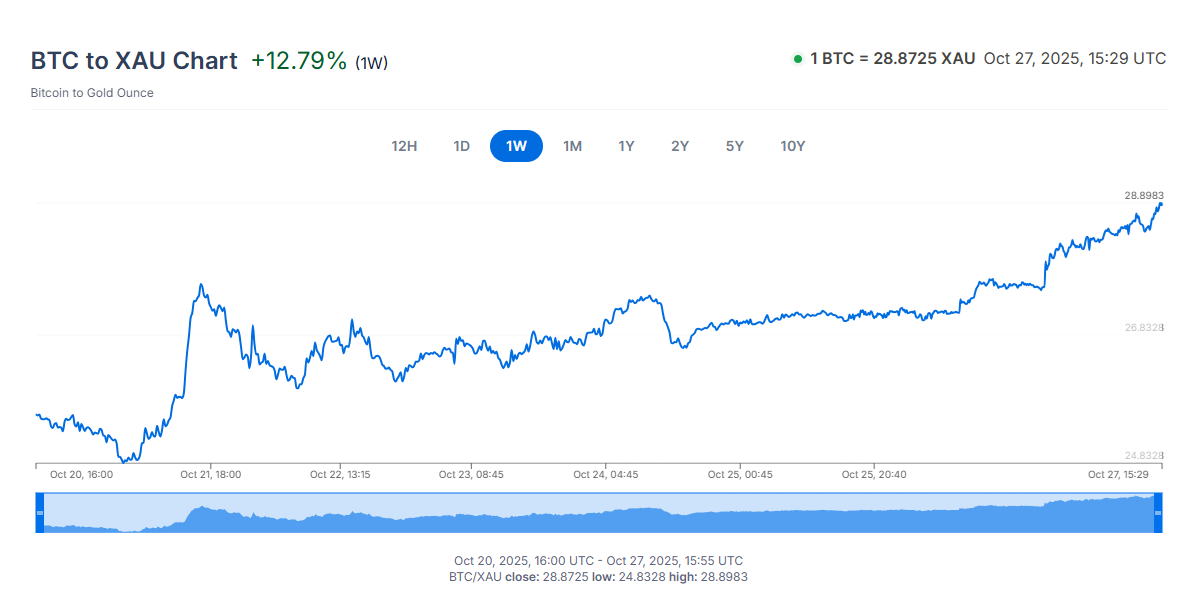

BTC takes a stronger position against gold and can buy 28 oz. This turnaround came as spot gold dipped below $4,000 while BTC rallied above $115,000.

1 BTC is currently buying just over 28 ounces of gold after precious metal prices fell below $4,000. Spot gold traded at $3,987.28, extending its decline from last week. While both BTC and gold are considered part of the “down trade,” these assets have also seen speculative trading near their recent highs.

BTC rose against gold and returned to November 2024 levels. Source: XE

As a cryptopolitan reported Previously, the rise in gold was seen as a hedge against other volatile assets, but the price record contained significant risks. Gold is down 9% from its recent highs, but has fallen more than 12% against BTC over the past week.

During the recent market downturn, BTC was considered to be undervalued relative to gold. This could potentially rebalance the market capitalization of the two assets. The entire market capitalization of gold is also seen as a potential target for BTC, especially if it becomes more widely adopted as a reserve asset.

After a period of turmoil for both gold and BTC, the assets have returned to proportions not seen since November 10, 2024. After purchasing up to 32 ounces of gold as of October 5th, BTC is still declining on a monthly basis. However, the recent trend reversal indicates that gold is no longer the primary focus, and BTC could respond with bigger gains.

Gold is expected to see another big correction next week

Analysts expect the correction to continue in the coming weeks as the hype surrounding gold subsides.

“I think many in the industry would actually welcome a deeper correction than we have at the moment,” said John Reed, market strategist at the World Gold Council. quoted According to the Financial Times.

Gold prices were at one point expected to rise to $5,000, but the irrationality of the rally meant the rally was unsustainable.

Tokenized gold also fell, with most tokens falling to the $3,800 range. The only exception was the UGOLD token, which continued to trade above $4,300 despite low volume and market depth.

BTC remains the year’s biggest winner

BTC is currently up 69% year-to-date and saw a slight increase in net income in October. There is no clear consensus on whether BTC is a safe-haven asset, an inflation offset, or a risk asset.

BTC still outperforms all other traditional assets as the digital asset has expanded against gold. |Source: WickedSmartBitcoin

The leading digital coin was briefly overtaken by silver at one point. Now, BTC is once again outperforming the precious metal.

Year-to-date, gold is up a net 45.9% and silver is up a net 37.5%. Short-term demand for physical precious metals has also not been sufficient to sustain metal expansion. The recent correction in gold and the drop in silver to $46.40 is seen as a potential driver to shift liquidity to other assets, including BTC and cryptocurrencies.