Establishing National Bitcoin (BTC) strategic preparation could create negative market impacts for BTC and the US dollar, according to Haider Rafique, global managing partner for government and investor relations at Crypto Exchange OKX.

Rafique told Cointelegraph that the government, which holds a key portion of the BTC supply, can manipulate prices by dumping its holdings into the market, thereby disrupting the core proposition of BTC as neutral and decentralized money.

He asked: “If the new administration decides this is a bad idea, what will happen in a few years?” Rafique was added:

“It is essential to remember that despite recent bipartisan crypto support, management policies can change rapidly. As things change over time, the concentration of large quantities of BTC on the national balance sheet can represent liquidation risk.”

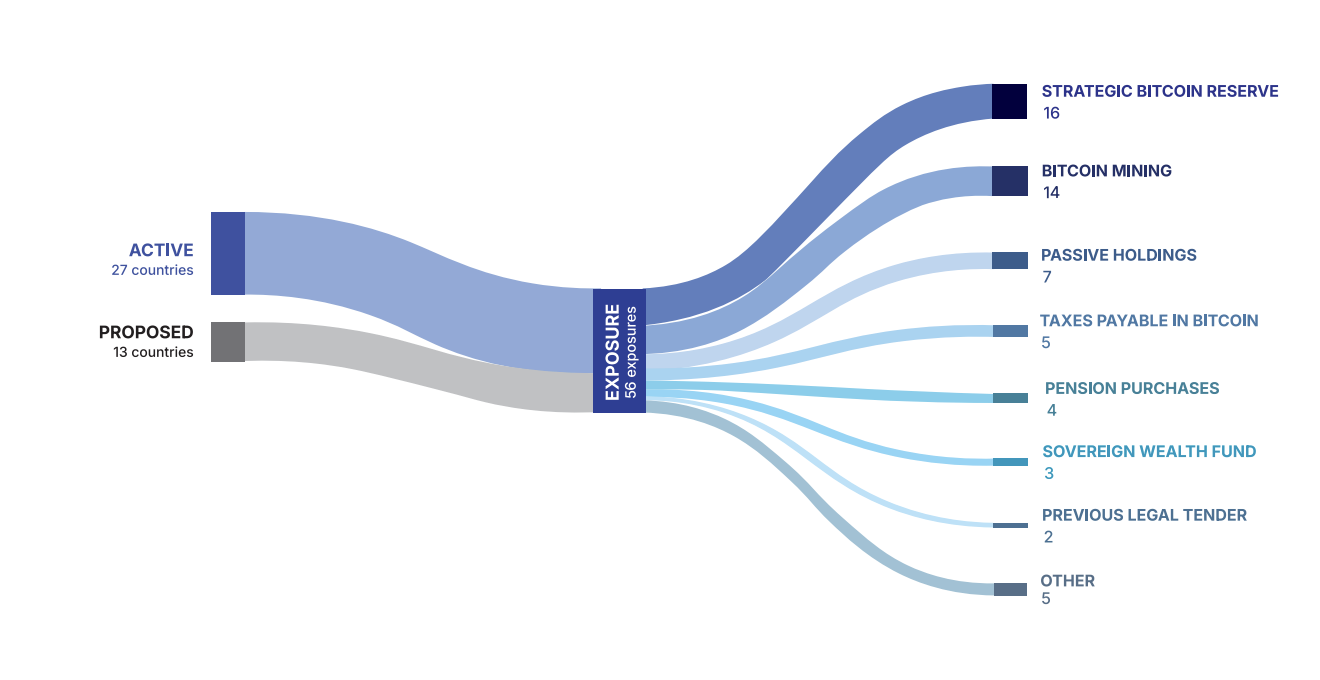

Breakdown of nation-state exposure to Bitcoin. sauce: Bitcoin Policy Research Institute

The German government was the example of dropping 50,000 BTC in 2024, with prices below the $60,000 level, Rafique said.

Bitcoin’s strategic reserves continue to be the best for many Bitcoin supporters, and it says that establishing such a national level BTC Treasury is the next step to making Bitcoin a global reserve currency and standard monetary unit.

Related: US lawmakers tap siloler to advance the Bitcoin Reserve Building

Risks to the US Dollar and Other Financial Markets

Establishing a strategic reserve for Bitcoin could create a contagion that is not limited to the crypto market but is widespread macroeconomic effects, Rafique told Cointelegraph.

“The most important macroeconomic implication is the loss of trust in the dollar,” he said.

https://www.youtube.com/watch?v=puxcqdo30jo

The creation of a Bitcoin reserve, he added, shows that the US dollar, which supports the global economy, is weak and cannot maintain its value alone.

This could send shockwaves throughout the financial system as investors escape the US dollar for safe inventory assets such as gold and Swiss franc, Raffick said.

He concluded that investors will also dump risk-on assets and create a cascade of liquidation across financial markets, where the market will likely culminate in a major crash, as they respond to earthquake changes in global finance.

magazine: We risk being “front run” in Bitcoin reserves by other countries: Samson Mo