Cryptocurrency markets suffered steep declines on Tuesday, but signs of easing from the Federal Reserve helped prices recover from their worst levels. President Trump’s Truth social post the previous day reminded bulls that he has the power to reverse the rise in asset prices at any time.

Bitcoin BTC$112,920.16 After falling from levels near $116,000 overnight, it fell to $109,800 in early U.S. trading on Tuesday. It then fell 2.8% over the past 24 hours to $112,600. Ethereum$4,121.87 During the same period, BNB, XRP, and Dogecoin fell between 4% and 6%. The broader CoinDesk 20 index fell 3.2%.

Markets gained some footing after Federal Reserve Chairman Jerome Powell said the central bank is nearing the end of its quantitative tightening (QT) cycle, the process of reducing its bond holdings. He also noted that there are signs of some tightening in money markets, as well as a cooling labor market, increasing risks to employment. Considering these comments, there is a high possibility that there will be another rate cut later this month.

U.S. stock indexes reacted sharply, with the Nasdaq and S&P 500 reversing early losses and briefly turning green, before closing with losses of 0.75% and 0.15%, respectively.

At least some of the day’s rally in both cryptocurrencies and stocks dissipated in the final minutes of trading after President Trump suggested on Truth Social that he block imports of edible oil from China unless the country ramps up its soybean purchases.

Miners continue to be bid

Crypto mining stocks once again led digital asset stocks as investors continue to bet that these companies will benefit from a surge in demand for computing power from artificial intelligence (AI). BitFarms (BITF), Cleanse Park (CLSK), IREN (IREN), Marathon Digital (MARA), and Terrawolf (WULF) each soared more than 10% on the day.

Massive Leveraged Flash Drives Bitcoin Accumulation

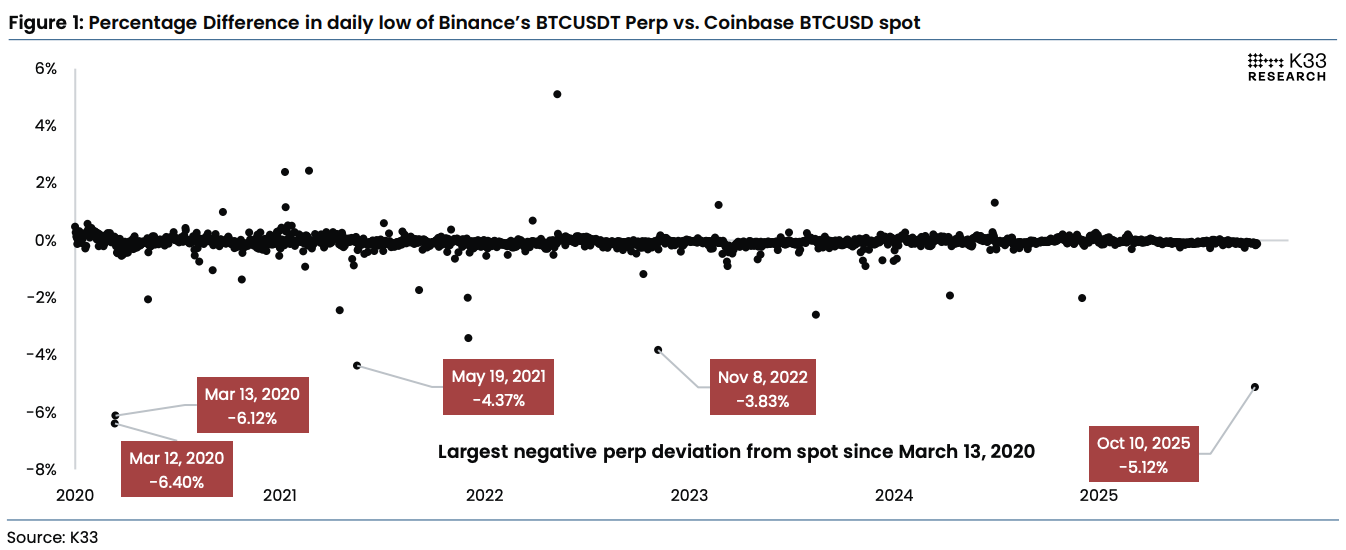

Although the rebound from last week’s flash crash lost momentum on Tuesday, K33 head of research Vetr Runde sees the current decline as a constructive setup for Bitcoin to stabilize after a significant reset of leverage.

“We are constructively bullish on Bitcoin after the recent leverage purge, but patience remains key,” Lunde said in a note on Tuesday. He noted that liquidity is likely to remain thin in the short term as traders recover from forced selling, but argued that this kind of unwinding in the past often signaled a market bottom.

Price deviation between Binance’s BTC Perpetual Swap and Coinbase’s spot price K33)

“Due to significant deleveraging, we have finally determined that current levels are attractive to increase our spot BTC exposure,” he said. “Combined with a supportive backdrop such as expansionary policy expectations, high demand from institutional investors, and a pending ETF catalyst, this setup favors gradual accumulation.