For years, Bitcoin has been considered digital gold, but the latest numbers suggest that this comparison may be losing credibility. Bloomberg strategist Mike McGlone sums it up bluntly: The Bitcoin-to-gold ratio is changing rapidly and could be the first sign of what he calls the Great Reset.

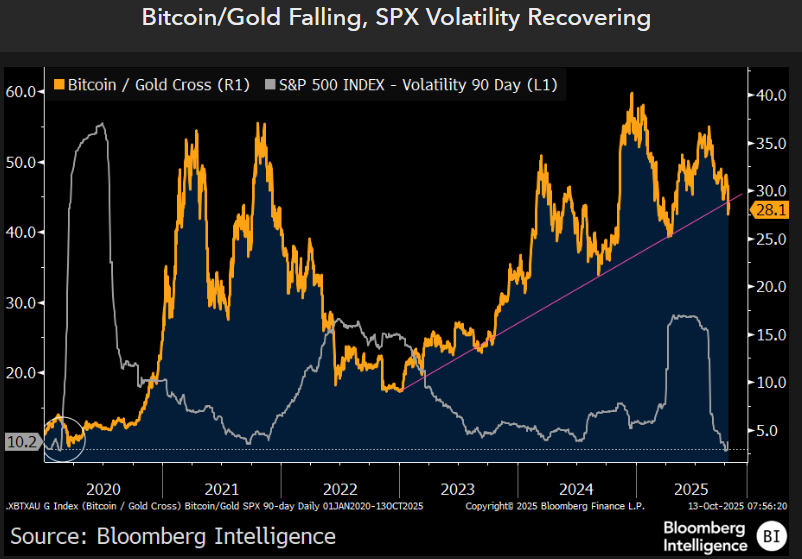

When it comes to data, charts speak louder than words. The Bitcoin-gold cross, which once hovered above 50, is now barely above 30 and has fallen while volatility has moved back into equities, with McGlone saying risk assets overall tend to suffer in this setup while gold quietly regains ground.

Bitcoin’s price has been volatile lately, initially trying to hit $124,000, but falling within hours, and by the time U.S. markets opened, Bitcoin was back below $111,000.

Gold, on the other hand, is doing very well, and it’s hard to say that digital scarcity is better than physical scarcity. In just one day, futures prices rose $130, ending the day at $4,130 per ounce. This is a new record, and the 3.3% increase added almost $1 trillion to the metal’s market capitalization.

even more numbers

GLD, the largest bullion ETF, traded $12.5 billion, the second-highest volume in history, and exceeded the volume of most of the 7 Magnificent stocks.

Gold’s RSI hit 91.8, its highest monthly reading so far, with only four months of decline since March 2024.

McGlone has faced criticism in the past for his pessimistic stance, but this time the evidence backs him up. Bitcoin may be on the rise in the crypto world, but when compared to gold, the message is very clear: the old metal is winning.