The Bitcoin price movement focuses on two conflicting scenarios, with traders focusing on. A breakout to $140,000, or a deeper fix to $60,000.

Analysts highlight the key levels in which they can determine the next key move:

Bitcoin prices should break $95,000 to stay bullish

Crypto analyst Big Mike is looking at a clear roadmap for Bitcoin’s price trajectory.

In the newly released Elliott Wave chart, he outlines two potential results. One is a surge above $95,000, which could push BTC to $140,000

Another route is between $72,895 and $72,895 before resuming the uptrend.

Does Bitcoin target $150K? Elliott Wave analysis suggests a bullish breakout. Source: Big Mike/X

His analysis is based on multiple Fibonacci extended targets, moving averages, and five-wave impulse structures.

According to his charts, the Bitcoin correction phase between $85,000 and $95,000 created the integrated zone.

A confirmed breakout beyond this range marks the start of a bullish wave targeting $114,693, with the final leg potentially reaching $150,000.

Big microphone highlights important levels:

“BTC above $95K triggers rapid movement towards a $130,000, $140K target. Under $78K, we test $72,000 and run to $140,000.”

Analysts warn of $60,000 breakdown if resistance applies

Not all analysts share bullish feelings. TradingView analyst Alixjey predicts that if he fails to break beyond $99,500, Bitcoin could crash to $63,000, as low as $63,000.

BTC sets to drop sharply to $60,000 Source: Alixjey in TradingView

He points out that Bitcoin’s latest drop below $90,000 has surprised many traders who are hoping for a continuous rally.

If resistance holds between $94,000 and $98,000, we expect BTC to drop sharply.

The last time Bitcoin traded in the $60,000 range was after the launch of the Spot Bitcoin ETF in early 2024.

Alixjey labels this potential slump as a “last chance” for investors to accumulate BTC at lower levels. He said,

“If Bitcoin didn’t break the resistance, we’ve seen a sudden pullback.”

Trump’s Bitcoin Reserve Plan causes market uncertainty

In addition to volatility, President Donald Trump’s executive order has triggered a mixed reaction by establishing a strategic US Bitcoin reserve.

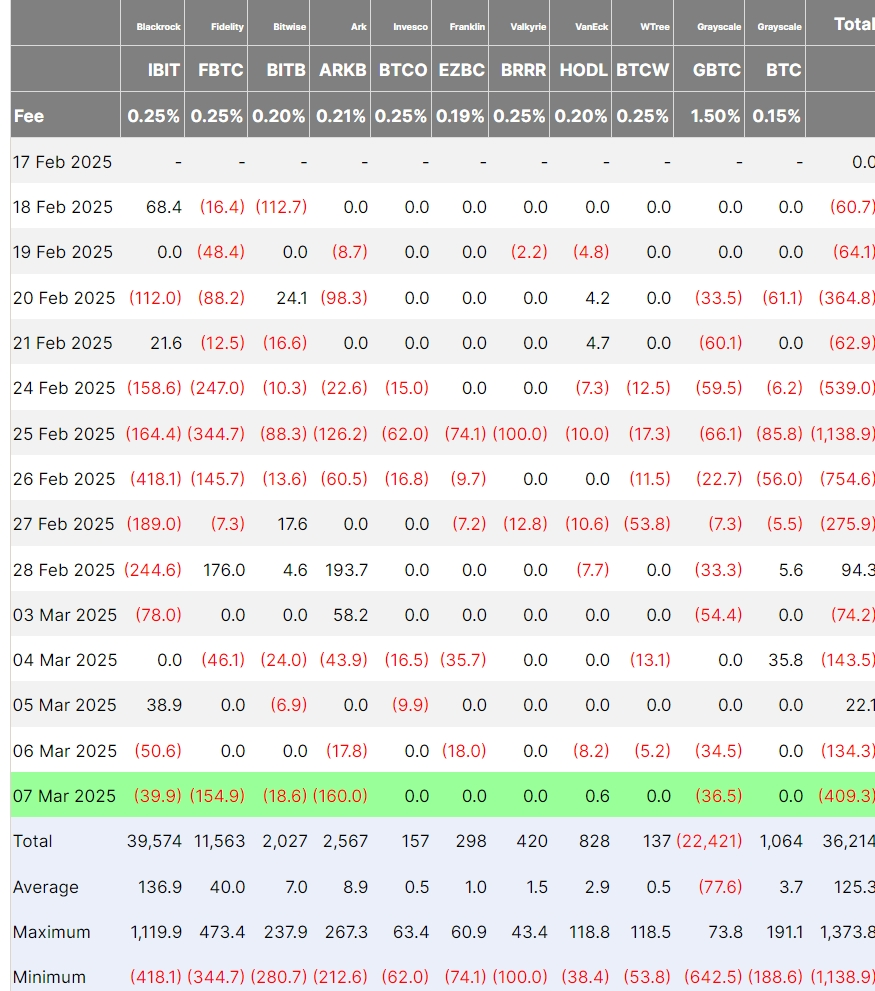

According to Farside investors, the Bitcoin ETF saw a net leak of $370 million on March 7, institutional traders responded to the news.

Bitcoin ETF flows show volatility amidst market fluctuations. Source: Farside

This order does not require the purchase of new Bitcoin, but allows for budget-neutral acquisitions using seized assets.

This has disappointed the market, and Wantane CEO Temujin Louie said it wasn’t reaching expectations.

Despite the sale, some view orders as a long-term bullish signal. Bitwise Research Head Ryan Rasmussen pointed out,

“The US reserve means other countries will buy Bitcoin. Financial institutions have no excuses.”

The current range for Bitcoin is important in the range of $72,000 to $95,000.

Analysts remain divided on whether BTC is on the rally crisis or on the verge of a massive revision.

With key liquidity levels still not being tested, all eyes are looking at whether Bitcoin can regain $95,000 or risk plunging into $60,000.