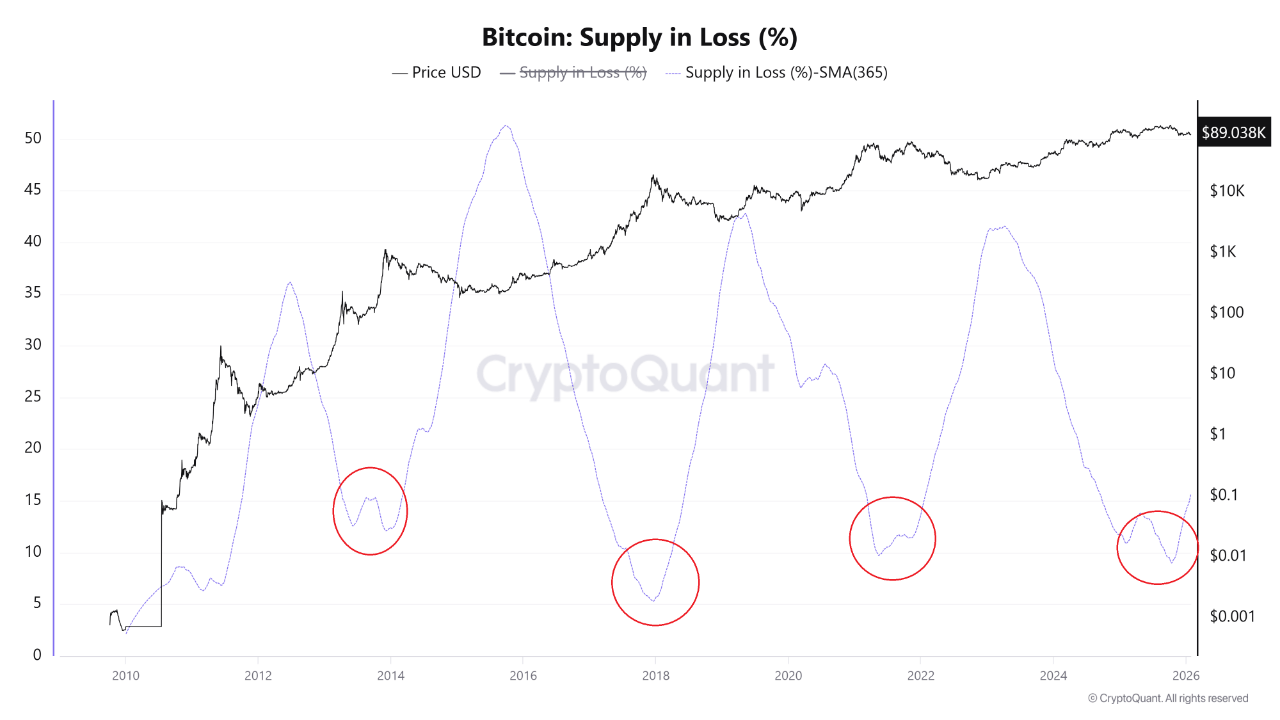

On-chain data shows that the Bitcoin supply-loss indicator has witnessed a change in direction and has often fallen into bearish phases in past cycles.

The 365-day SMA of Bitcoin supply loss has been rising recently.

As noted by analysts in the CryptoQuant Quicktake post, Bitcoin supply is on the rise again during losses. This metric, as its name suggests, measures percentage of total. $BTC Distribution supply currently has a net unrealized loss.

This indicator works by scanning the trading history of each token in circulation to determine the last price it traded on the network. If the previous trading value of any coin was higher than the latest spot price, the metric assumes that particular token is underwater.

Loss supply adds up all the coins that fall into this category and finds what part of the supply it replaces. The corresponding indicator, known as profit supply, tracks the opposite type of supply. However, the total supply must add up to 100%, so the profitable supply is simply equal to 100 minus the losing supply.

Here is a graph showing the trend of the 365-day simple moving average (SMA) of Bitcoin supply losses over the history of the cryptocurrency.

As shown in the chart above, the 365-day SMA Bitcoin supply loss plummeted to the lowest point of the cycle in October. This plunge occurred at a time when the asset hit a new all-time high ($ATH) is above the $126,000 level.

However, since the low, the stock has seen a rapid rise, which is a result of bearish momentum. $BTC I then faced $ATH. So far, this indicator has not risen to significant levels compared to historical capitulation levels, but a change in direction is becoming certain.

“Historically, this change signals the early stages of a bear market, where losses begin to spread beyond short-term holders and gradually reach long-term participants,” the quant explained. From the chart, we can see that bearish transitions occurred in past cycles as the indicator rose sharply, and its high values coincided with cycle bottoms.

It remains to be seen whether the recent reversal of supply losses is the beginning of something similar. Early in this cycle, the indicator’s uptrend was short-lived as the drawdown in the first half of 2025 gave way to new bullish momentum rather than a prolonged bearish phase.

$BTC price

At the time of writing, Bitcoin was trading at around $89,000, up more than 1% in the past 24 hours.

Featured image from Dall-E, chart from TradingView.com