- Cango’s Bitcoin reserves are valued at approximately $700 million, more than its stock market capitalization.

- Production in December increased by 4.1% to 569 units. BTCtotal holdings rose to 7,528.3 BTC.

- The miner controls approximately 5.4% of the world’s hashrate and is set to increase shareholder investment by $10.5 million.

Cango Inc.’s Bitcoin vault is now worth more than the company’s stock market capitalization, drawing renewed attention to a previous assessment by HCW and Greenridge analysts last month that valued the company’s stock as “significantly undervalued.”

The Dallas-based miner announced on Monday, January 5, 2025, that it produced 569 Bitcoins in December. This is an increase of 4.1% from the previous month, bringing the total amount held to 7,528.3 bits. BTC.

With the current market price hovering around $93,000 per Bitcoin, the company’s digital asset reserves are valued at approximately $700 million, which exceeds the New York Stock Exchange (NYSE) market cap of more than $568 million at the time of writing.

This disparity highlights the disconnect between Bitcoin miners’ assets under management and their stock valuations, especially as many participants in the sector continue to face declining profitability and increasing operating costs.

Cango’s CANG stock is up 16% today, January 6th, premarket. It’s also up double digits since the company’s recent expansion into crypto mining in November 2024.

Kango stock defies mining woes

Cango’s December performance stands out against the backdrop of increasing pressure on Bitcoin miners around the world.

According to the company, it maintained an average operating hash rate of 43.36 exahash per second (EH/s) during the month, with an installed capacity of 50 EH/s, which is approximately 5.4% of the total hash rate of the global Bitcoin network.

“Throughout 2025, Cango delivered strong and consistent business growth,” said Paul Yu, CEO and Director of the company. “In December, due to favorable adjustment of network difficulty, we maintained a stable operating hash rate level and achieved an increase in daily Bitcoin production, resulting in total Bitcoin holdings of 7,528.3. BTC”

The company’s production increased as other mining companies struggle with profitability concerns. Industry data from hashrate indexes shows that while network difficulty remains stable, many operations are operating at or near break-even levels, raising questions about potential miner capitulation.

