A day after President Trump publicly confirmed US airstrikes at Iranian military facilities, Bitcoin showed signs of investors’ hesitation, despite surpassing major support at $102,000. As of June 22, 2025, Bitcoin is trading between $102,700 and $102,810 with a market capitalization of $2.04 trillion and a 24-hour trade total of $313.2 billion. Price Action is volatile within the $100,945 to $103,939 range, highlighting a market that balances geopolitical risk with technical boundaries.

Bitcoin

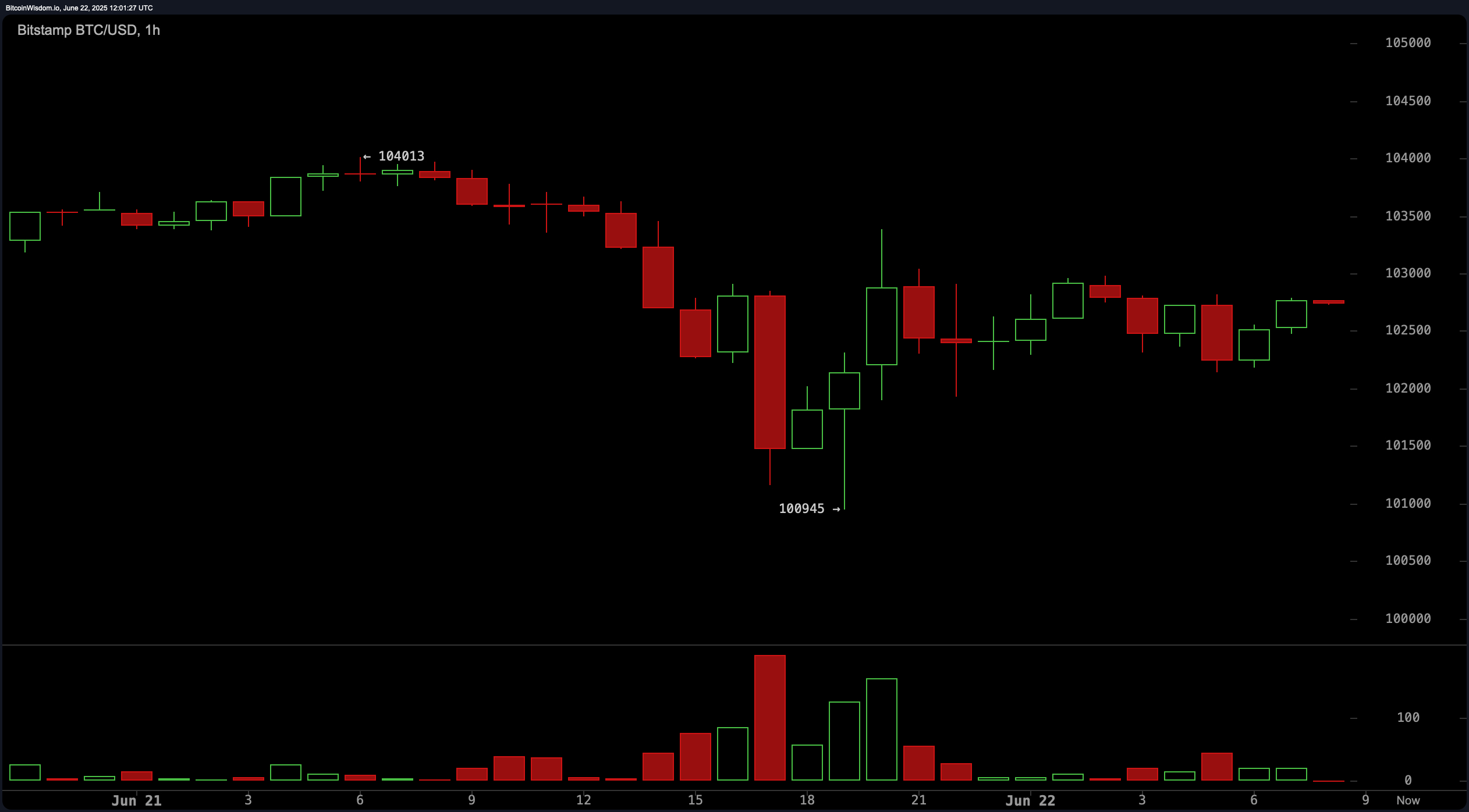

On the one-hour chart, Bitcoin is about to stabilize after dropping to $100,945. The visible integration pattern suggests a double bottom formation. Necklines near $103,000 are important. Breakouts above this level, particularly growing volume increases, could cover the range of $104,000 to $104,500. However, if support is not retained at $100,945, then the lower targets of $98,500 to $99,000 will be possible. The volume picks up a green candle and suggests interest on short-term purchases, but lacks the belief typical of bullish reversal.

BTC/USD 1-hour chart on Sunday, June 22, 2025 via BitStamp.

The four-hour BTC/USD chart strengthens the general short-term downtrend, with support being highlighted again at $100,945, with resistance forming between $104,000 and nearly $105,000. The latest sale features sharp volume spikes, implying either retail panic or facility exits. Several purchases have appeared, but the follow-through is weak. A $100,945 retest with reduced volume could provide a longer swing opportunity, but failing to hold that zone could lead to new bear legs.

BTC/USD 4-hour chart on Sunday, June 22, 2025 via BitStamp.

