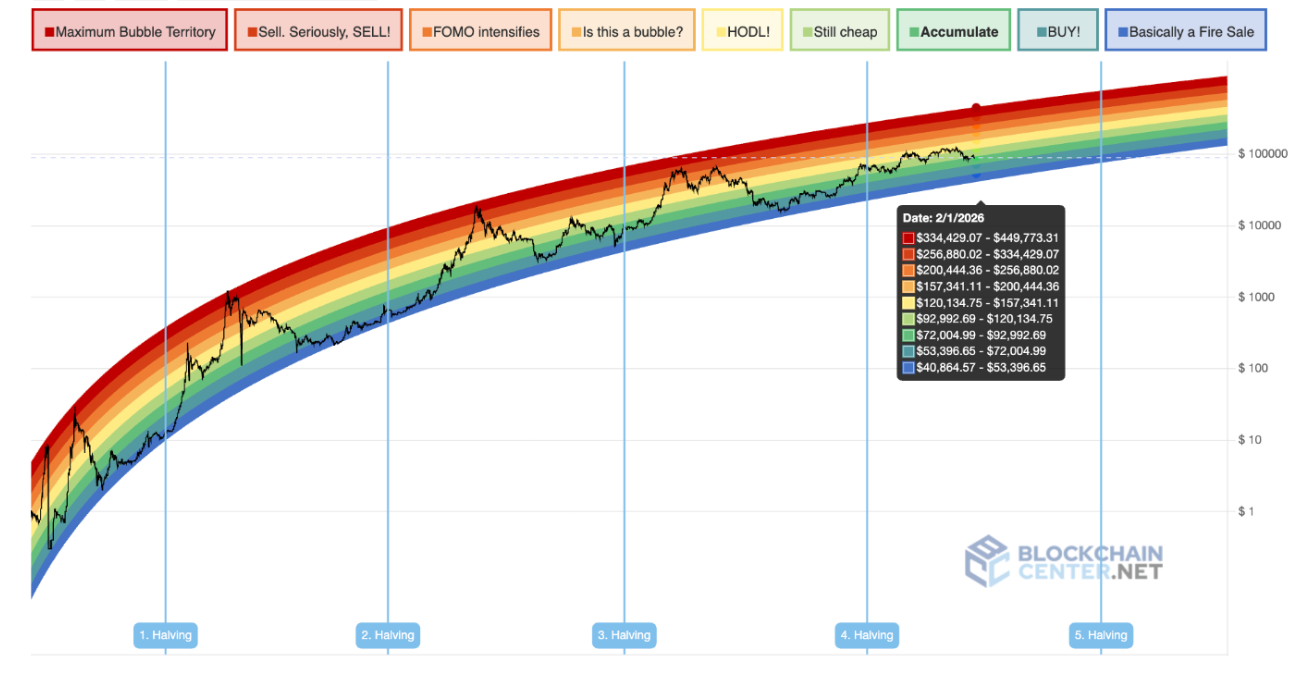

The Bitcoin (BTC) Rainbow Chart outlines a wide range of potential price outcomes on February 1, 2026, using a logarithmic growth curve intended to capture long-term adoption trends rather than short-term market noise.

Looking at the chart, we can see that the bottom “basically dump” band indicates severe undervaluation associated with capitulation and long-term accumulation, with the cryptocurrency sitting between $40,864.57 and $53,396.65 as of February 1st.

Next is “Purchase”. This band reflects severe undervaluation due to improving sentiment and historically strong long-term entry points (ranging from $53,396.65 to $72,004.99). The “accumulation” band above it indicates that Bitcoin is still undervalued but is stabilizing, with positions typically building gradually in the $72,004.99 to $92,992.69 range.

The “still cheap” band suggests that Bitcoin remains attractively priced as widespread awareness increases, from $92,992.69 to $120,134.75. “Hoddle!” This band represents a fair valuation within Bitcoin’s long-term growth trend and encourages a hold rather than an aggressive buy between $120,134.75 and $157,341.11.

For that matter, “Is this a bubble?” This band captures the increased speculation and volatility from $157,341.11 to $200,444.36. The “Increasing FOMO” band indicates a rally driven by momentum above fundamentals and is expected to range from $200,444.36 to $256,880.02.

The “Sell! Seriously Sell!” band historically indicates an overheated situation with downside risk, ranging from $256,880.02 to $334,429.07. The upper “maximum bubble region” band reflects extreme speculation and unsustainable price acceleration and ranges from $334,429.07 on February 1, 2026 to $449,773.31.

Bitcoin price analysis

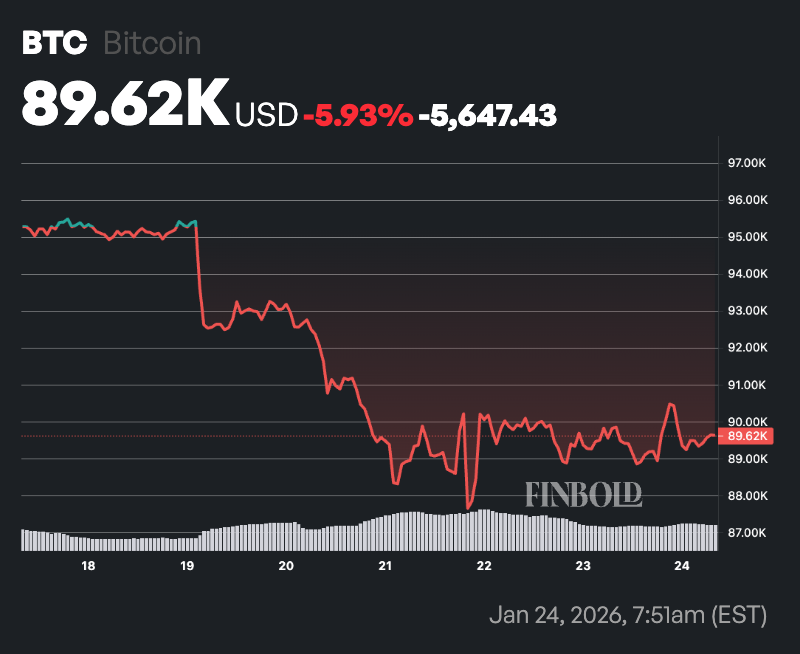

As of January 24, Bitcoin is trading at around $89,300, with the price sitting near the top of the “accumulation” band. If Bitcoin does not enter the euphoria phase and continues to follow the long-term trend of the rainbow chart, this model suggests a move into the “still cheap” band by early 2026, with a potential range of $92,992.69 to $120,134.75.

Technically, Bitcoin is just below its 50-day simple moving average (SMA) of $90,313 and well below its 200-day SMA of $105,072. This setup indicates short-term weakness and broad cooling in long-term momentum.

The 14-day RSI is 42.84, meaning Bitcoin is in neutral territory but on a downtrend. This indicates that selling pressure has eased, but there is still not enough momentum to support a strong reversal.

Featured image via Shutterstock