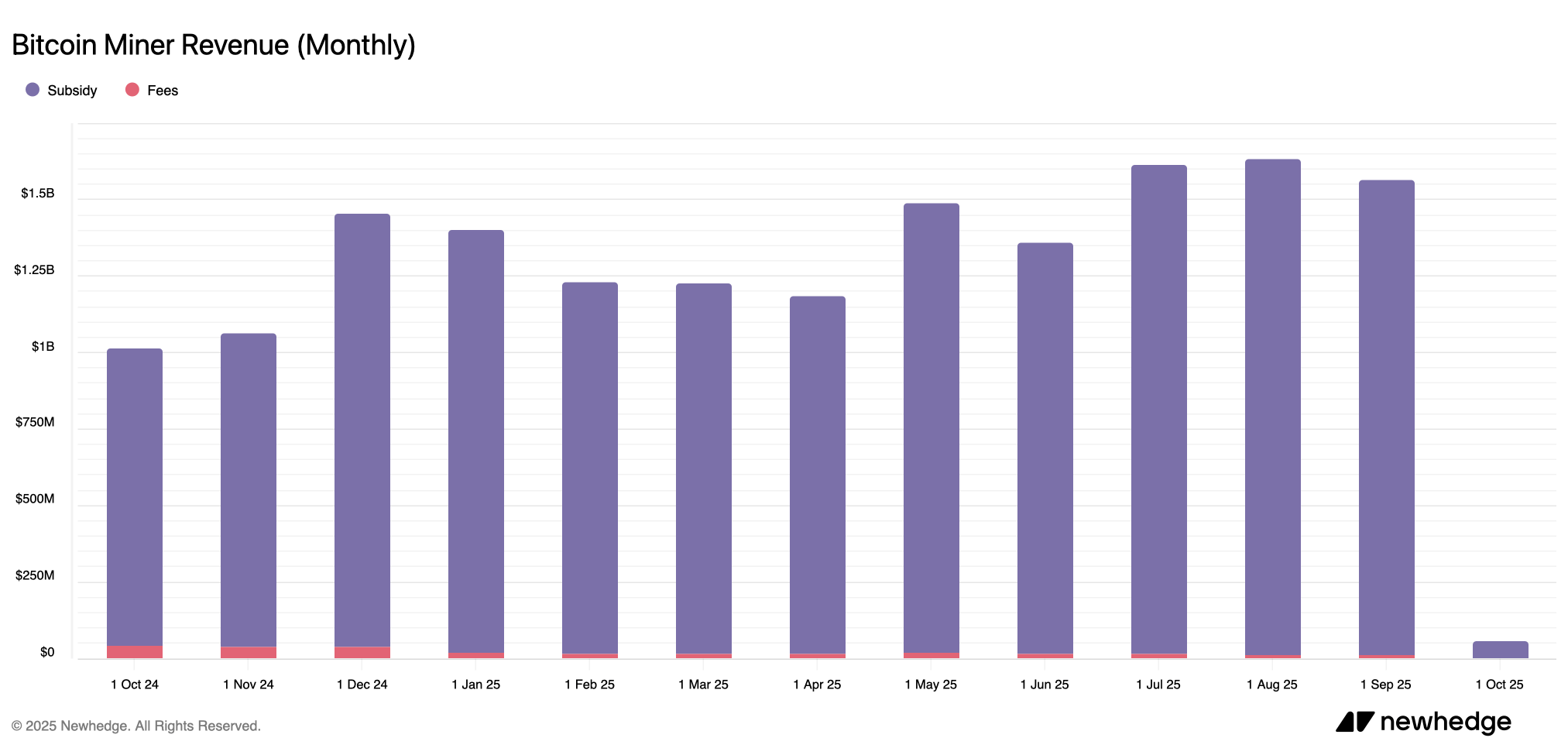

Bitcoin Miner had a modest September slump, shrinking revenues by 4.23%.

Slide Bitcoin Mining Profits in September

At the time of publication, HashrateIndex.com data is shown The SHA256 hashrate stand has a spot rating of 1 second per second (pH/s) of $52.10. It’s a modest decline from the $53.15 diagram recorded on September 1st. September is not the gold of the Bitcoin Miner, but has cut $69 million from August, and landed $1566.4 billion.

Figures collected by NewHedge.io show that almost everything ($1.55 billion) came from good old block rewards, but a modest $14 million has been reduced from on-chain fees. Essentially, Bitcoin Miner has scored $13 million in total last month from transfer fees, starting with $1.633 billion in August.

Image source: newhedge.io

The September metric similarly dragged the July total. The mining business has raised a collective $1.6 billion, making block subsidies alone $1.595 billion. On-chain fees were still low, miners earned less than 1% of their total compensation from fees, with a 24-hour average of 0.65% of block reward tally.

Even if revenue hits, miners aren’t slowing down. The hashrate is bent at 1,065.53 exahash (eh/s) per second on the miles that I was standing only 30 days ago. In September, Bitcoin’s computing power peaked at 1,109 EH/s, but today’s block intervals were recorded considerably faster than the standard 10 minutes.

At a fierce pace, hikes with the current expected 4.63% to 5.9% difficulty are set on stage as miners chew 2,016 blocks of epoch faster than planned. Of course, that estimate is not set on stones. If the block falls into place, it could tilt it either way. With revenue slides and difficult climbs, only the leanest rigs continue to hum. Others are squeezed in an arena where each epoch cuts the edge thinner than the edge of the razor.