- Bitcoin has been trading above $94,000 and appears to be determined to ignore bearish releases and multiple sales signals.

- On-chain data appears strong, increasing active addresses and reducing replacement reservations.

- Technical support is retained, Bitcoin has been re-anchanting at 200 days of MA, and has been further upside down with the code.

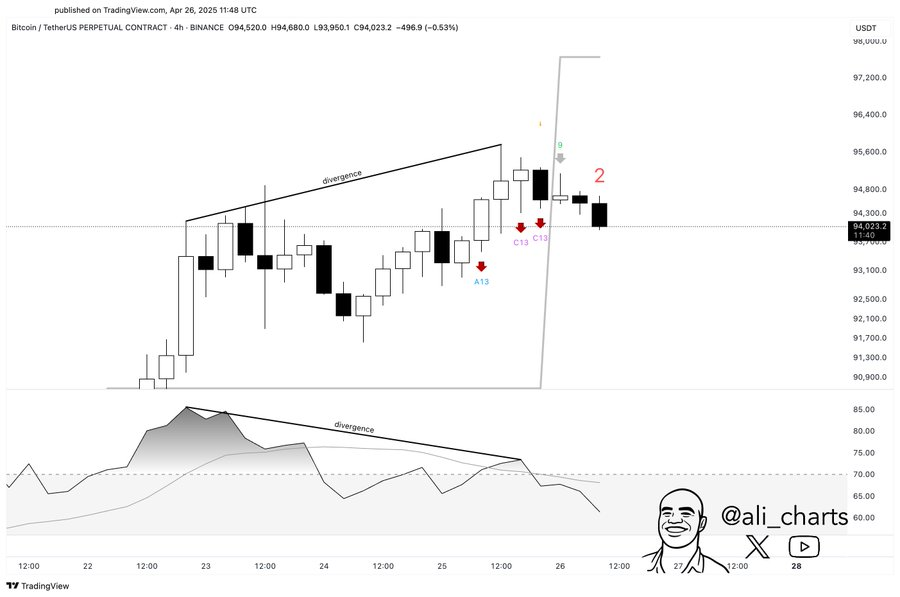

Bitcoin maintains over $94,000 despite visible signs of bearishness. Ali Martinez flagged bearish divergence on the four-hour chart between Bitcoin’s price and the relative strength index (RSI), warning that the TD sequential indicator had flashed multiple sales signals. The divergence indicates that upward price momentum is slowing despite the recent bullish pattern.

Source: x

Bitcoin trading volume rose to $384.9 billion, an increase of 16.49%, reflecting an increase in trading activity. Over the past 24 hours, Bitcoin has risen 3%, currently trading at $94,800. However, new divergence warns traders that there may be a pullback or trend reversal soon.

