According to the latest on -chain data, the Bitcoin miner refuses to offer the BTC holding, despite the historically low profitability.

The BTC transaction fee is the lowest since 2012.

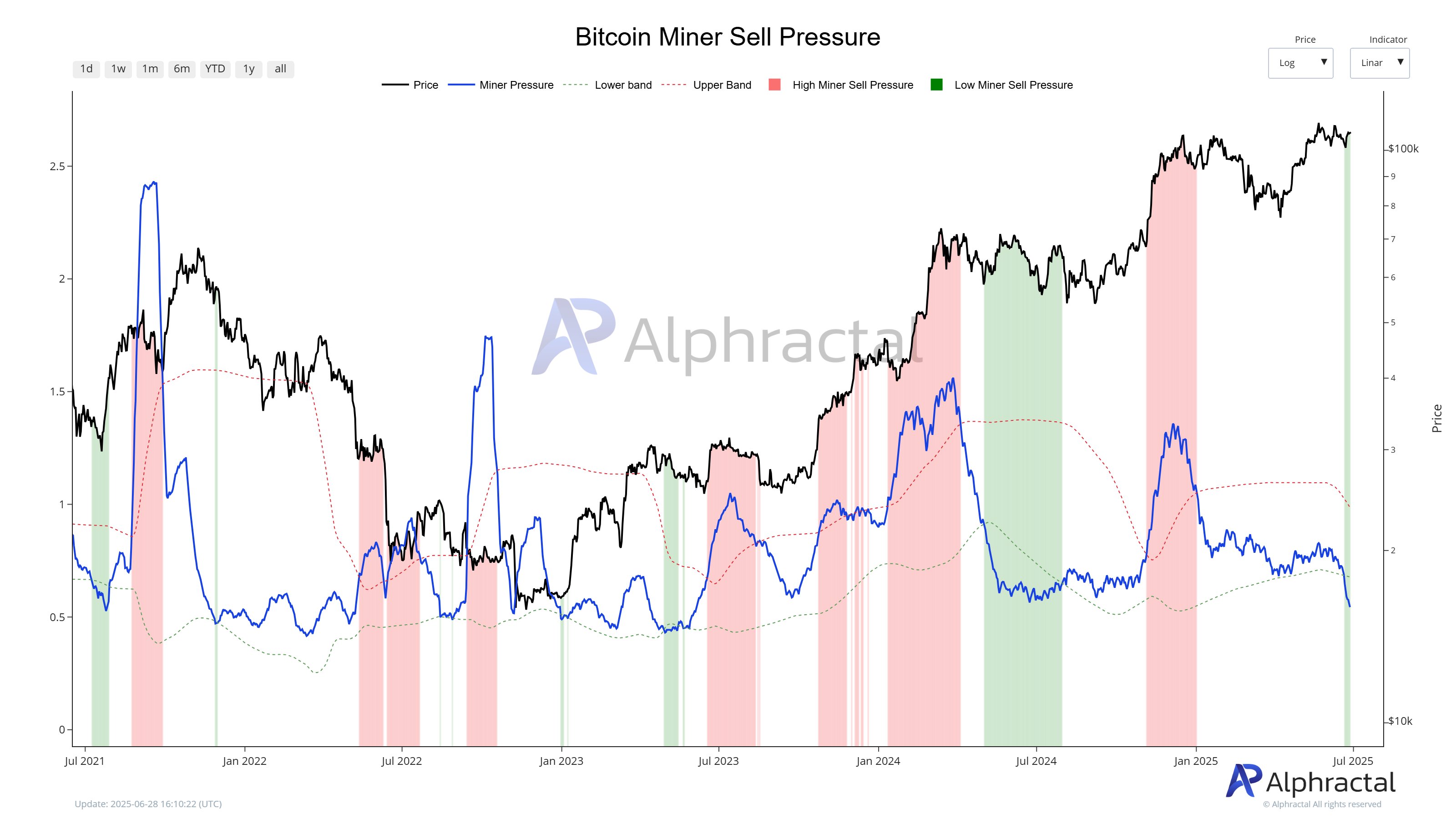

In the new post of X, Alphractal, a Blockchain Analytics company, found that Bitcoin Miners still maintains its reserves despite the decrease in imports. The onchain data platform discussed the reasons for this trend and the potential impact on the BTC mine industry.

First, Alfathal emphasized low warm chain activities in one of the reasons for significant decrease in minor revenue. As a result of the decrease in activity, the total trading fee paid in the Bitcoin network has fallen to the lowest level since 2012.

The market intelligence platform also mentioned that the difficulty of mining has increased despite the recent witness of the hash ratio. In general, there is a direct relationship or positive correlation between the hashrate and the difficulty of mining. However, according to Alphractal, this recent delay or Harry further tensions and delays network equilibrium.

Alpha Ractal also said that Bitcoin hash ratio volatility has reached a new all -time high in X. This basically means that the network is the highest hash speed change or a change in history.

Blockchain Analysis Company has added:

This can be caused by a large -scale mining operation that closes ASIC machines because of the low profit reduction and network demand.

Source: @Alphractal on X

Despite network revenue and high mining difficulty, the miners’ pressure was maintained at a low level. As exhibited by a low miner sales pressure metric, it indicates that the miner does not actively offset its retention for profit.

Alphractal admitted that the low sales pressure of the miners is especially a positive signal for the price of Bitcoin. The blockchain company mentioned that some mining pools may reduce the operation of the bitcoin network. Alphractal said, “As the BTC trades more than $ 107K, we can simply see that miners are assigning haveh power to adapt to the current demand.

In general, BTC miners tend to sell coins for a quick price increase and high blockchain activities. However, Alphractal believes that the two current absence suggests the adjustment period rather than the surrender between the miners.

Bitcoin price at a glance

At the time of this article, BTC is about $ 107,375, which is only 0.3% in the last 24 hours, continuing to the side.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

Istock’s main image, TradingView chart

Editorial process focuses on providing thorough research, accurate and prejudice content. We support the strict sourcing standard and each page is diligent in the top technology experts and the seasoned editor’s team. This process ensures the integrity, relevance and value of the reader’s content.