Bitfinex analysts said Bitcoin buyers were hit hardest by recent Crypto Market sales in their purchase last month.

Bitcoin (BTC) dropped 13.5% of its value in the last 30 days, down more than 29% from its biggest correction in January, the highest ever set in January, according to the Bitfinex Alpha report released on March 17th.

Past cycles have witnessed similar drawdowns ranging from 30% to 50%. However, some people were hoping for a different outcome this time, due to the new institutional adoption via the Spot BTC Exchange-Traded Funds on Wall Street.

The US Spot BTC ETF recorded over $100 billion in assets under management within a year as issuers such as BlackRock and Fidelity attracted a massive capital inflow.

You might like it too: North Korea jumps Bhutan in El Salvador at Bitcoin Holdings after Bitcoin Hack

Short-term Bitcoin Holder Suspends

Cash allocated to these EFTS has been reduced over the past few weeks, but records have been set due to consecutive outflows. Nearly $1 billion left these products last week, signaling that “the facility’s buyers have not yet returned, strong enough to curb sales pressure,” Bitfinex analysts wrote.

The lukewarm price action also rattles the code sentiment. Bifiniex reports that as short-term holders surrendered, indicators like the Fear & Greed Index fell to multi-year lows.

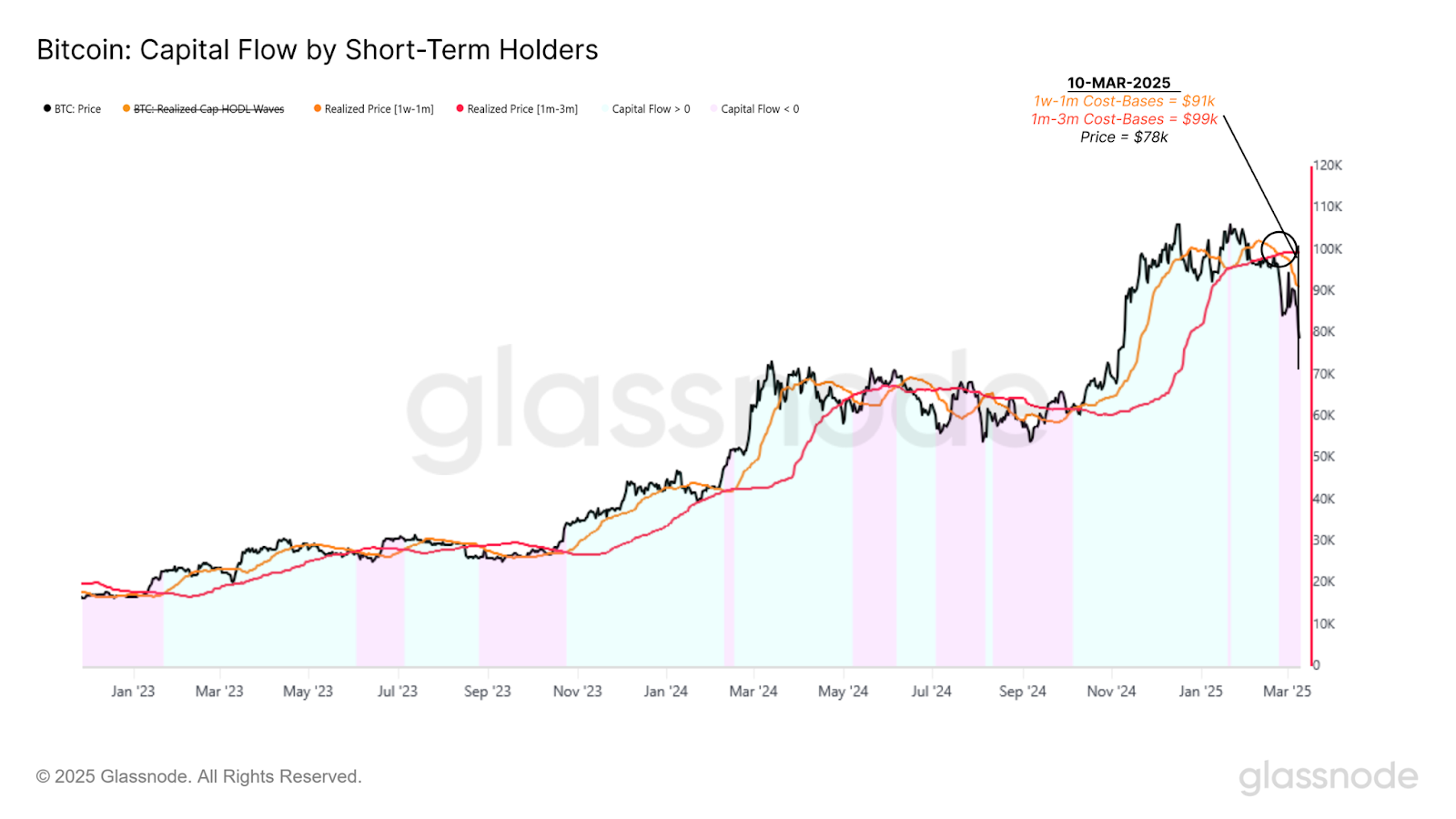

BTC Capital Flow by Short-Term Holders | Source: GlassNode

IntotheBlock data now supports assertions from Bitfinex analysts. The “Global In/Out of Money” metric showed 20% of all BTC holders with unrealized losses. Most of these buyers purchased Bitcoin between $85,700 and $106,800 per into theblock.

Historically, slower fresh capital inflows and changing cost-based trends indicate weaker demand environments. This trend is becoming increasingly apparent as Bitcoin struggles to surpass key levels. Bitcoin risks extending integration without the need for new buyers to intervene. Or it becomes even more downsided as the weaker hands continue to finish their position.

Bitfinex Analyst

Possible turnarounds

More downside price actions could occur as financial markets digest Trump’s tariffs and the results of US macro data.

Inflation has cooled and the job market has shown signs of resilience, but the lack of employment and increased macro uncertainty have encouraged handoff approaches from many investors. However, Bitfinex analysts believe bullish results are still possible if the correct factors match.

An important factor to look at is whether long-term holders or institutional demand will re-emerge at these lower levels. As deeper out-of-pocket investors begin to absorb supply, they could indicate a shiftback to accumulation, stabilizing price action and reverse emotions.

read more: Standard Chartered Slash ETH Price Target forecasts 60%, $4K per year end