Bitcoin faces a rough patch. BTC prices fell by about 6% from the all-time high of around $123,000.

Retailers want bounce, but on-chain signals suggest deeper trouble. Both the whales and the institutions seem to be receding, and the charts don’t look good either.

Whale activity draws a bearish picture

BTC prices fell 6% from an all-time high of $122,838. The reduction may not be random.

Over the past 10 days, the number of whales holding BTC between 1,000 and 10,000 has decreased from 2,037 to 1,982. This is a 2.7% slide. This is the sharpest decline in whale participation in more than six months.

Bitcoin Price and Whale Address: GlassNode

It’s not just the shrinking wallet that’s important. The proportion of exchange whales, a metric indicating the amount of exchange inflows from whales, is also increasing.

Historically, this ratio created three straight low highs on July 4th, 8th and 13th. This was in line with BTC prices rising to an all-time high. Now we are seeing higher prices again. This ratio was 0.5 on July 22nd, and by July 24th it rose to 0.52 as BTC prices began to immerse.

Bitcoin Price and Exchange Whale Ratio: Encryption

This pattern suggests that whales are not only retreating, but are sending coins to exchange. As history repeats itself, more sales pressure could continue. The Galaxy Digital reportedly deposited it to exchange 10,000 BTC a while ago, adding to the institutional uncertainty.

Bearish EMA setup indicates failure

This whale-driven weakness is shown on the 4-hour chart. Smaller time frames are often used to perceive trends earlier.

BTC prices have just fallen below the 100th EMA (exponential moving average), which is important short-term support. Worse, the 20th EMA (red line) is just about to cross under the 50-cycle EMA (orange line), hinting at a bearish “death” crossover.

Bearish Crossover Waiting for It to Happen: TradingView

Why is this important? These EMA levels often serve as a momentum signal for the trader. Bearish crossovers between 20-50 EMAs usually make sure that the short-term seller is in control.

It matches big players like Whale Spills and Galaxy, quietly reducing exposure.

The next important support is the 200-period EMA (blue line) on the 4-hour chart, which is currently close to $113,000. This EMA line is in sync with the key support levels revealed in the next section.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

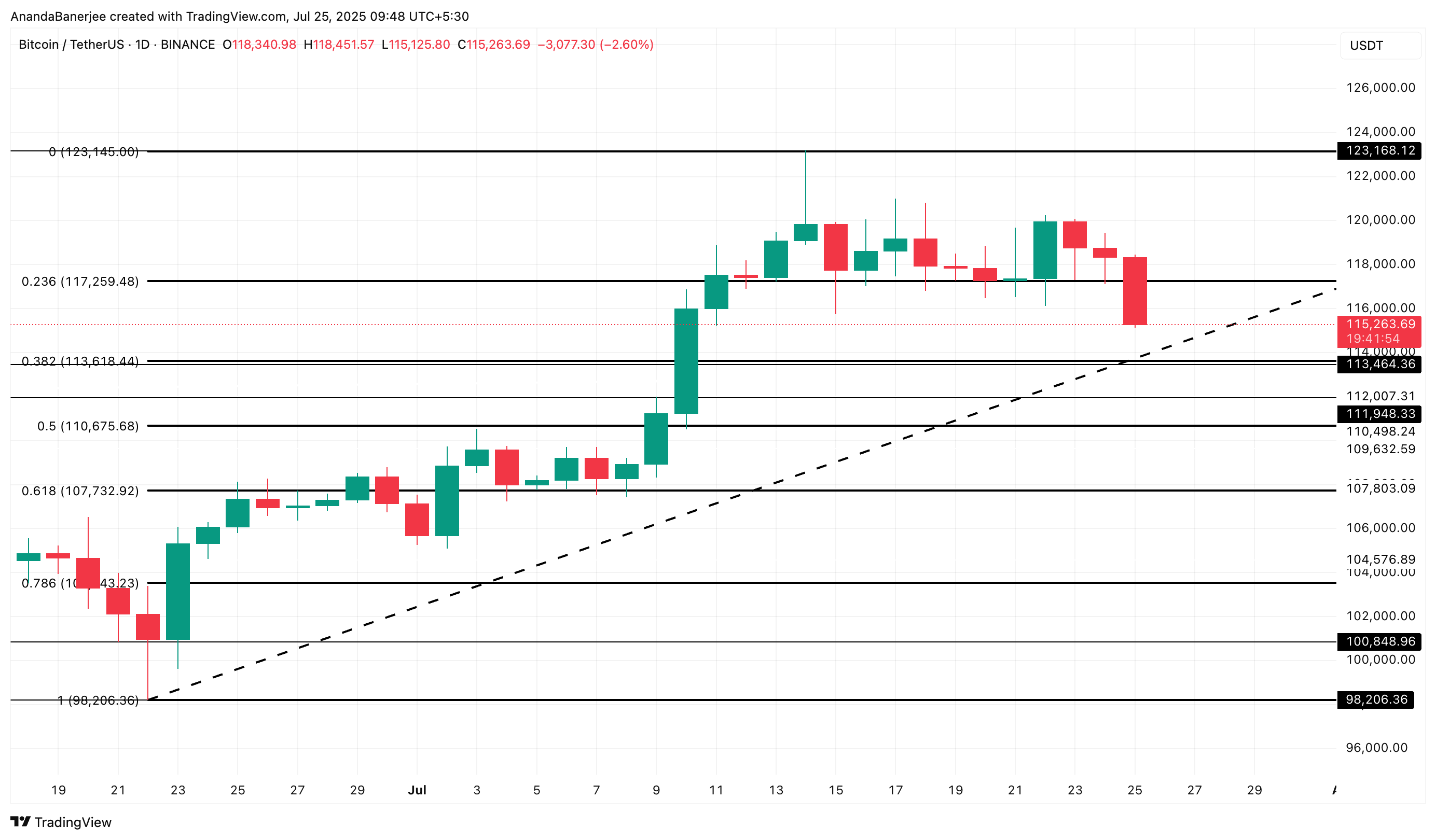

Bitcoin price chart points to $113,000 as a major defense

The Daily Bitcoin Price Chart tells a similar story. After holding nearly $117,000 for nearly a week, BTC has dropped sharply and is now hovering nearly $115,000. If $113,000 is not retained, the following support will be in the presence of $110,000 and $107,000.

Bitcoin Price Analysis: TradingView

These are not just random lines. They reflect the broader trader psychology of pullbacks. If the price falls below $113,000, the BTC price could face a deeper correction. Combined with a bearish EMA pattern and rising exchange activity from whales, the risk of Bitcoin conflict continues to rise.

However, if Bitcoin’s price can regain $117,000 and a previous all-time high of $123,000, the bearish structure could soon collapse. However, to do so, it may be necessary for celebrities from the Bitcoin space to return to the party.