On-chain metrics signal the underlying signal of strength

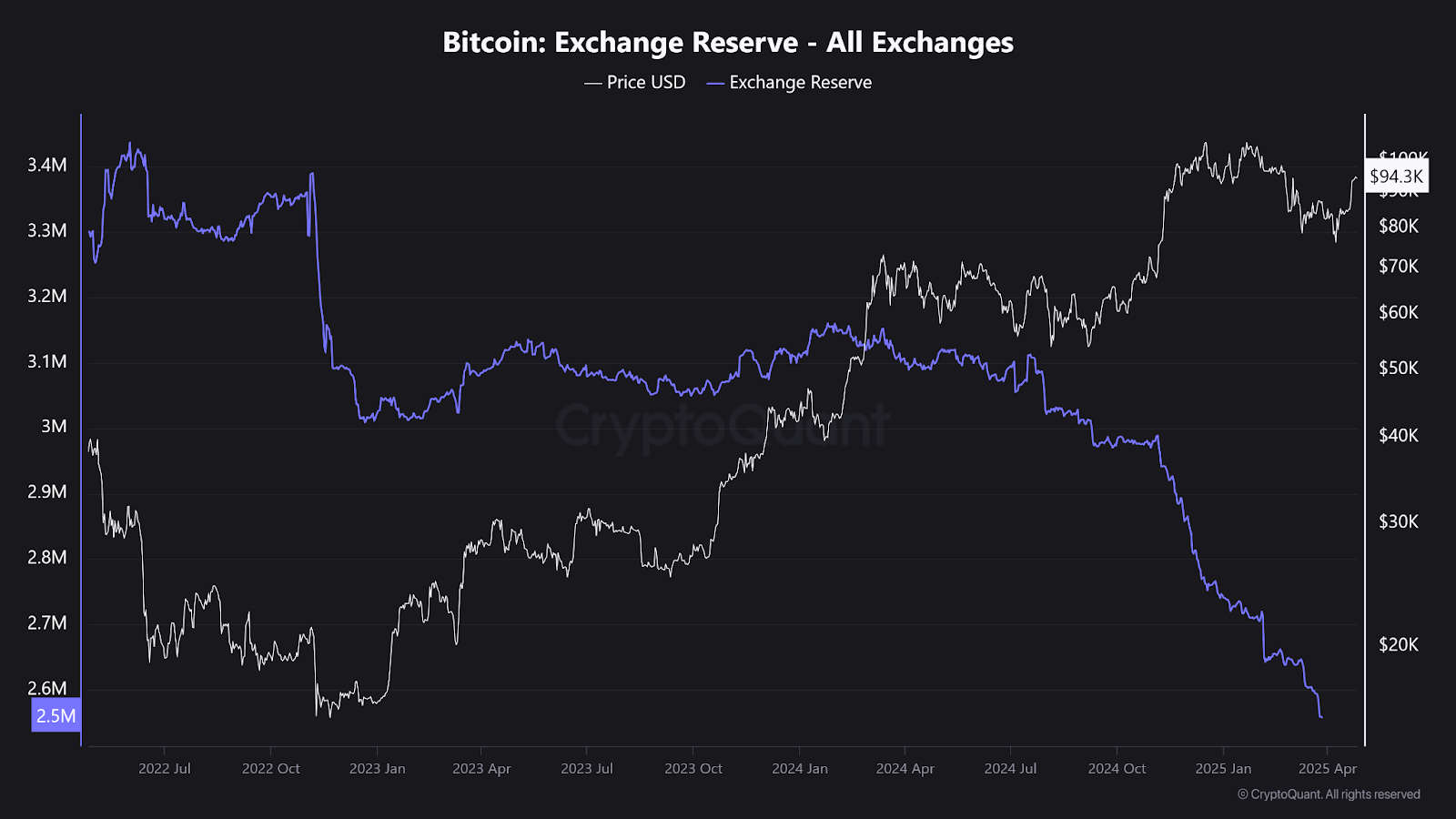

On-chain data draws much better pictures. Data from Cryptoquant shows that exchange reserves are declining and are currently at the 2.5 million BTC level. This is the lowest level of the year. Furthermore, a consistent leak into exchange suggests that users prefer to transfer Bitcoin to a cold storage wallet, supporting long-term bullish feelings.

