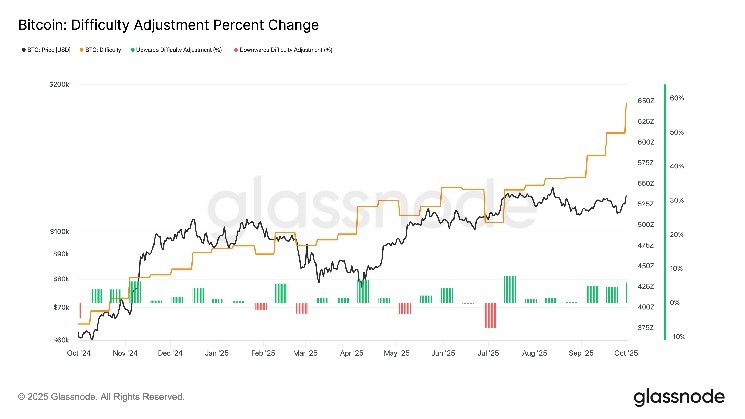

Bitcoin mining difficulty rose 5% on Wednesday to a record 150.84 trillion on Wednesday, marking its seventh straight upward adjustment, according to GlassNode.

The difficulty of resetting per block (about every two weeks) in 2016 measures how difficult it is for miners to find new blocks and how difficult it is for them to maintain average block time in around 10 minutes.

This increase reflects the continued growth of the network’s hashrate, currently surpassing one Zetthash at 1.05 ZH/s. A higher hashrate signals more machines that compete to protect your network, increasing security while increasing the bar for profitability.

That pressure is manifested in hashplith, miner revenue per hashrate unit, which slipped in at less than $50 per second, Luxor data shows.

The metric temporarily touched on $52 when Bitcoin was traded above $118,000 this summer, but has since grown in difficulty and has declined as prices softened.

To improve the minor margin, one of the three levers must be moved. This is a high rate that remains at multi-year lows, a rebound in Bitcoin prices, or a slower network hashrate.

Despite record difficulties and lower hash prices, mining inventory has gathered over $118,500 with a surge in Bitcoin, rising more than 51% over the past month, with BitDigital (BTBT) rising 25% and Marathon Digital (MARA) climbing nearly 16%.