As Bitcoin price recovery shows key signs of weakening, the on-chain analysis shows retail investors increasingly withdrawing from the market.

Market “tourists” head towards the exit

According to an analysis by Martunn, an analyst of encrypted on-chain data on the on-chain data platform, chain-on-chain data suggests a prominent departure for small investors from the Bitcoin market.

In X’s post Thursday, analysts pointed to a massive slump in retail engagement.

“The change in retail demand is -5.7%. They are tourists in the crypto market, and here because of hype, it disappeared when it faded.”

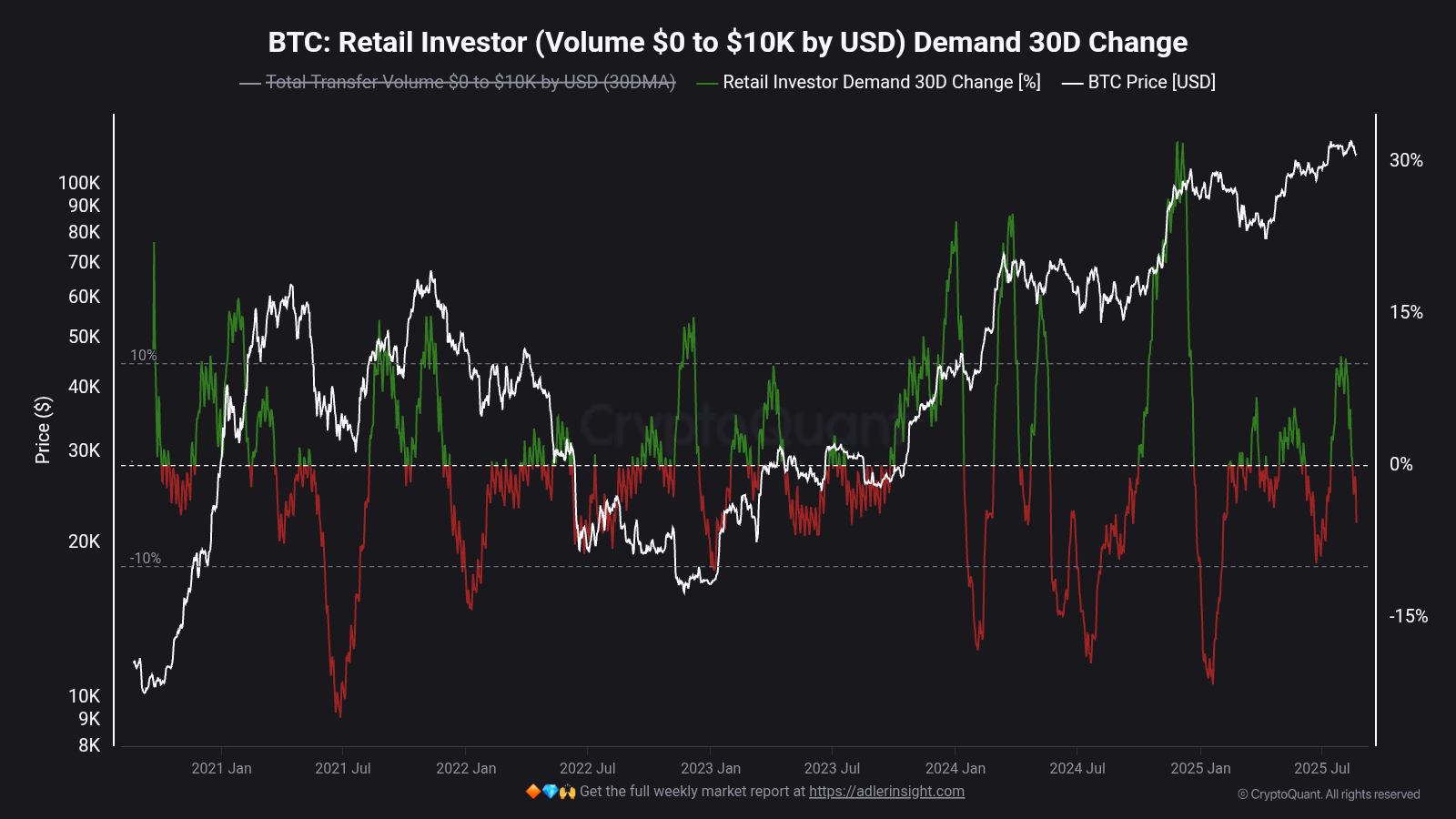

BTC: Retail investors demand 30D changes. Source: Cryptoquant

The metric in question, Cryptoquant’s “30D Changes for Retail Investors,” is an on-chain indicator that measures the change in the percentage of Bitcoin trading demand from small investors. This metric serves as an important barometer of individual traders’ emotions and participation, and is often seen as a proxy for the excitement and fear of the broader market.

The indicator works on a simple premise. Positive green reading means increased participation from small investors, suggesting a new inflow of capital and a growing interest. Conversely, as it is now, negative red readings indicate a decline in interest and trading activity.

Broader market sentiment shifts to neutrality

This is often correlated with price declines and general market cooling. Analysts use this metric to measure the strength of retail sentiment. This indicates that a sustained negative trend often considered a bearish signal could indicate further price drops or long-term market indifference.

Julio Moreno, head of Researc, saidh Cryptoquant does not quarantine this trend with the smallest investors. Moreno explained that a wider cooling of sentiment can be observed across the market.

Post-Bitcoin retail investors are leaving the market: crypto analysts first appeared on Beincrypto.