Main highlights

- On November 19th, Bitcoin fell below $89,000 on the daily chart with a 4% drop.

- Abu Dhabi Investment Council announced that it will acquire an additional $250 million worth of shares in BlackRock’s iShares Bitcoin Trust (IBIT).

- According to cryptocurrency analysts, Supertrend indicator shows significant decline in Bitcoin

On November 19th, Bitcoin fell 4% on the daily chart to below $89,000. Market capitalization is $1.77 trillion.

At the time of writing, BTC is currently trading around $100, showing a slight rebound. Includes $90,108.83 According to CoinMarketCap, the trading volume in the past 24 hours was $77.19 billion.

Cryptocurrency trader raises Bitcoin sell signal

According to Ali, a crypto analyst at X, the Supertrend indicator, a popular technical analysis tool, is showing a significant decline in Bitcoin.

https://t.co/t6c0IavsNG

— Ali (@ali_charts) November 18, 2025

This indicator has over a decade of documented history of accurately identifying significant changes in market trends.

According to its historical data, whenever this indicator turns bearish, a significant correction in Bitcoin price is followed. Here is the historical data for previous sell signals:

- February 2014: 75% crash

- January 2018: 73% crashes

- October 2019: 54% crash

- May 2021: 38% crash

- January 2022: 67% crashes

The main factor is the historical consistency of the indicator. In the past, whenever a supertrend turned into a sell signal on the weekly chart, the price of Bitcoin subsequently experienced a significant decline.

The indicator is once again in sell mode, suggesting that BTC may be entering a new correction phase in the market.

Ali said if current signals follow historical patterns, we could see a significant decline. The average price decline from all previous SuperTrend sell signals is calculated to be approximately 61%.

If this happens, we apply this average decline to Bitcoin’s recent market structure and suggest a potential price target near the $40,000 level.

However, it is important to note that this signal does not guarantee that such a move will occur. However, based on over 10 years of historical data, this is the key level that market participants are watching.

Abu Dhabi Investment Council increases holdings in Bitcoin ETF

The Abu Dhabi Investment Council has significantly increased its investment in a leading BTC exchange-traded fund (ETF). The sovereign wealth fund bought an additional $250 million worth of shares in BlackRock’s iShares Bitcoin Trust (IBIT), according to the report.

🇦🇪 Abu Dhabi Investment Council: “We see Bitcoin playing an increasingly important role alongside gold” – Bloomberg pic.twitter.com/bAXCzeJfUZ

— Bitcoin Archive (@BitcoinArchive) November 19, 2025

The investment comes as the cryptocurrency market is experiencing a major liquidation, with Bitcoin’s value falling by about 20% since the end of September.

A spokesperson said both assets would help diversify the investment portfolio and confirmed the council’s intention to continue holding both as part of its ongoing strategy. This recent purchase comes after an initial investment of $436.9 million was made in the same ETF in February 2025.

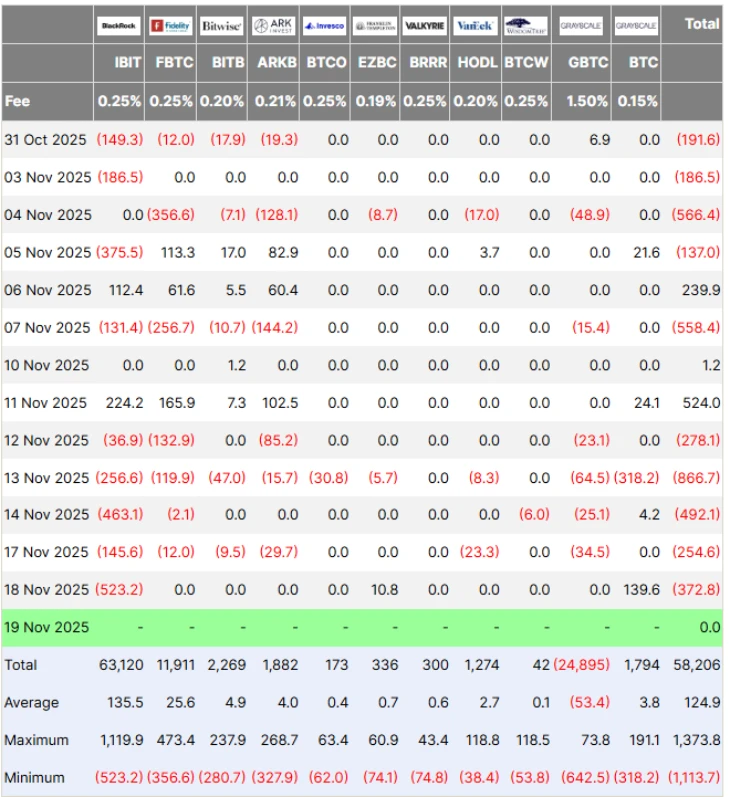

Bitcoin ETFs expected to see large outflows in November

Investors withdrew nearly $3 billion from U.S. spot BTC ETFs this month, according to data from Farside Investors. This large-scale withdrawal marks a sharp reversal in a market that had previously seen strong investor demand. This trend shows a shift in sentiment as major funds experience large redemptions.

(Source: Farside)

Leading this wave of outflows is BlackRock’s iShares BTC Trust (IBIT). This fund is currently the largest source of reimbursement.

The fund withdrew $523 million in a single trading session, the largest single-day outflow since it began trading. The BlackRock Fund accounted for about $2.1 billion of the $3 billion total withdrawn in November. This steady stream of outflows shows that institutional investors’ confidence in the crypto market is declining. This downward trend was also observed in other cryptocurrencies such as Ether, XRP, Solana, and BNB.