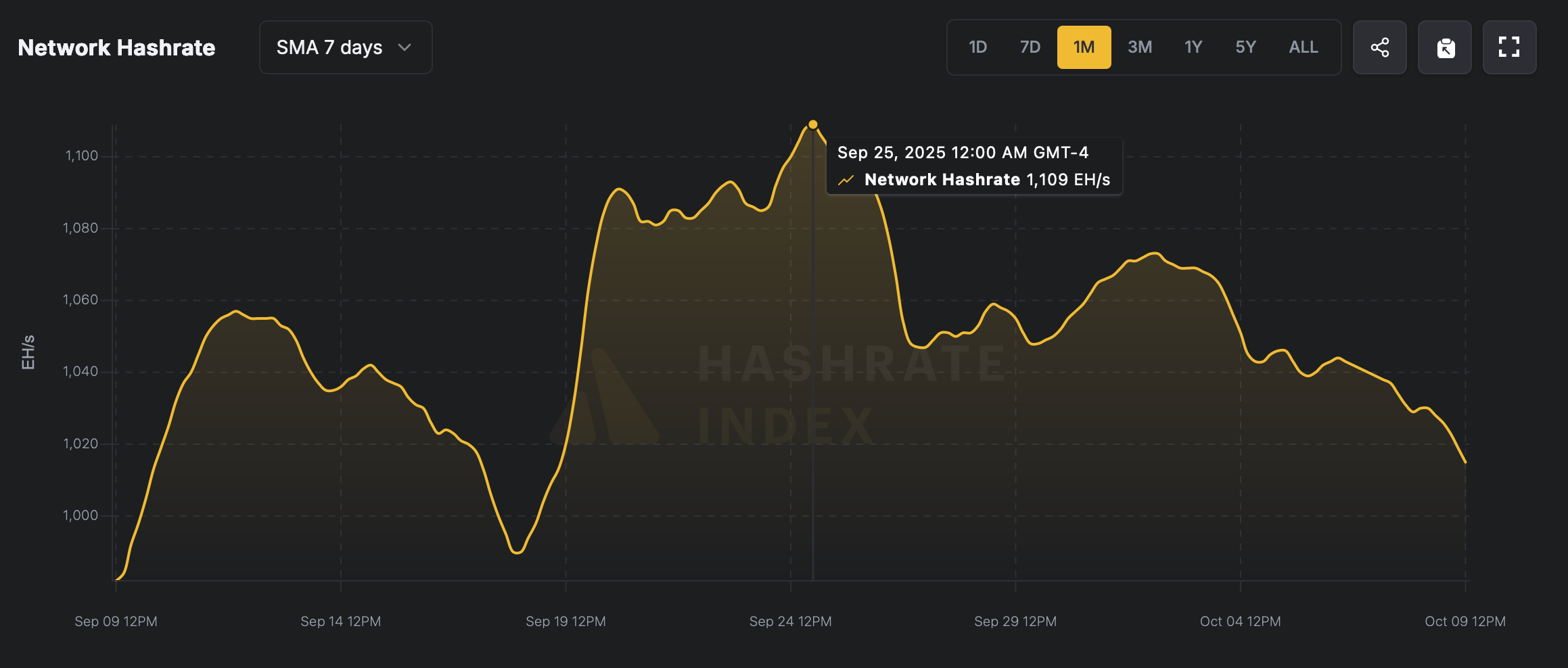

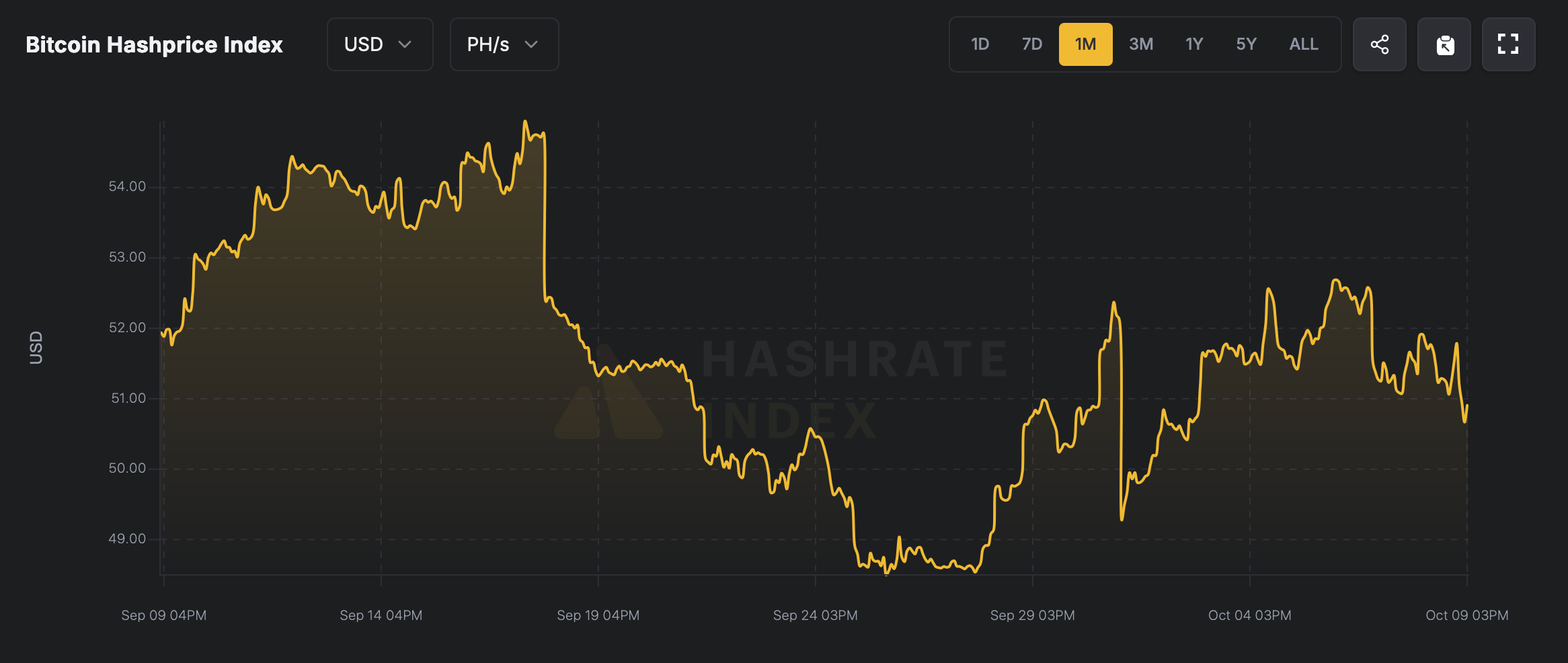

Over the past two weeks, Bitcoin’s hashrate has fallen by nearly 100 exahashes per second (EH/s), indicating a slowdown in global mining activity. This decrease is consistent with a $2 decrease in mining revenue per petahash (PH/s) from last month, reflecting a contraction in miners’ profit margins due to fluctuations in network conditions.

Global Bitcoin hash rate retreats from record high, signs of network rebalancing

As the next difficulty adjustment approaches next week, estimates predict a notable decline in mining difficulty, which may provide short-term relief but points to broader volatility across the Bitcoin mining ecosystem.

About two weeks ago, the total hashrate of the Bitcoin network reached a record-breaking peak of 1,109 EH/s, marking the highest level of computing power in history. Since then, the network strength has weakened, with the current hashrate hovering around 1,011 EH/s, indicating a measurable contraction in mining activity and network efficiency.

Much of this decline is due to Bitcoin’s mining difficulty rising to an all-time high of 150.84 trillion, following seven consecutive difficulty increases. This continuing trend is tightening profitability for miners and increasing network competition across the global Bitcoin ecosystem.

As of October 10th, Bitcoin mining difficulty is predicted to drop by approximately 7.57%, potentially giving miners a reprieve after weeks of margin compression. This reduction in difficulty could help carriers recover from the recent hashrate slump and restore balance to network economics.

