Bitcoin prices have been under pressure since it won an all-time high of $123,731 on August 14th. The coin price fell about 10% last week as it is currently trading at $113,167.

Pullback coincided with an increase in sales activity from miners, which soon sparked concerns about even more downsides.

BTC Minor Off-Road Holding

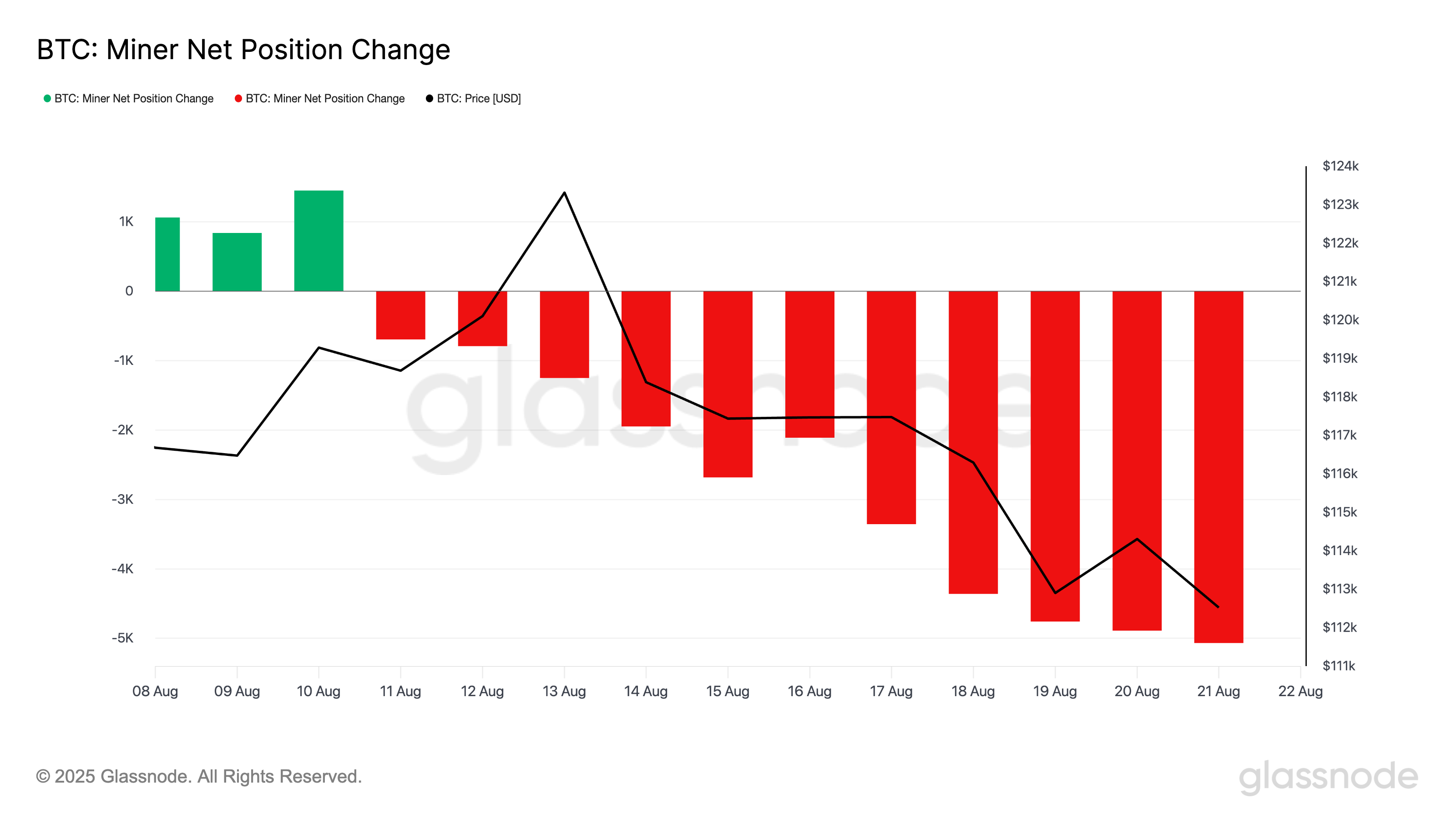

According to GlassNode, changes to Bitcoin’s minor net position have dropped to this year’s lowest level.