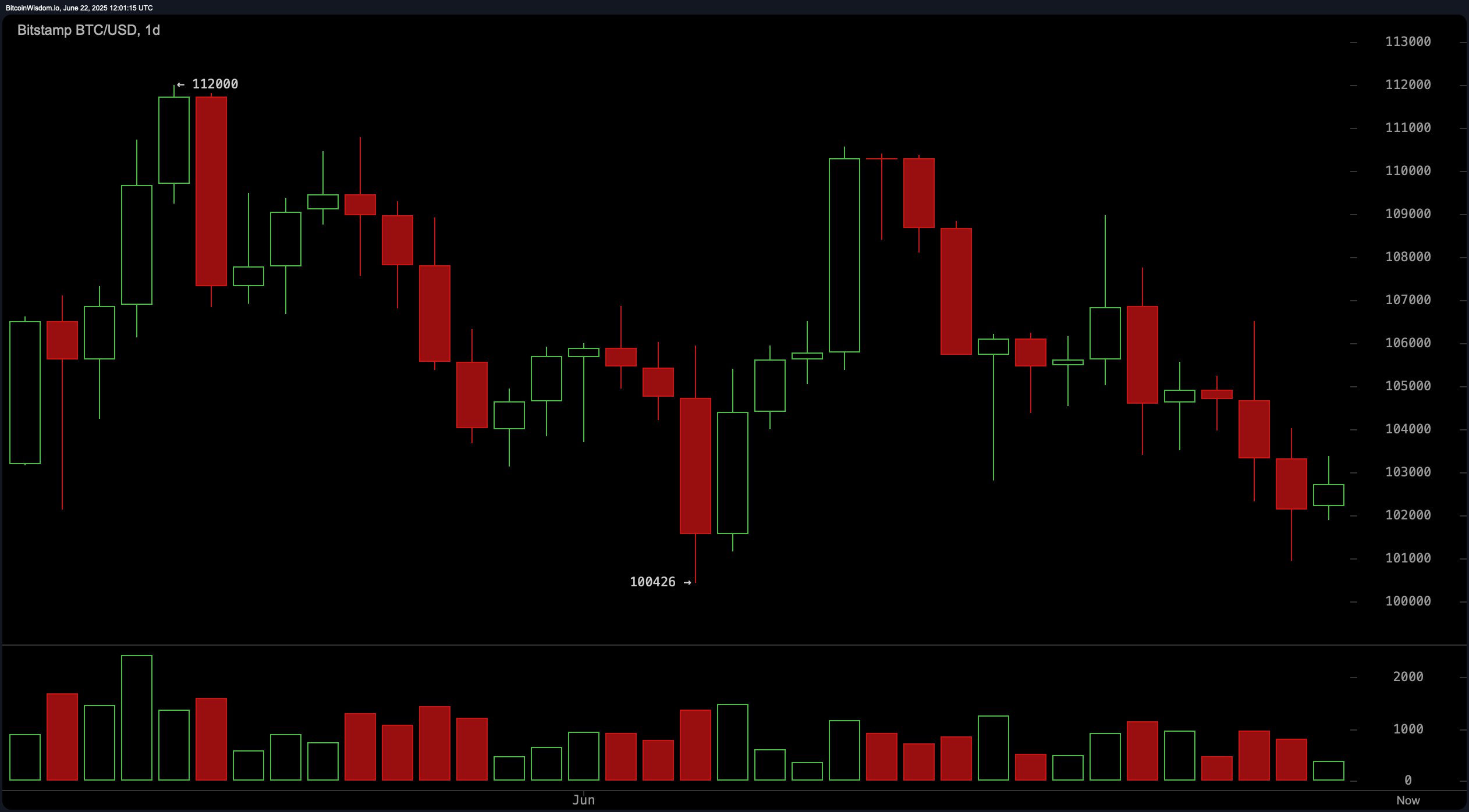

In the daily time frame, Bitcoin has a bearish stance with a clear downward trend channel and a recent red candle that prevails after a short-lived rally. Resistance remains about $112,000 apart, but short-term support is just over $100,400. This structure suggests a lower height configuration that is usually associated with continuity of the lower trend. Bullish reversals between $100,000 and nearly $101,000 are effective when supported by inversion patterns such as hammers and bullish sieges confirmed by increased volume. Without such confirmation, a break below $100,000 opens the door to a move from $96,000 to $98,000.

BTC/USD 1-Day Chart on Sunday, June 22, 2025 via BitStamp.

The oscillator indicator adds to the overall uncertainty and presents a mixed image. The relative strength index (RSI) is located at 43, signaling neutral momentum. The probabilistic index is 14, neutral, and the Commodity Channel Index (CCI) is -125, suggesting potential purchasing opportunities. Momentum of -2,980 is similarly tilted towards purchasing, but a moving average convergence divergence (MACD) of -368 indicates a bearish signal. The great oscillator remains negative at -2,492 with a neutral attitude, reflecting indecisiveness among market participants.