Mining profits briefly improved earlier this week as Bitcoin prices soared to new highs, with hash prices (estimated at 1 PH/s) rising to nearly $53. As of this writing, the hash price is around $51.20, reflecting a moderate cooling that still remains favorable compared to the previous month.

In the coming weeks, the state of Bitcoin mining will depend on how miners adapt to broader market trends that will shape future difficulty adjustments and profitability. A 7.57% reduction in difficulty may provide short-term relief, but a sustained recovery will depend on Bitcoin’s price stability, energy costs, and global network participation.

Historically, such cycles of hashrate contraction and rebound have acted as a natural realignment of the network, rewarding operations that can innovate and scale while weeding out those that are less efficient. For now, the decreasing hashrate and easing of mining difficulty signals a potential stabilization phase, offering miners an opportunity to optimize their operations before the next big change in the BTC economy.

💡 FAQ: Bitcoin hash rate and mining difficulty

- What caused Bitcoin’s hashrate to drop recently?This decline is primarily due to increased mining difficulty and decreased overall network profitability.

- How much do you expect Bitcoin mining difficulty to change?Estimates from hashrateindex.com suggest a 7.57% decrease, marking the first significant drop in difficulty in weeks.

- What is Bitcoin’s current hash price per PH/sec?Hash price is hovering around $51.20 per petahash, slightly below the recent peak of $52.

- How will this difficulty reduction affect miners?A lower difficulty level could temporarily increase miners’ rewards and help stabilize operations during recent instability.