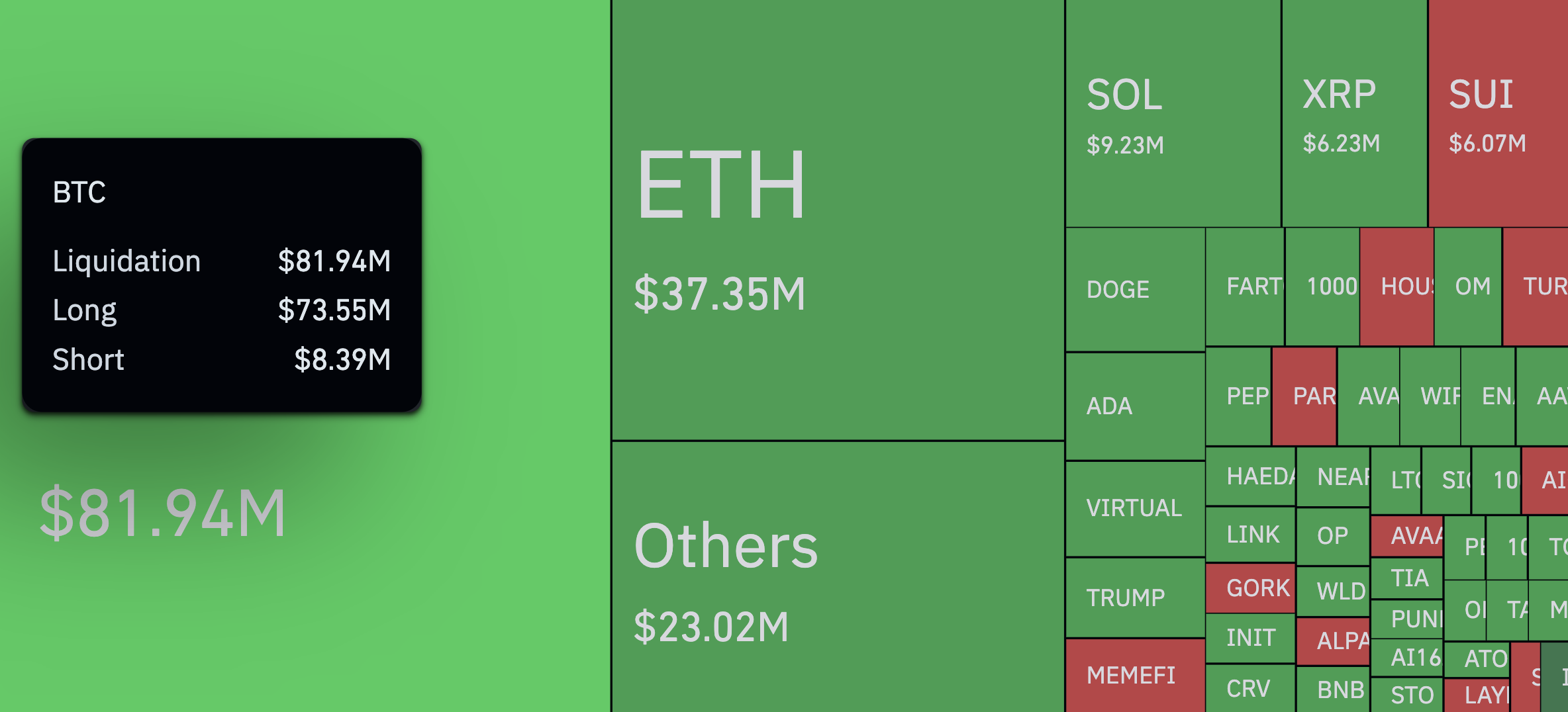

In the last 24 hours, Bitcoin (BTC) traders have faced $8194 million in liquidation, of which $73.55 million came from a long position. Shorts? It’s only $8.39 million. It’s a 9-to-1 imbalance (900% spikes that prefer one side), and welcome to one of Bitcoin’s most extreme biased liquidation events these days.

It happened as part of a larger trend in crypto space liquidation. In total, the $209.97 million position was cleared in just one day, hitting over 74,000 traders. Like Bitcoin, Longs was borne the brunt of damage. These are $16703 million and $42.94 million shorts.

Ethereum (ETH) was also unavailable, with the liquidation totaling $37.35 million. Solana (Sol) and XRP continued at $9.23 million and $6.23 million, respectively. These numbers are not normal in themselves, but they lean towards long liquidation across almost every major token.

The 12-hour window showed $855 million in a long liquidation of $855 million in $26.84 million.

It’s interesting that this all happened without a major price drop. Bitcoin and other top cryptocurrencies have soaked it, but it’s not enough to explain this level of washout. That’s how difficult this market is usually – it’s not just the movement itself, but the position behind it that can actually do some damage.

According to Coinglass, the biggest liquidation was $2.36 million from HTX’s ETH/USDT pair. For now, it’s hard to say whether this is any kind of reset or a sign that the market is in a bad state.