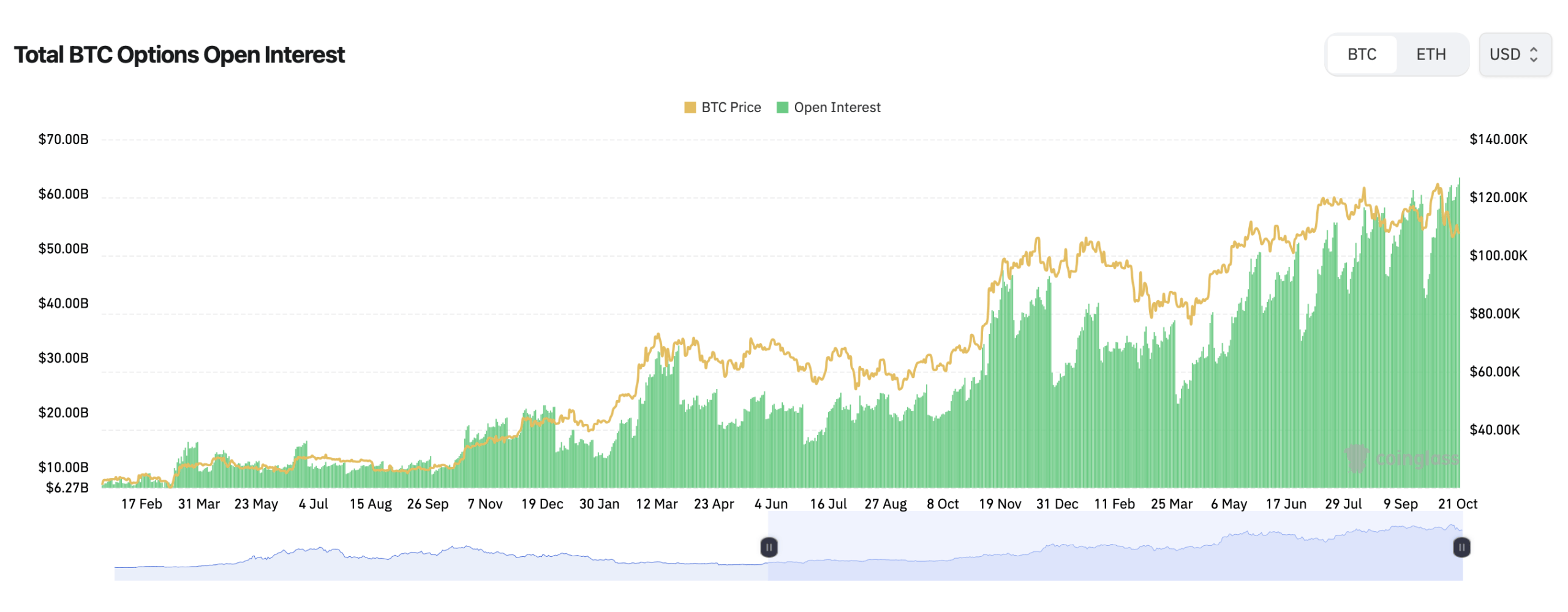

The Bitcoin options market is hot. Bitcoin’s price hovers around $110,614 per coin, with open interest surging to a new record as traders wrestle between euphoric calls and cautious puts, according to data from Coinglass.

BTC options data shows record leverage

Total open interest (OI) in Bitcoin options rose to nearly $65 billion, an all-time high. The market is It hums with power, conviction, and enough nerve to wake everyone up.

Deribit, a leading player in cryptocurrency options today, is seeing a ton of activity. Trading volumes have exploded in recent weeks, pushing them into billion-dollar territory every day. This week’s session has been one of the busiest this year, suggesting that even short-term players are jumping in before volatility decides which side will bite.

Bitcoin options open interest on October 23, 2025, according to Coinglass statistics.

The split between calls and puts paints a fascinating picture. Open interest remains in favor of optimists, with calls at 57.96% (301,842.96 BTC) versus puts at 42.04% (218,924.29 BTC), indicating more traders are betting on a continuation of the rally.

But if you look at the past 24 hours, the tone changes. Puts accounted for 55.66% (32,133.77 BTC) of the volume, outweighing calls by 44.34% (25,597.3 BTC). translation? Bullish for the long term, hedged for the short term — the perfect cocktail for fireworks.

The location of the strike suggests traders are targeting the moon, or at least the stratosphere. Deribit’s largest open interest clusters are $140,000, $150,000, and $200,000 through December 2025 expiration. These high call stacks indicate that traders are dreaming big, while the $85,000 and $80,000 puts indicate where nervous money is living.

Then there is the “max pain”, the level at which most traders lose the most money. Coinglass data currently pegs that zone between $108,000 and $114,000, which is exactly where BTC is currently waltzing. If prices level out, options writers will smile. If BTC breaks, someone will get burned.

In summary, the derivatives picture screams high stakes poker. Record open interest, high volume, high call strikes, and a fierce battle over the $110,000 line make this one of the most tense situations of the year. TorAdar is either trying to get rich or is in a very humble state.

Frequently asked questions 💡

- What is the price of Bitcoin now? Approximately $110,614 per coin at time of writing.

- How high is the open interest? Total open interest in BTC options is approaching $65 billion, a record high.

- Who wins between calls and puts? Calls lead the open interest, but puts dominate the day’s trading volume.

- Where is the greatest pain? At around $108,000 to $114,000, most options become worthless if BTC stays flat.