Bitcoin miners are facing financial pressure as hash prices have fallen to levels that could force them out of the market. The cryptocurrency mining sector is facing challenges stemming from falling Bitcoin prices, rising energy costs, and increasing network difficulties, putting miners at risk for survival.

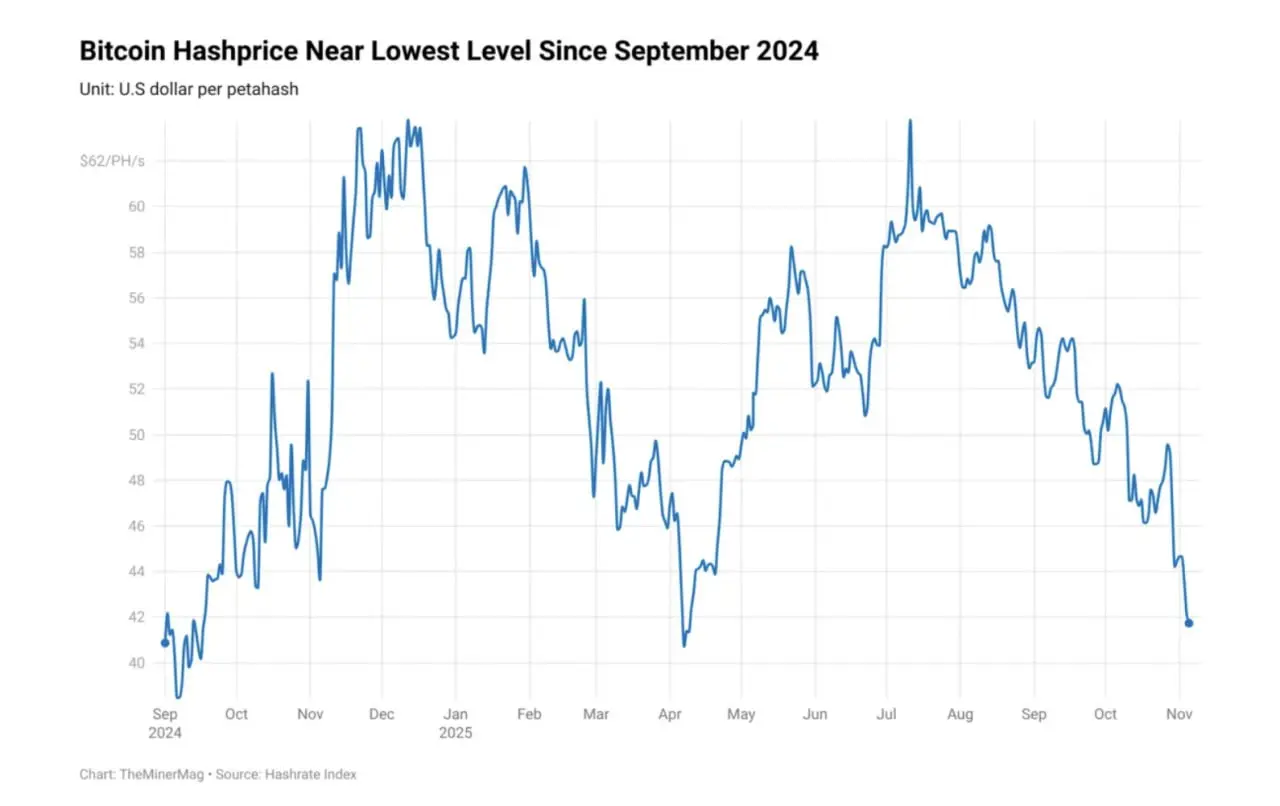

TheMinerMag showed that the BTC mining hash price has fallen to $42 per petahash per second (PH/s). The hasprice PH/s number determines the expected daily revenue earned per unit of computing power and helps miners measure the profitability of mining. PH/S in July was around $62, down more than 30% at current rates.

Some BTC miners are shifting focus to AI and data center infrastructure services

Small-scale miners may be excluded from the market due to high operating costs. So far, most miners have scaled back their operations and sought new revenue generation avenues to act as a buffer against potential losses.

Bitcoin hash price is close to $40. Source: TheMinerMag

The decline in hash prices began to surface when mining hardware operators and suppliers began reporting a drop in orders due to financial strain. The October crash especially exacerbated the impact for miners who were selling in BTC.

One mining company, Bitdeer, has shifted its focus to self-mining to directly generate revenue, rather than relying entirely on hardware sales. Some analysts have warned that this strategy will not be profitable in the long run, as the price of hashrate will be under pressure, impacting the entire sector.

The cost of acquiring and upgrading high-performance application-specific integrated circuit (ASIC) hardware is part of the challenge impacting miners. Another challenge is rising electricity prices, making it nearly unprofitable for miners.

Some mining companies are shifting their focus to AI solutions, data centers, and high-performance computing (HPC) services to gain access to alternative revenue streams. The AI and data center fields rely on large-scale computing infrastructure similar to cryptocurrency mining.

For example, Cipher Mining signed a $5.5 billion deal to supply computing power to Amazon Web Services’ cloud infrastructure for 15 years. IREN also signed a $9.7 billion GPU computing deal with Microsoft. However, some analysts warn that relying on AI infrastructure services requires significant upfront capital and expertise, which could limit participation by large mining companies.

BTC network hashrate exceeds 1 zetahash per second

The Bitcoin halving event in April 2024 increased competition among miners for limited block rewards, decreasing from 6.25 BTC to 3.125 BTC per block.

Based on CryptoQuant analysis, Bitcoin’s total network hashrate, which measures the total computational power required to secure the network, has exceeded 1 zetahash per second (ZH/s). This increase is due to the significant participation of industrial-scale miners and improvements in hardware efficiency.

As the hashrate increases, it becomes harder to mine new blocks. Therefore, the cost of mining a single Bitcoin block is increasing, regardless of the market price of BTC.

The hashrate is over 1 zetahash per second. Source: CryptoQuant

Bitcoin mining has evolved from CPU-based setups in 2009 to today’s large-scale ASIC-based operations, leaving the market in the hands of investors with large capital investments and significant energy resources.

Initially, mining a block earned a reward of 50 BTC, but this has gradually decreased to the current 3.125 BTC per block, creating economic pressure to reward only the most efficient and capital-intensive operators.

BTC After the decline, the situation remained unstable over the weekend. By Friday, it was below $100,000. So far, the token has traded above $102,000 and has grown by 0.84% on the daily chart. BTC has also fallen by 7.2% over the course of the week, falling from trading above the $104,000 support level to current levels at $102,330.