- Bitcoin should stay at $82,000 or more to avoid liquidation and volatility increase after Bitcoin reserve

- Investor sentiment has weakened after Trump’s Bitcoin Reserve Plan ruled out new BTC purchases.

- Future US economic data, including CPI and job reports, could affect Bitcoin prices.

Bitcoin’s price trajectory is at risk as it centers around a critical $82,000 support level. Analysts warn that weekly proximity below this level could trigger a liquidation of leverageding in exchange. This will lead to increased volatility in the crypto market.

Trump’s Bitcoin Reserve and Market Reaction

Recent weakness in prices follows an executive order signed by then-President Donald Trump on March 7th. The order outlined a proposal to establish a strategic Bitcoin reserve in the United States using seized Bitcoin from criminal cases.

The move has disappointed investors who were eagerly waiting for a full purchase of federal Bitcoin as a demonstration of institutional approval. Bitfinex analysts said the lack of aggressive government investment led to short-term bearish sentiment, which contributed to the decline in Bitcoin prices.

“Investors wanted the federal accumulation to be a sign of robust institutional support to increase prices, but using the holdings based on today has allowed expectations to remain curtailed. Bitfinex analyst explained.

Macroeconomic development

Apart from regulatory decisions, Bitcoin prices remain affected by macroeconomic development. Nexo analyst Iliya Kalchev said the short-term price of Bitcoin will be affected by future US releases.

Next week, everyone will hold their breath for the Consumer Price Index (CPI) and job posting reports. These numbers inform us of inflation trends and labor market health, and it will affect investors’ feelings.” Karchev said.

If inflation slows down and labor market conditions worsen, expectations for interest rate cuts could increase. This is beneficial for Bitcoin as a diversifying vehicle. Alternatively, economic news that is stronger than planned could continue to put downward pressure on Bitcoin prices.

Technical indicators

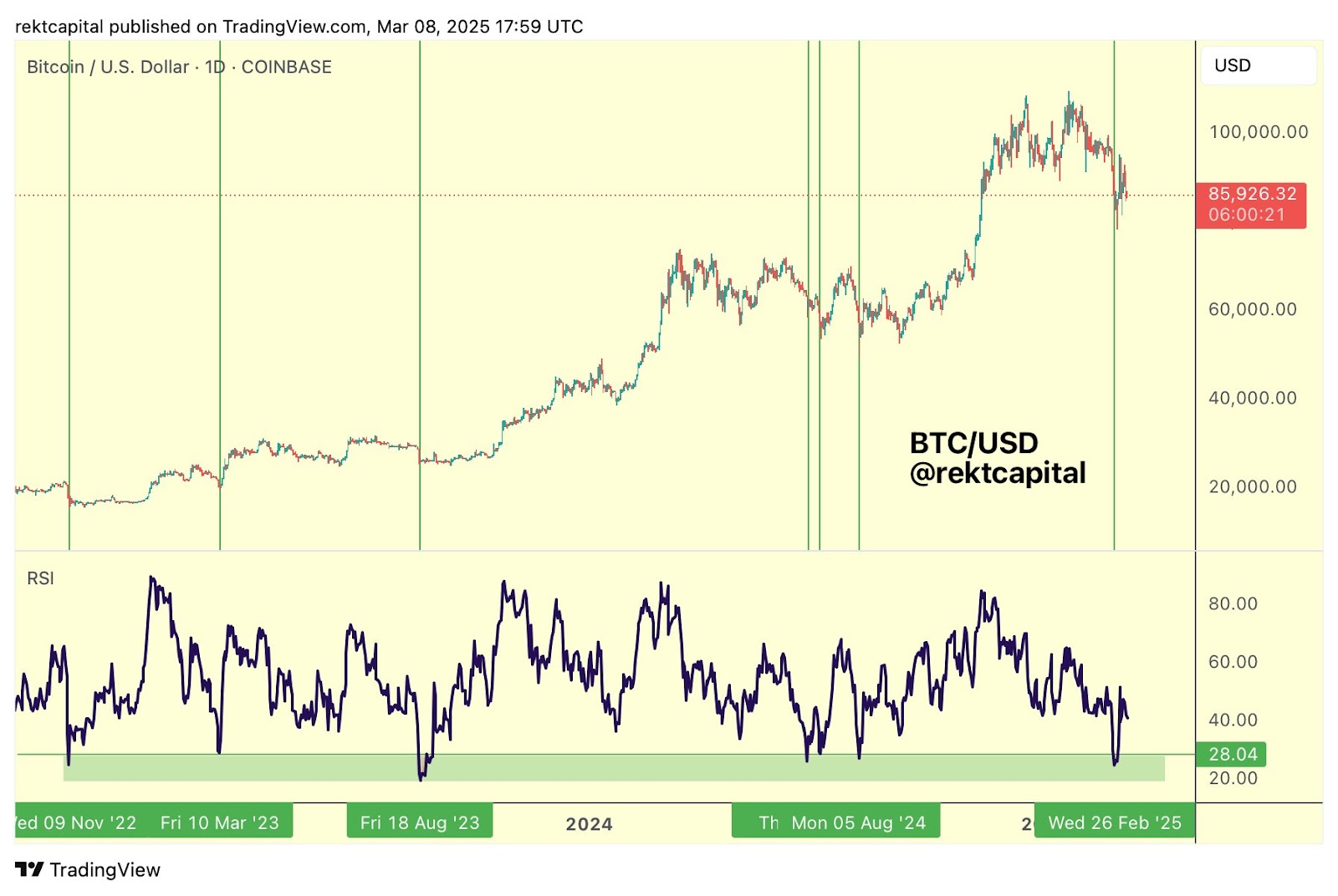

Despite its bearishness, some technical indicators say Bitcoin is near the local bottom. Relative Strength Index (RSI), or measurement of whether an asset is over-acquired or over-acquired, reads 28 on a daily chart. Historically, whenever Bitcoin’s RSI is around this number, prices have either bottomed or fallen within 2% to 8% of doing so.

If Bitcoin finishes a week beyond $82,000, it will help you send a message to change your emotions and correct investor trust. However, the lower break brings more volatility to the lower side, so traders and investors hold their breath for it to happen.

The market is handling Trump’s preliminary approach to Bitcoin and macroeconomic development. So everyone will sit and wait and observe if Bitcoin will maintain its critical support level for the next few days.