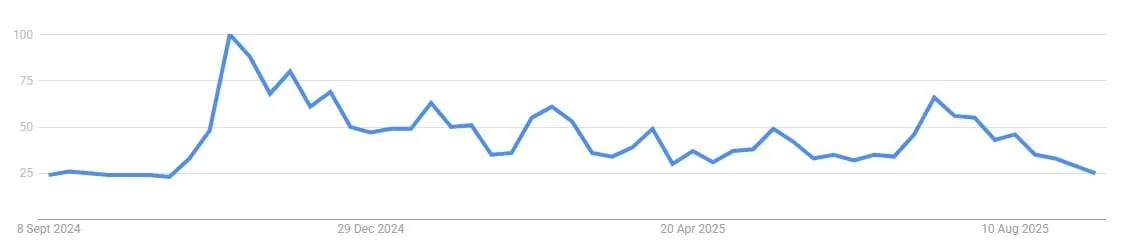

Bitcoin’s US Google search volume has fallen 11 months low amid a record-breaking surge in gold, with experts showing the possibility of a pioneer’s capital turnover into crypto.

Google Trends data shows that despite strong institutional ETF flows in early 2025, Bitcoin search interest fell to the lowest it last saw in October 2024.

US Google trends “Bitcoin” data. Image: Google

Performance between the two assets reflects this different trend, with gold increasing by 38% compared to 18% of Bitcoin since its launch in 2025.

“This difference reflects a fundamental shift towards investor psychology in speculation amid increasing macroeconomic uncertainty,” said Derek Lim, head of research at Kaladan. Decryption.

Bitcoin has been stagnant since May 2025, trading around $111,565, according to Coingecko data. Meanwhile, Gold reached $3,613.48 today.

MEXC chief analyst Sean Young said that search interest is “cyclical” and driven by “retail attention spikes.” Decryption. “Macro drivers like the expectations of the Fed rate cut, weakness in the dollar, and central bank purchases are driving gold to fresh records,” he explained.

Lim emphasizes that Bitcoin’s 15% delay is at an all-time high in gold terminology, highlighting the edge of precious metals in a risk-off environment driven primarily by its “established narrative” and “universal acceptance.”

Gold is a record hit: What’s next for Bitcoin?

Analysts have previously highlighted the dynamics of lead rugs, where gold gatherings preceded Bitcoin’s oversized move.

“Gold often moves first, followed by Bitcoin outperform,” said Lawrence Lepard, co-founder of Equity Management Associates LLC, posted in a tweet in August.

Matthew Sigel, head of Vanek’s digital assets research, reiterated the sentiment in a tweet on Saturday, saying, “All gold gatherings cause the same pattern: Bitcoin breaks a lot.”

All Gold Rally causes the same pattern. Bitcoin will grow. pic.twitter.com/ylzi2baxp8

– Matthew Sigel, Recovering CFA (@matthew_sigel) September 6, 2025

Leopard predicted a gold breakout of over $3,500, “a prelude to Bitcoin of $140,000.”

Experts are cautiously optimistic. They expect that once the macrocatalysts are aligned, the lead lag pattern of Bitcoin and Gold will last.

LIM has identified Fed rate reductions as a key trigger that can update its risk appeal and support Bitcoin’s “higher beta characteristics.”

Young needs sustained reflection expectations, such as central bank gold purchases and signals on the chain, to “flip marginal allocations from bullion to bitcoin.”

Both see the rotations accelerated with risk-on shifts.

This consensus is bullish for the Bitcoin inflation hedge story, with Lim projecting a target of $120,000 to $150,000 in 2025 with outliers of $200,000 in rotation scenarios.

Young projects range from $125,000 to $250,000 for medium bulls, based on ETF trends and policies.

However, Lepard expects $250,000 along with $10,000 in Fiat Erosion, placing Bitcoin as the “escape hatch” of the growth cycle.

Countless forecast market traders have been released DecryptionParent company Dastan is not optimistic. Almost 60% expect gold to surpass Bitcoin in 2025.