Bitcoin has achieved records in computational power, but increasing block difficulty continues to hurt miners’ profits.

summary

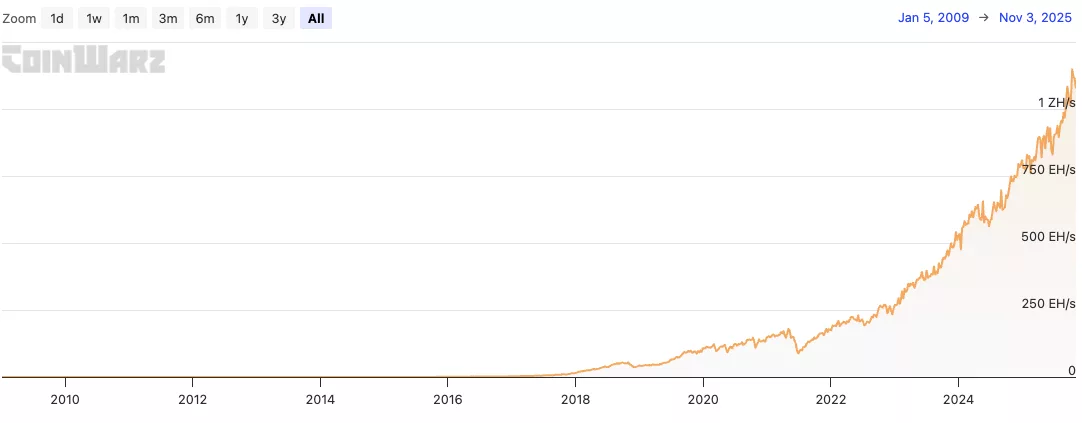

- Bitcoin mining hashrate reached a record 1.13 Zh/s in October.

- Geographically, this expansion was driven by Kazakhstan and the Middle East

- Still, mining profitability decreased by 7% due to increased block difficulty

Bitcoin miners found themselves under pressure from all sides in October. The sector hit a record hashrate of 1.13 Zh/s in October. This shows that participation in Bitcoin mining is increasing. Still, increased mining difficulty, rising energy prices and a record $19 billion in liquidations weighed on miners’ profits.

Bitcoin hash rate since launch | Source: CoinWarz

“October was a remarkable month for the Bitcoin mining market,” TeraHash analysts told crypto.news, highlighting that the hashrate briefly exceeded 1.13 Zh/s. “This growth was primarily driven by infrastructure expansion in North America and increased participation from Kazakhstan and the Middle East.”

Hashrate refers to the amount of computing power that participates in mining Bitcoin. This is very important for decentralization and security, as a high hashrate makes attacks on the network more difficult. However, this indicator does not automatically lead to an increase in mining profits.

Specifically, revenue per exahash per second (EH/s) decreased by 7% compared to September, from $52,000 to $48,000. Additionally, the drop in Bitcoin prices has reduced miners’ rewards, causing hash prices to drop nearly 12% since the beginning of the month.

Bitcoin miners are struggling to survive

The fall in Bitcoin prices coincided with rising energy costs. Rising oil and gas prices affected miners who are not connected to the grid. In some regions, particularly in Europe and the United States, miners have also had to deal with power cuts. Because of this, hashrate is likely to drop in the near future.

“Looking ahead, we think hashrate growth is likely to temporarily slow in November, primarily due to rising energy costs and weather-related constraints. We expect a slight decline in the next difficulty adjustment, providing temporary relief for small-scale miners,” Terahash analysts said.