Crypto Markets fell on Monday morning, with seven of the top 10 cryptocurrencies, including Bitcoin, seven of the 10 red cryptocurrencies.

Market Dip drags bitcoin under $94K, but stocks are stable

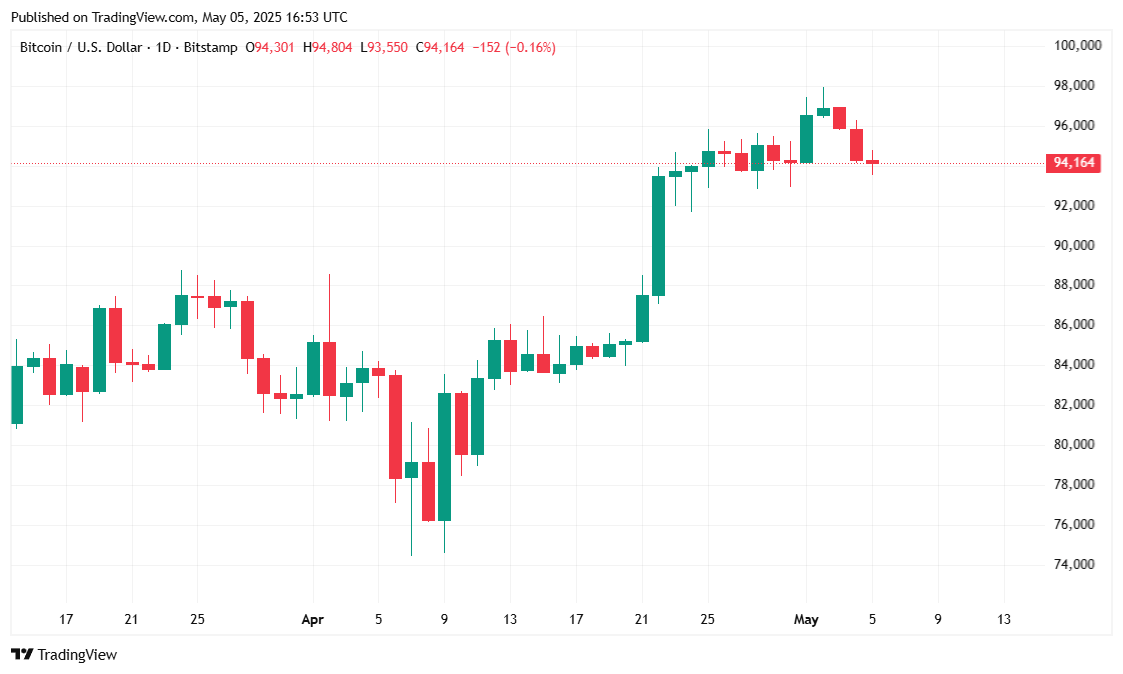

Bitcoin (BTC) fell to $94,000 on Monday morning, down 1.06% to $2.93 trillion market capitalization, according to CoinMarketCap data. The stock traded primarily sideways, with key indicators barely swelling, but at the time of reporting gold rose to 2.38% per ounce to $3,320.60.

Cryptocurrency Pullback surged BTC to $97,905.90 on Friday after the U.S. Department of Labor released stronger employment data than in April following a rally last week.

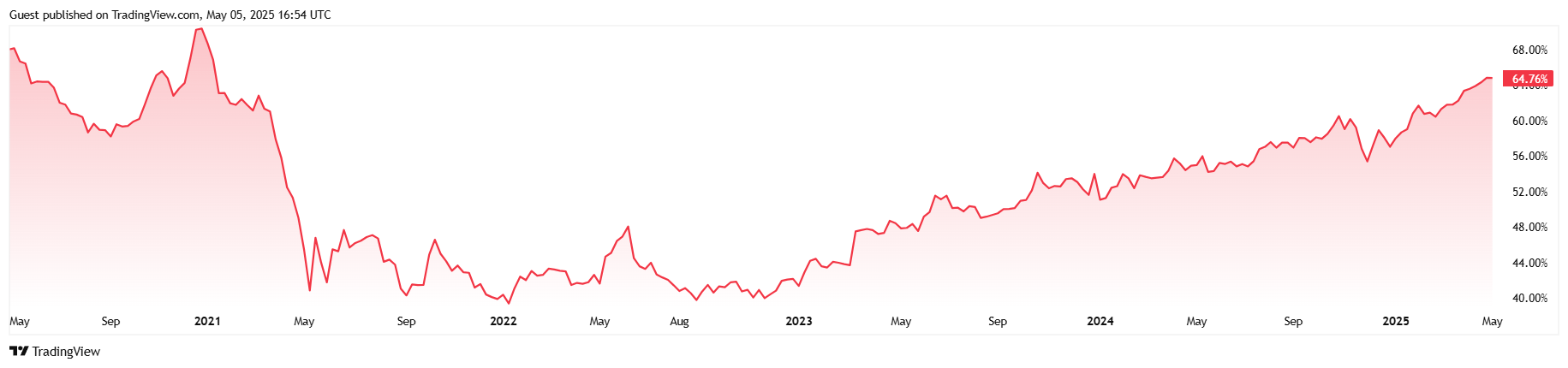

President Donald Trump’s unprecedented tariff views have led to confusion, economic uncertainty, and sparked flights to non-US assets as investors seek the stability of valuable, safe storage such as gold and Bitcoin. Additionally, BTC is down around 1.5% today, accounting for nearly 65% of the total crypto market.

The decline in cryptocurrency prices is almost certainly temporary. Bitcoin Treasury Firm Strategy Chairman Michael Saylor announced on Monday that he purchased around $180 million, bringing the company’s total holdings to 555,450 BTC. The move suggests that Saylor views Bitcoin’s pullback as a purchase opportunity rather than showing a weakness in its digital assets.

Market Metric Overview

According to CoinmarketCap, Bitcoin has dropped by 1.45% over the last 24 hours, falling to $94,132.64 when reported. Despite the DIP, BTC remains up 0.65% over the past seven days, showing continuous strength over the wider time frame. Cryptocurrency trades between $93,566.26 and $95,762.18, indicating mild volatility, primarily in the horizontal market.

(BTC Price/Trade View)

Trading volume rose to 56.38% to $245.8 billion, following a typical post-week pattern. However, the increase in activity occurred with a decline in market capitalization, falling 1.38% to $1.87 trillion. Bitcoin dominance across the Crypto market also fell 0.11 percentage points to 64.75%, suggesting that traders may be paying attention to Altcoins.

(BTC dominance/trade view)

In the derivatives sector, open interest on BTC futures has soaked between 1.04% and $63.18 billion, suggesting a slight cooling of speculative positioning. According to Coinglass, the total liquidation for the past 24 hours has reached $697,890, with long positions accounting for $359,070 and shorts at $338,820. A relatively balanced liquidation between the bull and the bear means indecisive in the market as traders await a stronger directional signal.