Bitcoin prices rose again above $97,000 this week, supported by continued flows into U.S. spot Bitcoin exchange-traded funds (ETFs), signaling a structural shift in demand after months of sideways trading, data and market watchers said.

Since the start of the year, U.S. Spot Bitcoin (BTC) ETFs have attracted nearly $1.5 billion in total net inflows, according to data cited by Bloomberg ETF analyst Eric Balchunas. This total reflects a period of weak ETF flows at the end of 2025, followed by several days of positive creation activity amid renewed interest from large allocators.

In a post on X, Balciunas said the ETF’s demand pattern “suggests that buyers have probably run out of sellers,” suggesting that Bitcoin has broken out of a prolonged selloff around $88,000.

sauce: Eric Balchunas

Net inflows by ETF buyers reached $843.6 million on Wednesday alone, bringing the weekly total to $1.07 billion, pushing up the year-to-date figure. While the one-day influx has garnered attention, the broader story is that steady demand will return after an early rotation of products.

Related: 5 Bitcoin stories that analysts are paying attention to beyond price

Will financial institutions reverse the Bitcoin scenario?

Bitcoin has historically rallied at the start of a more difficult period for the asset. Market observers often point to Bitcoin’s four-year cycle, which roughly coincides with its halving, and the price typically peaks 12 to 18 months after each decline in supply, a pattern that suggests the market may already be above its cyclical high.

Although the four-year cycle is not a rule, many analysts approach this stage cautiously, given past market trends.

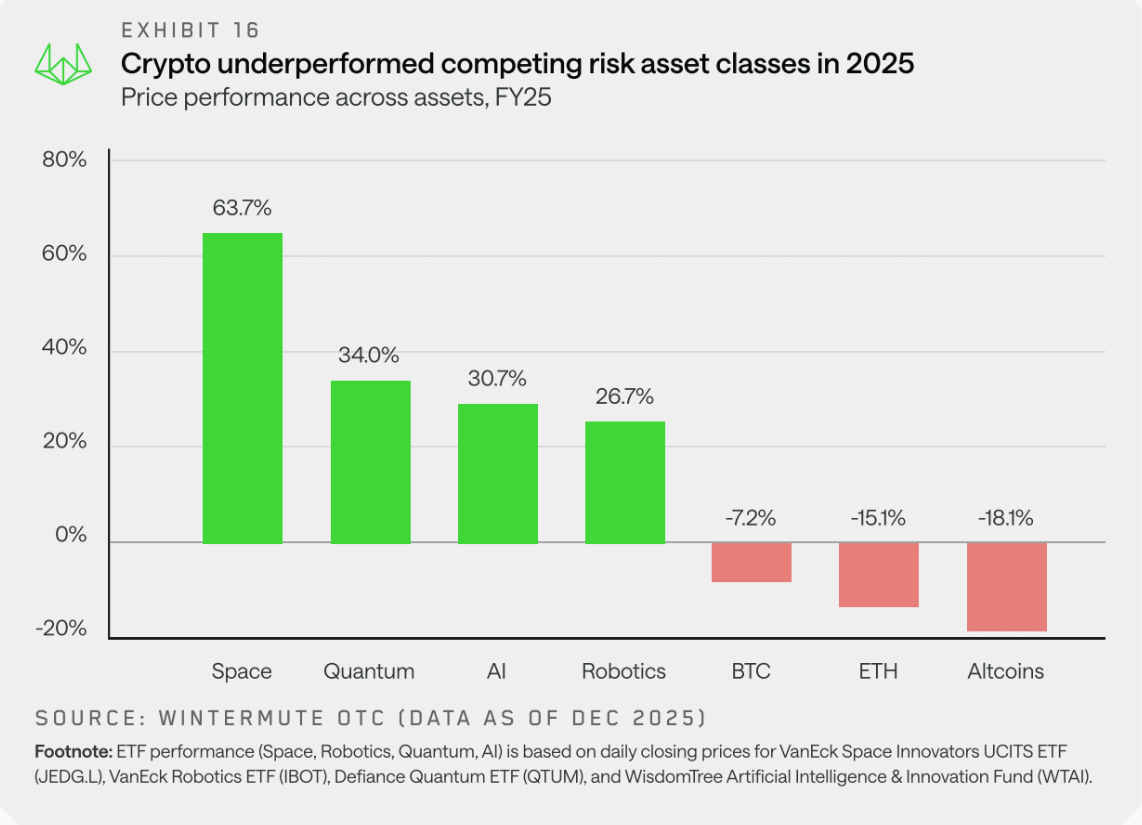

The current recovery follows a mixed performance in 2025, when Bitcoin hit new all-time highs but failed to maintain momentum across the broader crypto market. Despite the overall price increase, this rally did not translate into an extended “altcoin season”, with many investors disappointed by the lack of follow-through.

According to Wintermute, structural changes in the Bitcoin market may be needed to support a broader recovery into 2026. In a recent outlook, market makers said the overall market recovery is likely to depend on continued accumulation by exchange-traded funds and digital asset treasury firms, or the expansion of their mandates beyond Bitcoin to other digital assets.

Bitcoin failed to attract sustained retail inflows in 2025 as investors explored new growth themes centered on AI, robotics, and space stocks. Source: Wintermute

Wintermute also pointed out that stronger and more consistent performance is needed across major cryptocurrencies, including Bitcoin, to create a broader wealth effect.

Related: 2026 Investment Strategy for Cryptocurrency: Bitcoin, Stablecoin Infrastructure, and Tokenized Assets