The metric tracking 30-day changes in BTC held at minor addresses fell to -5,066 on August 21, indicating a prominent drawdown of minor reserves, at its lowest read since December 2024.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

Changed BTC minor net position. Source: GlassNode

When this metric immerses it shows increased sales pressure from miners, one of the most influential groups on the market. Persistent outflows from minor wallets can be weighed for prices, especially as the market struggles to absorb this additional supply.

This will degrade the downward momentum of BTC and lengthen the possibility of important short-term corrections.

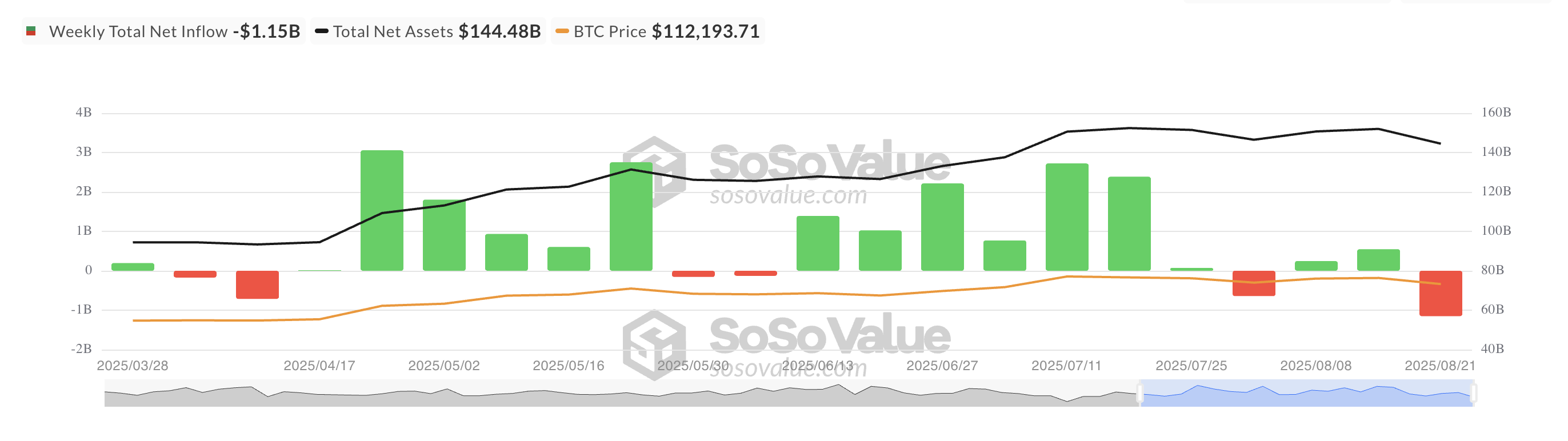

ETF spills skyrocket to $1.5 billion

In addition to miners, institutional investors exposed to BTC through ETFs have also become heavier in the market. According to Sosovalue, weekly outflows from these funds totaled $1.51 billion since Monday, and are on track to record the largest weekly outflow since late February.

Bitcoin spot ETF online inflow. Source: SosoValue

A reduction in capital inflows from ETFs adds more headwinds to the assets. It could exacerbate the impact of miner sales on the coin, stalling notable rebounds in the short term.

BTC faces downside risk of $107,000

At current prices, BTC outweighs the support formed at $111,961. As miners continue to sell and capital to BTC ETF continues to decline, the risk of the coin violates this support flow and drops to $107,557.

BTC price analysis. Source: TradingView

However, an increase in new demand for BTC would negate this bearish outlook. Once accumulation resumes between traders and miners on the network and reduces distribution, Kingcoin can regain its strength and climb to $115,892.

Post Bitcoin Miner has released spares and added headwinds to its BTC price outlook.