Financial metrics for March reveal that Bitcoin Miner’s revenues have contracted by $20 million compared to February. At the same time, hash pris (theoretical daily yield of 1 peta hash per second) is up 3.93% from the benchmark in early March.

Hashprice’s 3.93% slide meets 862 EH/S Frenzy

Fresh data collected via HashrateIndex.com on April 1, 2025 shows a descent of Hashpris from $48.84 per PH/s on March 1st to the current $46.92. This diagram encapsulates the hypothetical daily returns of mining production at 1 pH/s. Despite the moon’s downward orbit, the Hashpris vibrated dramatically, climbing to its $54.38 peak in early March, and by March 10th it had eroded a $44.05 trough.

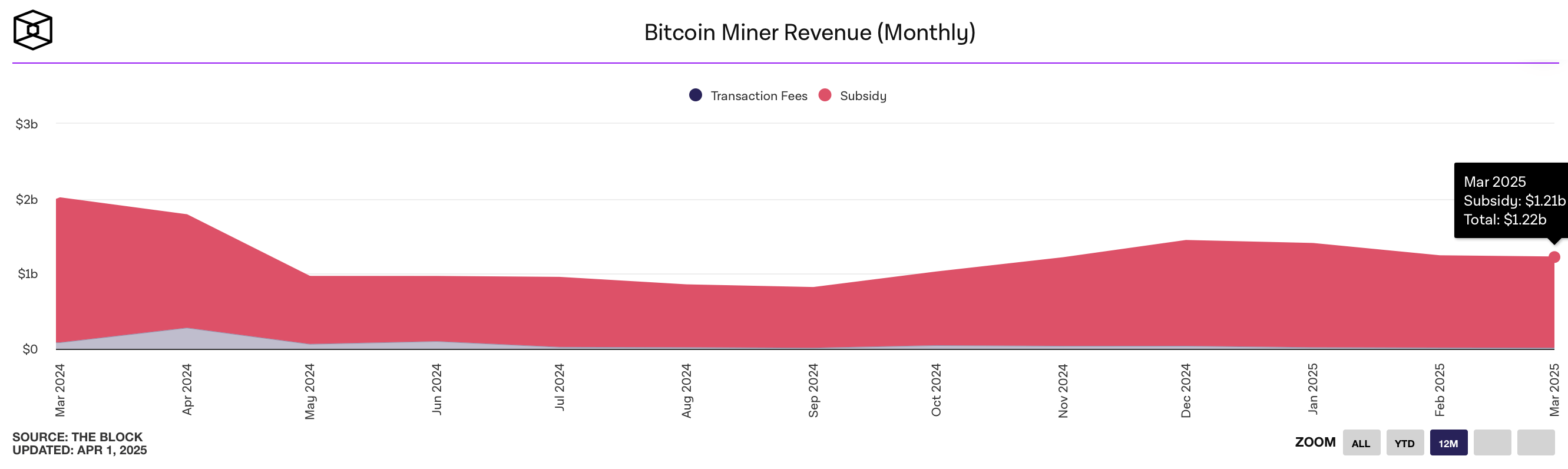

1 PH/s revenues have been contracted 3.93% since the start of March, but have rebounded 6.52% since March 10th. The analysis revealed that Bitcoin Miner had a $20 million shortfall in revenue in March in February, according to the data set from TheBlock.co. In February, miners earned $1.24 billion in profits, of which $1.22 billion came from the subsidies. Data for March reflects a $1.22 billion accumulation, resulting in $1.21 billion from block grants.

Onchain fees donated $16.45 million to the February total, and recorded $1511 million from the stream in March. Additionally, Bitcoin hashrate reached an unprecedented peak in March, surged to 862 exahashes per second (EH/S). The block interval is clipped at a Brisker pace than the 10-minute benchmark, which is expected to have the difficulty adjustment expected on April 5, 2025.

Meanwhile, at the end of March and early April, on-chain transaction throughput was suppressed, with blocks below intraday capacity. This lull compressed on-chain fees to just 1-4 Satoshu per virtual byte (SAT/VB). Translate slimmer profit margins for mining operations.