Cango approaches the top 10 Bitcoin treasury

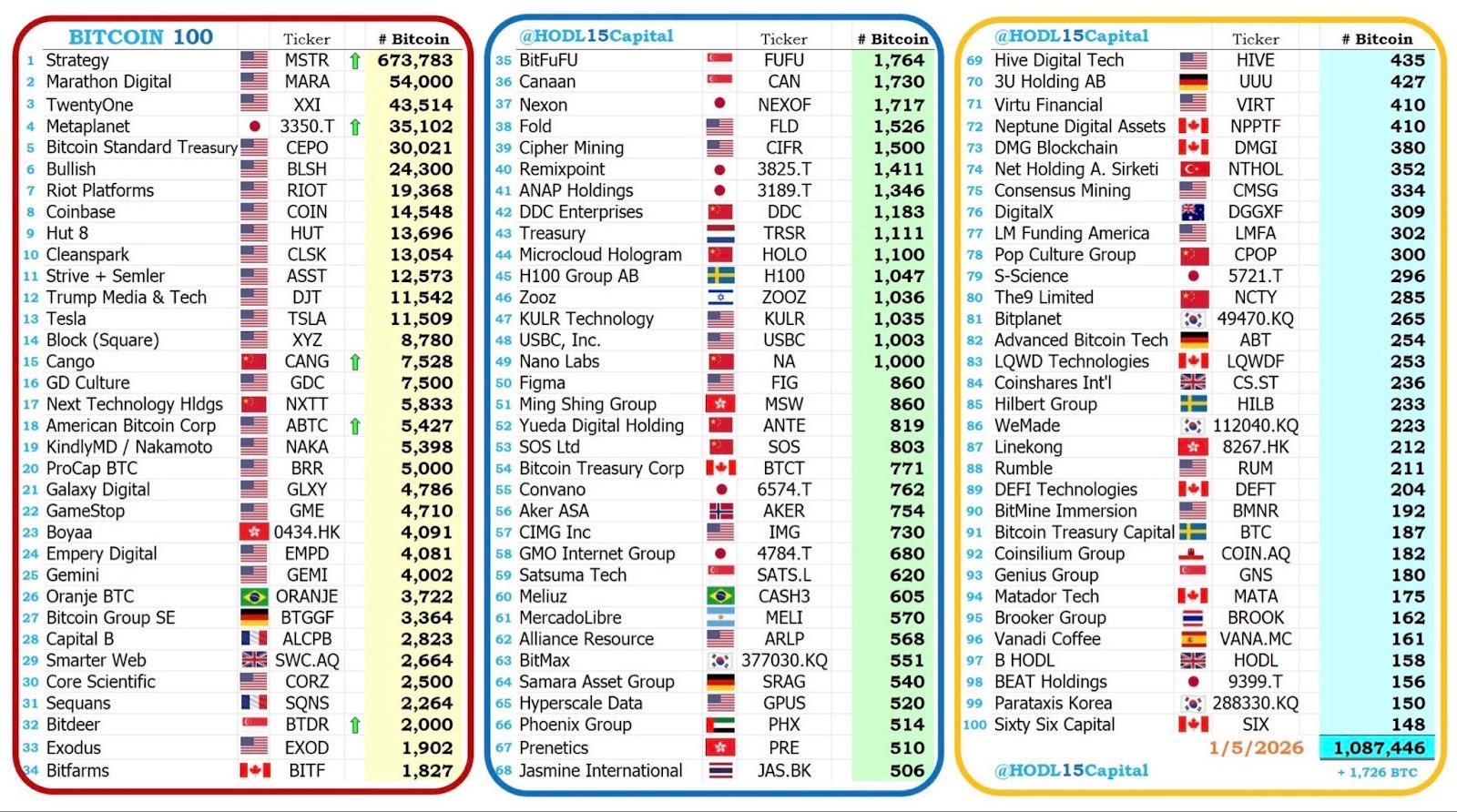

Cango has already surpassed GD Culture to become the 15th listed Bitcoin reserve company. The company has adopted a “HODL” strategy and has made it clear that it has no intention of selling its current Bitcoin holdings.

But unlike leading companies like Strategy (formerly MicroStrategy) that employ this strategy, Cango’s much smaller market capitalization creates a more pronounced valuation dynamic, with Bitcoin holdings alone accounting for about 140% of the company’s stock value.

The company received a vote of confidence from investors who put money into the company.

According to Yu, “In late December, our major shareholders decided to increase their investment in Cango with a commitment of US$10.5 million, which is expected to be completed in January 2026, representing a strong vote of confidence in our strategic roadmap.”

Cryptopolitan reported in December that Enduring Wealth Capital Limited (EWCL) had made a $10.5 million commitment to Bitcoin miner Cango, following a $70 million funding deal announced in June 2025.

Yu added that the investment will help Cango “increase the efficiency of Bitcoin mining and accelerate the parallel development of energy and AI computing platforms in 2026.”

Diversification beyond mining

Like many miners who have embraced diversification in the face of recent challenges in the mining sector, Cango is pursuing a diversification strategy.

The company operates more than 40 mines across North America, the Middle East, South America and East Africa, while also developing integrated energy solutions and distributed artificial intelligence computing pilot projects.

Cango also continues to maintain its original business line, AutoCango.com, an international used car export platform, representing an unusual hybrid corporate structure in the crypto mining sector.

For now, analysts are looking for signals that Cango can close the gap between Bitcoin’s asset value and market capitalization.

However, the success of the company’s Bitcoin mining business is undisputed, and that has spilled over into its stock price, which rose as much as 13% yesterday following the announcement, approaching the $2 level.

As of mid-December, HCW analysts were claiming CANG stock would reach $3, while Greenridge analysts were more bullish, with a $4 price target for CANG.

AI ambitions move up the priority list

Cango has consistently signaled plans to become a globally distributed AI computing network. The company is already working toward this goal by leveraging its existing computing infrastructure and access to gigawatts of grid-connected power capacity granted across its global locations.

“The nature of competition in AI has shifted from software algorithms to a lack of power and space,” Juliet Yeh, the company’s director of investor relations, explained to Cryptopolitan.

Cango is developing an innovative plug-and-play AI infrastructure solution designed to help Bitcoin mining sites migrate to facilities capable of running AI inference workloads. This infrastructure upgrade often costs tens of millions of dollars and tends to discourage such transformations.

The company has already validated the solution in a real-world environment and “plans are underway to replicate this model at several mine sites later this year,” Juliet added.

Cango’s strategy addresses the growing demand from the long-tail inference market for geographically distributed computing power close to data sources. We also support many small and medium-sized businesses. BTC Mining sites around the world will be able to transition to AI without the associated infrastructure costs.

In the short term, the company aims to maximize the value of its 50 EH/s mining capacity while selectively entering the GPU computing lease market, with medium-term plans to develop a regional AI network and long-term ambitions to build a globally distributed computing grid backed by multi-year computing offtake agreements.