Moving averages (MAS) are overwhelmingly bearish on the short-to-medium scale. The exponential moving average (EMA) and simple moving average (SMA) values for periods 10, 20, 30, and 50 are all aligned in the sales area, suggesting continuous underside pressure. However, long-term averages such as the $99,223 EMA (100) and $95,675 SMA (100) currently offer structural support under current price levels. Similarly, EMA (200) and SMA (200) suggest that the broader upward trend remains unharmed at $93,586 and $95,956, respectively. Until short-term emotions change, traders need to pay attention and wait for a clearer signal before they can be positioned for a bigger move.

Bull Verdict:

If support continues to be retained at $100,945, and sustained breakouts of over $103,000 are realized with strong volumes, Bitcoin could have a short-term recovery. Confirmation of potential fatigue in sales pressures on multiple time frames could catalyze a relief rally, particularly when investors are seeking alternatives amid growing geopolitical tensions.

Bear Verdict:

Despite the technical setup for bounce, Bitcoin remains vulnerable to further losses given the general bearish momentum and lack of volume checks. The dominance of sales signals across short- and medium-term moving averages and oscillators highlights persistent debilitation. The geopolitical shock of US airstrikes on Iran brings about an increase in systemic risk. If this spirals into a wider conflict or market panic, Bitcoin can fall below $100,000 and cause slides to almost under $96,000.