Bitcoin miners have started February on a shaky note, with revenues declining significantly since mid-January and well below their 12-month peak in July. In addition, the US winter storm has kept hashrate well below the high levels seen in October.

Bitcoin miners start February with profit indicators flashing red

Most people are familiar with the winter storm that has hit multiple states in the United States, causing some mining operations to temporarily lose power to ease the strain on local power grids. As of this writing this weekend, the hashrate is around 850 exahashes per second (EH/s) idle. It hasn’t fallen to this low since late June 2025.

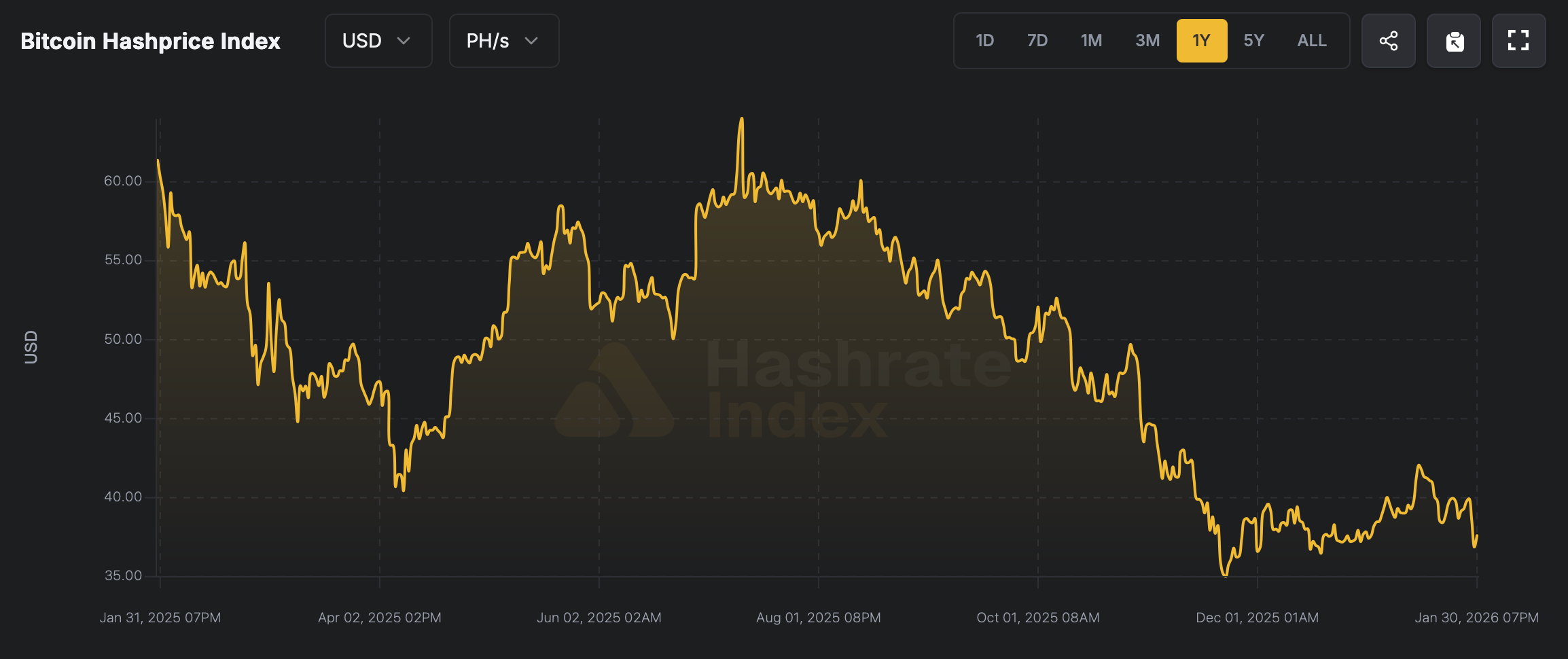

On top of that, Bitcoin mining companies have been plagued by price declines to areas not seen since April 2025. This drop has pushed the hash price, a metric that measures the estimated value of hashing power in petahash per second (PH/s), to painfully low levels. The $35.22 hash price isn’t quite as high as $34.99 on November 22nd, but it’s uncomfortably close in terms of comfort.

Bitcoin hash price on February 1, 2026.

This is the second-lowest return for Bitcoin miners in the past 12 months and is approximately 45% below the 12-month high of $64.03 per PH/s recorded on July 11, 2025. To add insult to injury, the top 13 publicly traded Bitcoin miners by market capitalization all ended Friday with significant losses.

Applied Digital (APLD) was the hardest hit, down 11%, followed by IREN Limited (IREN), down 10.19%, and Cipher Mining (CIFR), down 9.83%, with significant losses across the leaderboard. Taken together, all of this is putting severe pressure on miners, and there is only a short list of factors that could potentially ease the squeeze.

read more: Latin America Insights: Venezuelan oil flows back to US, El Salvador buys gold

These include Bitcoin recovering from its recent lows, and at current prices BTC is still 37.4% below October’s all-time high north of $126,000. On-chain fees may also ease some, but they have remained less than 1% of the average block reward for quite some time. The greatest and more reliable source of relief is likely to come from the next difficult period, which is shaping up to be a very meaningful adjustment.

For now, miners must struggle through a cold, unforgiving period where margins are thin, machines are quiet, and patience wears thin block by block. Until prices recover or a reset of hardship provides a breather, survival will depend on efficiency, balance sheet discipline, and usually less comfort as we wait out the storms caused by both the weather and the markets.

Frequently asked questions ⛏️

- Why are Bitcoin miners’ profits decreasing now?

Mining revenue declined as Bitcoin prices fell and hash prices fell to their lowest levels in the past year. - What is Hash Price? Why is it important for Bitcoin miners?

HashPrice measures the estimated daily revenue earned per petahash per second (PH/s) and directly reflects a miner’s profitability. - How far is Bitcoin from its recent highs?

Bitcoin is currently about 37% below its all-time high of $126,000, set in October. - What can improve Bitcoin miner profits in the future?

A recovery in Bitcoin prices and a downward adjustment in mining difficulty could help ease pressure on miners’ margins.