Source: Cryptoquant

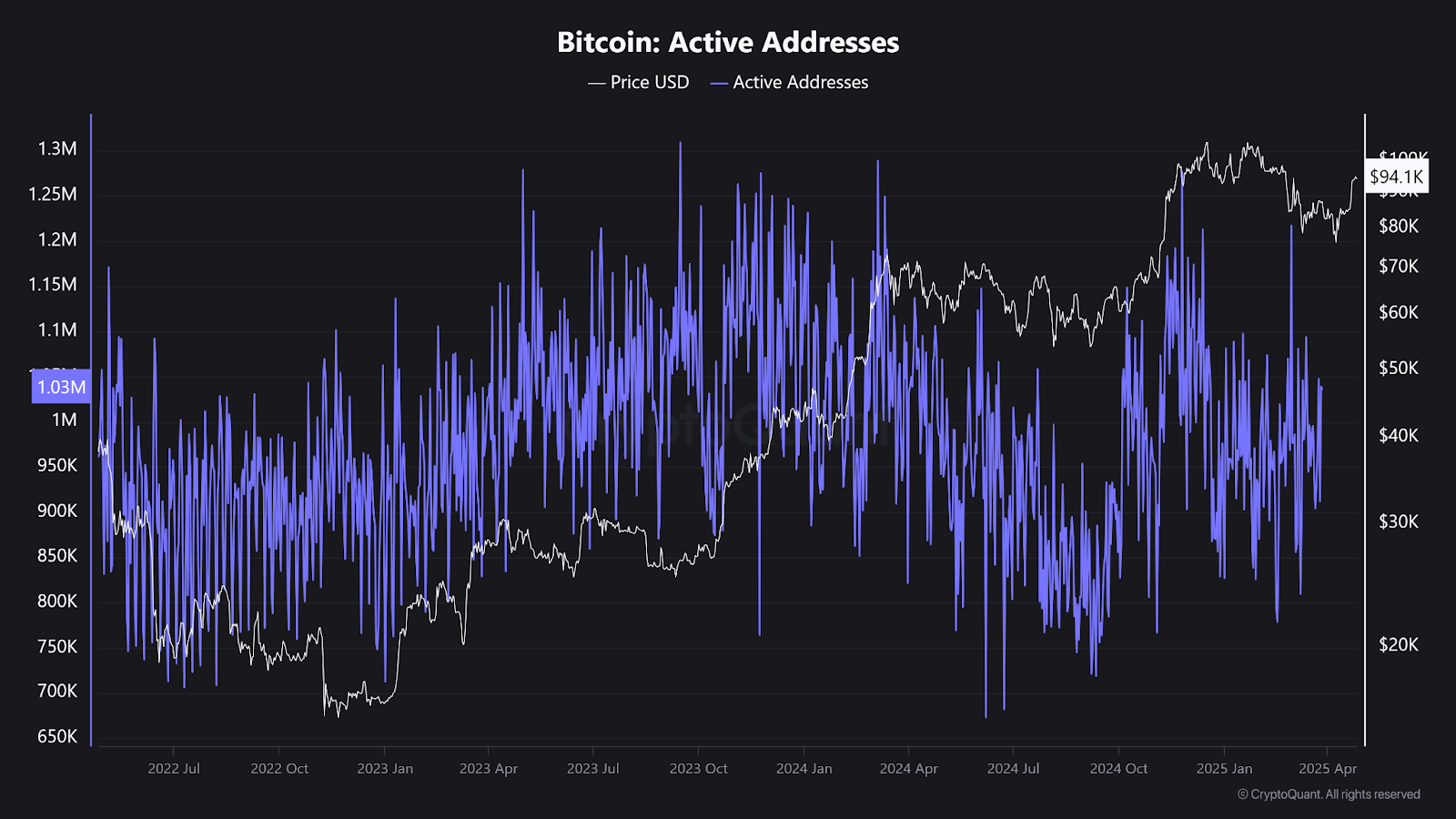

Furthermore, the number of active addresses for Bitcoin remains high. The current figure is 1.03 million active addresses, suggesting strong network activity. Historically, active address counts have correlated with rising or stable prices, including periods of volatility.

Source: Cryptoquant

In line with this, according to Coinglass, BTC spot outflows remained higher than influx, and recently net sessions reported negative numbers. These spills boost investors’ trust as coins move from exchanges to storage wallets and reduce pressure on exchanges.

Key technical levels after average recovery of important movements

A short-term bearish approach is required, but most technical indicators show the ability to continue moving upwards. Cryptojellenl also noted that Bitcoin has returned to its mysterious 200 MA for the third time in its current cycle. Historic trends show that once Bitcoin exceeds this moving average, it is likely to consolidate over it for a long period of time.

Source: x

Crypto Caesar also states that Bitcoin has responded to key support levels recently and has shown excellent metrics. His analysis also points to a higher target if Bitcoin can continue to rise past the support level.

Source: x

Additional evidence of bullish outlook is another chart showing an upward trend with a constant boom after the merger. Bitcoin, which has been traded within the pennant class with a bullish trend, has formed a higher low and a higher high. However, despite these moves, traders must be wary in the short term.