As Bitcoin hit new highs over the weekend, analysts are calling for a new phase of accumulation that could accelerate the rally to $150,000 by the end of the year.

Bitcoin (BTC) has hit a new all-time high of over $125,700, and its market capitalization briefly surpassed the $2.5 trillion milestone for the first time in crypto history, Cointelegraph reported early Sunday.

The rally was supported by multiple macroeconomic factors, including the recent U.S. government shutdown, the first since 2018, which some analysts say has renewed interest in Bitcoin’s role as a store of value.

Fabian Dori, chief investment officer at digital asset banking group Sygnum Bank, said similar situations have led to “major price milestones” in the past.

The US government shutdown has “reignited the debate over Bitcoin’s role as a store of value as political dysfunction highlights interest in decentralized assets,” Dori told Cointelegraph. “At the same time, a broader environment characterized by loosening liquidity, accelerating service-driven business cycles, and narrowing underperformance relative to equities and gold is drawing attention to digital assets,” he added.

BTC/USD, year-to-date chart. Source: Cointelegraph/TradingView

However, Jake Kenneth, senior research analyst at Nansen, told Cointelegraph that the extent of the tailwind the government shutdown will have on the crypto market will ultimately depend on how it affects the view of the US Federal Reserve’s interest rate decisions.

“Crypto markets could benefit from a closure resolution if uncertainty is reduced and the Fed moves toward a more dovish stance,” Kenneth added.

While some analysts see the government shutdown as a sign of a possible bottom for the crypto market, Kennis said it is “premature to call this a bottom for the domestic market” as confirmation would require “weeks of stability above key support levels.”

Related: Bitcoin ETF launches ‘Uptober’ with $3.2 billion in second-best week in history

Bitcoin enters a new accumulation phase

Some analysts see Bitcoin’s recent growth as a sign of a new phase of accumulation by large corporations, as on-chain data suggests less selling pressure from whales.

“Market data indicates that the current price movement may be related to an accumulation phase,” said Signim Bank’s Dori.

“Selling pressure from long-term holders appears to be easing, while short-term investors are showing signs of stabilizing after some realized losses.”

He added that historically Bitcoin’s big gains have been preceded by periods of “calming speculative activity and stabilization of positioning.”

Related: Cryptocurrency trader turns $3,000 into $2 million as meme coin soars by CZ Post

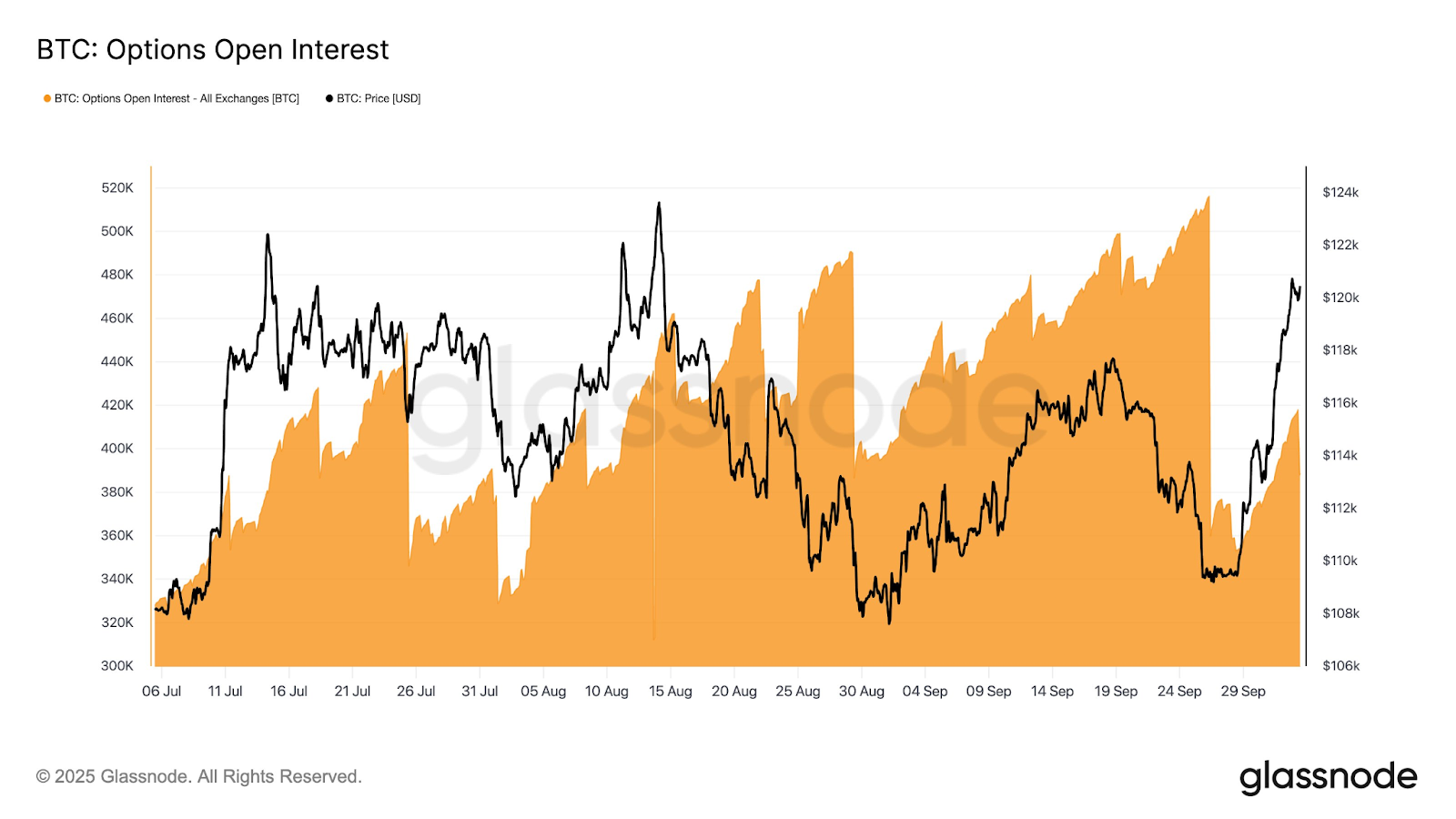

Meanwhile, Bitcoin’s open interest “reset sharply” after last week’s options expiry, potentially “setting the stage” for the fourth quarter, according to blockchain data platform Glassnode.

sauce: glass node

Charles Edwards told Cointelegraph at Token 2049 that a slowdown in speculative activity could draw more attention to Bitcoin, reinforcing analysts’ predictions for a breakout to $150,000 in the fourth quarter of 2025 if Bitcoin can maintain its momentum above the key psychological level of $120,000.

https://www.youtube.com/watch?v=-CpXXSNaN8s4

magazine: Bitcoin sees ‘another big push’ to $150,000, ETH pressure increases