Bitcoin is approaching a new all-time high that could potentially be steadily moving forward towards the $123,000 mark. Overall, both technical indicators and sentiment data point to the potential for a continuous rise, suggesting that the rally still has momentum behind it.

Shayan Market

Daily Charts

In the daily time frame, Bitcoin continues to be a sharp upward channel. The recent bullish crossover between the 100-200-day moving average further strengthens the bullish market structure.

With prices approaching a major resistance level of $123,000, many traders are hoping for a strong breakout and the possibility of continuing the rally. For now, the slower channel trendlines are acting as dynamic support, helping to increase prices.

However, if this channel support fails due to a sudden pullback, the nearby $110,000 level, along with the nearby 100-day moving average, can serve as a key support zone, causing rebounds and continuation to fresh highs.

4-hour chart

The four-hour chart suggests that Bitcoin has moved from a clearly bearish or lateral stage to a bullish structure, and has escaped from the descending channel after almost a month of integration. The assets are currently following the uptrend line.

The RSI is above 50 levels, strengthening bullish momentum, increasing the chances of retesting, and potential breakouts exceeding $123,000. Still, if a pullback occurs, the $116,000 support zone could serve as a key area for rebound and continuation of uptrends.

On-Chain Analysis

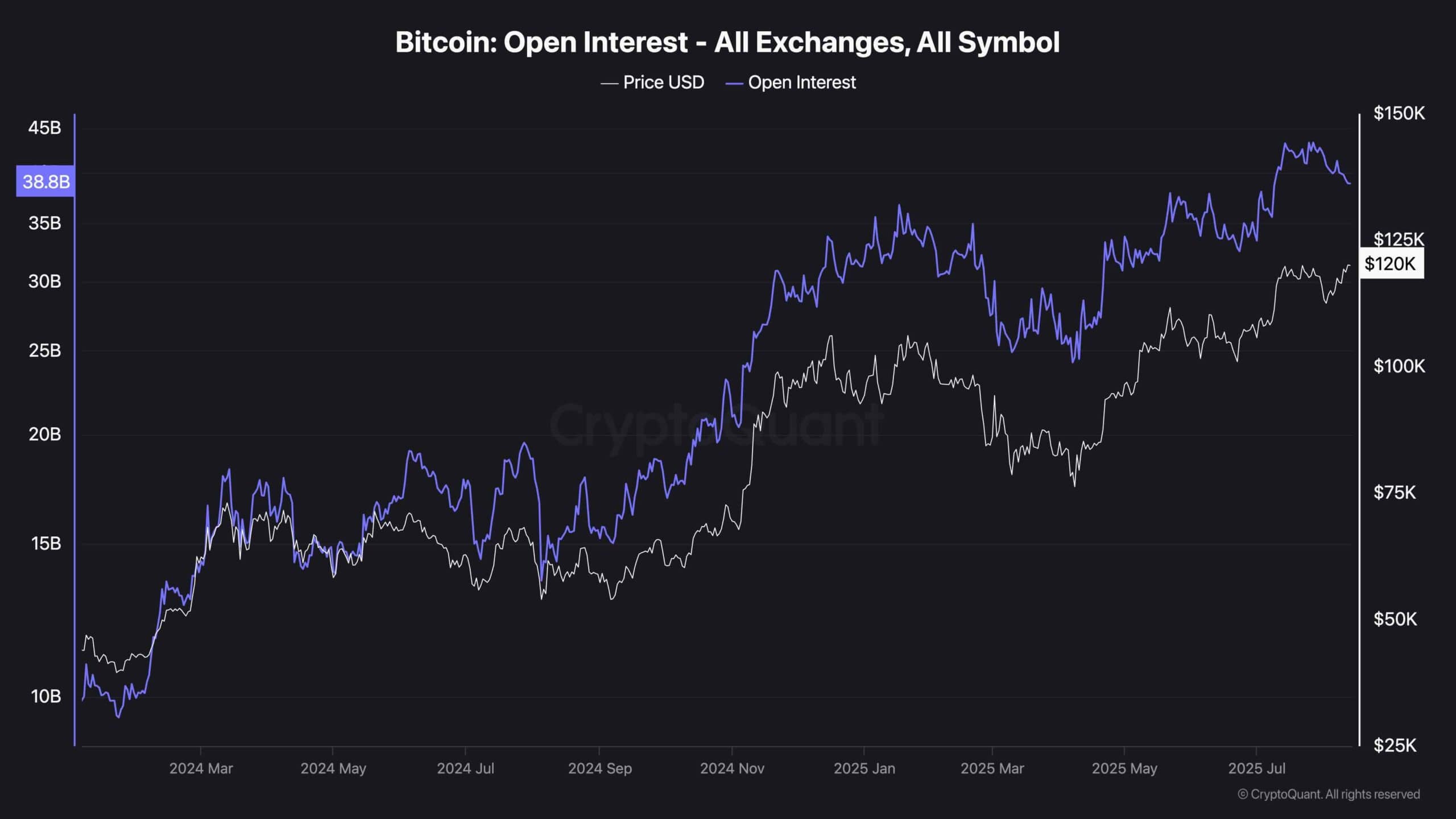

Bitcoin Open Interest

Open Interest (OI) is a key metric in the derivatives market that reflects the total number of prominent futures and option contracts. Typically, as Bitcoin prices rise, we expect open interest to continue as more traders open up longer positions, and the rally will continue. This behavior is often driven by increased market participation, increased leverage, and overall bullish sentiment.

However, over the past few weeks, Bitcoin prices have gradually risen, while open interest has steadily declined. This difference suggests that current gatherings may be driven not by leveraged positions or positive inferences, but rather by spot demand or short cover.

This decline in OI could point to healthier, less speculative gatherings despite rising prices, but it also means that fewer participants could quickly follow the key levels if momentum slows down.