Thursday, Bitcoin (BTC) prices shook the US financial market with the fall of Donald Trump and the world’s most wealthy man Elon Musk. However, for the last 48 hours, the virgin cryptocurrency has registered a rebound climb to more than $ 105,000 before it slipped sideways. Among these developments, the popular encryption analysts of X Pseudonym Killaxbt explained several scenarios of Bitcoin’s next price measures.

$ 100,000 after Bitcoin rebound

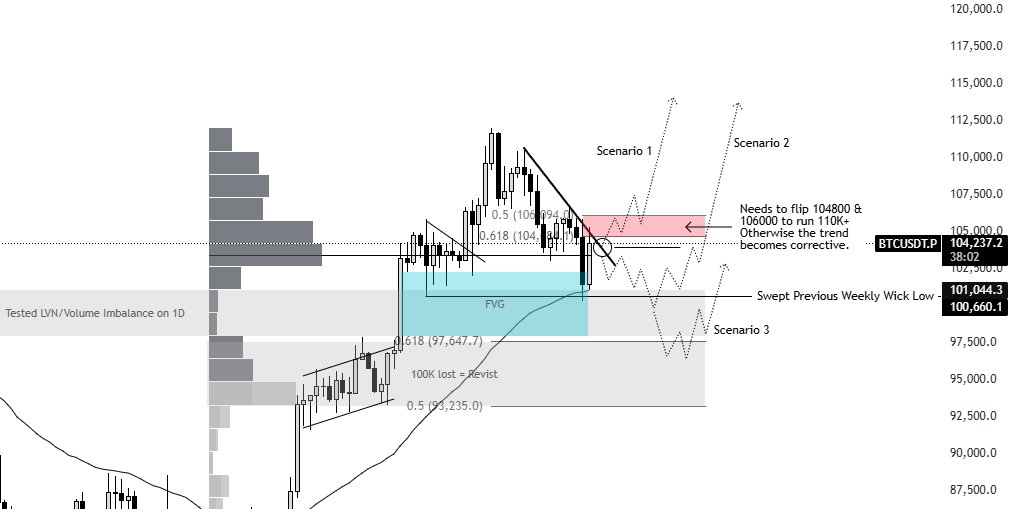

at X post On June 7, Killaxbt provides a profound technical analysis of the bitcoin market, which discusses the recent prices and potential development. On May 22, after reaching a new record of nearly $ 112,000, BTC participated in a 10% decrease in the price range of $ 100,000 before the recent rebound in the last two days.

Killaxbt explains that this recoil is not randomly and led by a combination of technology and market factors. These factors include daily FVG and volume imbalances, which are non -efficiency filled with the remaining prices on the chart.

In addition, the steady decline of Bitcoin has caused a lot of stop losses in the long position of the lowest price of the previous week, resulting in liquidity cleaning. This development has created liquidity flushes for big players who lead the market rebound.

Lastly, Killaxbt talks about short weaving settings, and merchants have shorter the bitcoin market when the initial price is expected from $ 100,000. When the price began to rise, these short traders had to buy again to cover the loss and add fuel to the rally.

What is the next step of BTC?

Looking at the future, Killaxbt emphasized the three potential scenarios of BTC. Currently, analysts said that Premier Cryptocurrency is testing the resistance area between $ 104,800 and $ 106,000, matching the 0.5-0.618 Fibonacci Retression level.

For the first scenario, Killaxbt predicts optimistic continuous continuous only if Bitcoin breaks and fixes this resistance area. This movement can be trapped once again, which can cause potentially greater upward exercise.

However, if Bitcoin faces rejection in this specified resistance area, the second scenario is likely to reduce the price of $ 100,000 and resume. Third, the final and worst scenarios include prices of less than $ 100,000 or less to test the support area around the price area of $ 97,000.

Interestingly, Killaxbt’s personal projection expects that market manufacturers will continue to raise the price of Bitcoin and use the recent rapid rebound that have recently prevented many short merchants. There is no clear “safe” entrance, but it can be used, but the analysts suggest that shorter sellers will be able to improve the shorter sellers and forcibly forced to chase the rally.

In the press time, BTC continues to trade at $ 105,600, reflecting a 1.16%profit last day.

Istock’s main image, TradingView chart

Editorial process focuses on providing thorough research, accurate and prejudice content. We support the strict sourcing standard and each page is diligent in the top technology experts and the seasoned editor’s team. This process ensures the integrity, relevance and value of the reader’s content.