Bitcoin fell to just over $100,000 late Monday, but rebounded slightly to $101,000 as a wave of liquidations and renewed macro uncertainty wiped out billions of dollars of speculative positions across crypto markets.

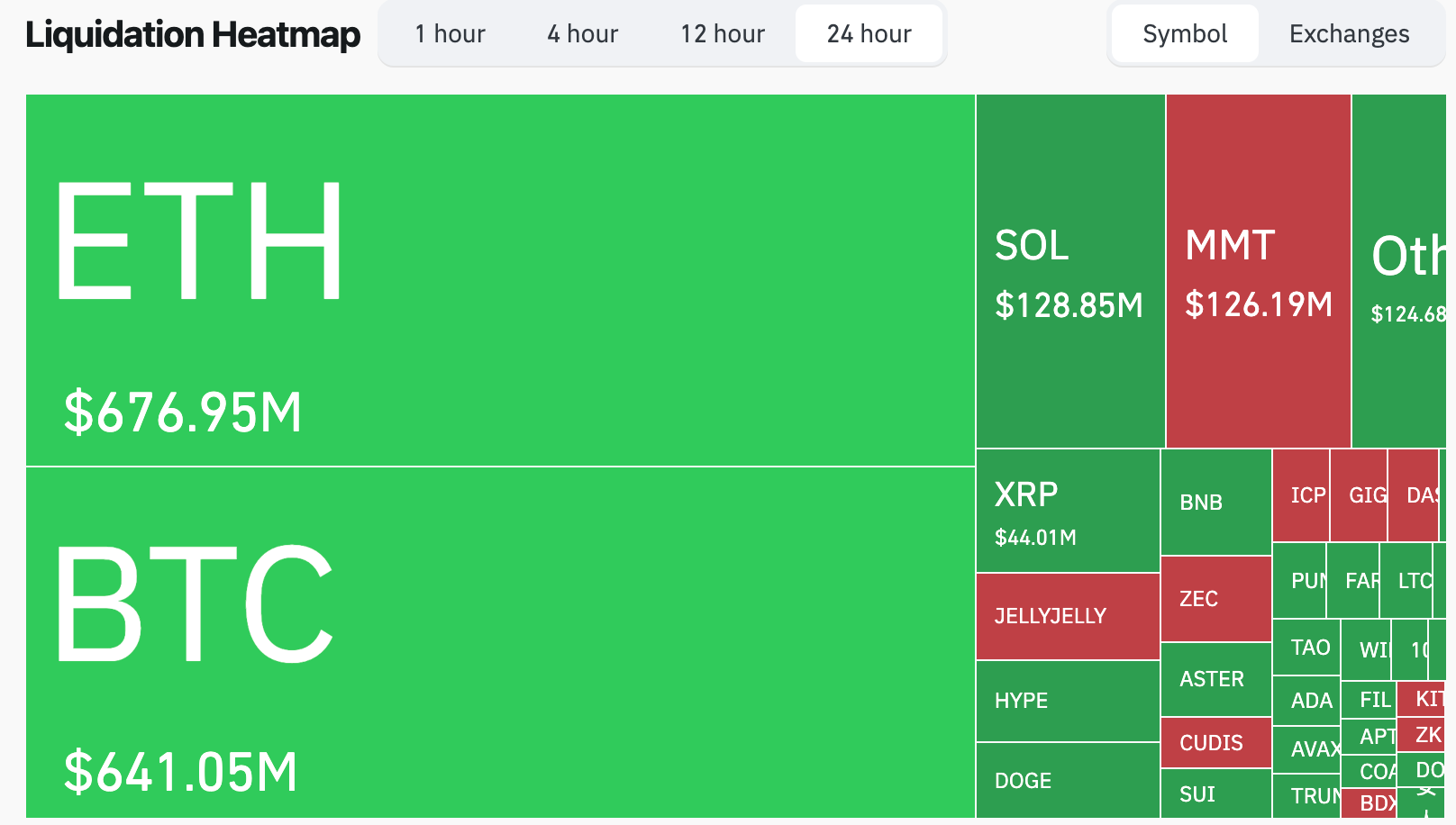

According to CoinGlass, more than $2 billion in futures contracts were liquidated in the past 24 hours, with long traders accounting for nearly 80% of the $1.6 billion in losses.

Cryptocurrency liquidation heatmap. (coin glass)

Liquidation occurs when a trader using borrowed funds is forced to close a position because the margin falls below the required level. On crypto futures exchanges, this process happens automatically, as if the price moves rapidly for a leveraged trade, the platform sells the position to the open market to cover the loss.

A large cluster of prolonged liquidations could signal a capitulation and possible short-term bottom, while a reversal in momentum could result in a mass short-term wipeout ahead of a localized top.

Traders can also track where liquidation levels are concentrated, helping to identify zones of forced activity that may act as short-term support or resistance.

The wipeout marks one of the largest deleveraging events since September and shows how fragile the positioning has become after weeks of volatile price action.

Bitcoin has fallen 5.5% in the past day and more than 10% in the past week. Ether fell 10% to $3,275, while Solana’s SOL and BNB fell 8% and 7%, respectively. XRP, Dogecoin, and Cardano also fell between 5% and 6%.

The market capitalization of cryptocurrencies has retreated to $3.5 trillion, the lowest level in a month.

“Bitcoin traded at around $100,000 today as risk-off sentiment spread across financial markets, impacting a wide range of digital assets, stocks, and commodities,” Jerry O’Shea, head of global market insights at Hashdex, said in an email to CoinDesk.

“Recent speculation that the FOMC may hold off on further rate cuts before the end of the year, as well as concerns about tariffs, credit market conditions, and equity valuations, contributed to the market decline.Bitcoin’s recent price trajectory has also been influenced by selling by long-term holders, which is to be expected as the asset matures,” O’Shea added.

Among exchanges, Bybit accounted for $628 million in liquidations, followed by Hyperliquid with $533 million and Binance with $421 million. The single largest trade was an $11 million long BTC-USDT on HTX.

Analysts said the broader outlook remained constructive despite the volatility.

“While $100,000 may be a psychologically important support level, we do not view today’s price action as a sign that Bitcoin’s long-term investment case is weakening,” O’Shea said.

With the US Federal Reserve pausing further interest rate cuts and global risk appetite remaining fragile, traders say the next few sessions will test whether Bitcoin’s rally can turn into a sustained recovery or whether another wave of forced selling is in store.