The increase in private sector employment in August was significantly lower than many economists had predicted.

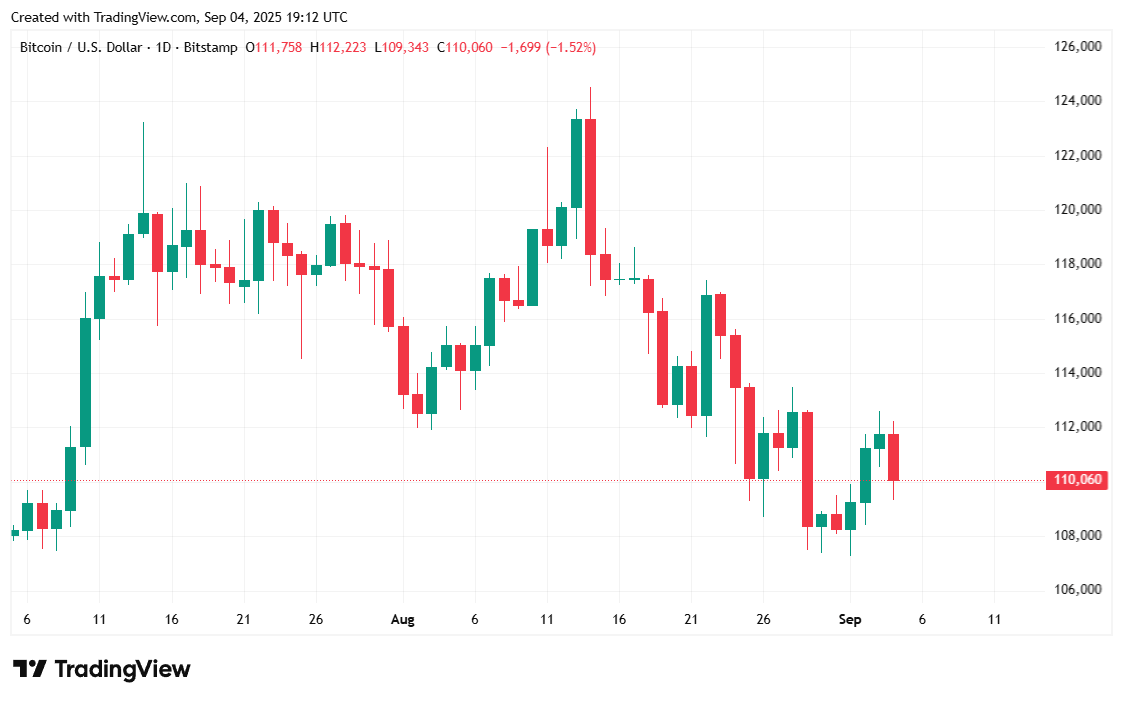

Disappointing Private Sector Job Data Trigger BTC Slides Under $110K

New Jersey-based personnel firm ADP reported an increase in private sector U.S. employment of 54,000 people on Thursday, far below what the 75,000 employment economists had hoped for. The stock market appears to be plagued by the news, and perhaps waiting instead for a federal employment report on Friday, but Bitcoin was hit, falling over 2%.

Industry such as manufacturing, trade, education, health and even finance saw the biggest cuts, losing a total of 38,000 roles. Others such as leisure and hospitality have been much better, gaining 50,000 positions, and areas such as construction and professional services have also reported an increase in work.

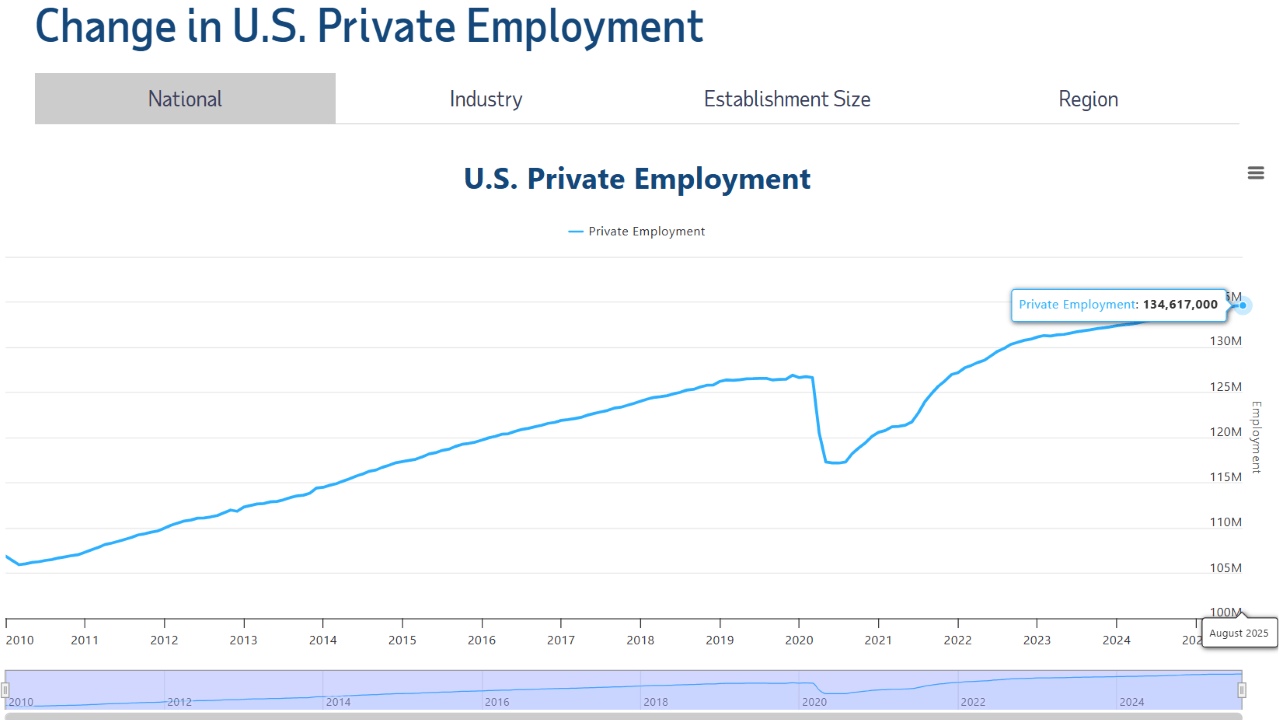

(Thursday’s ADP Private Sector Employment Report showed a 54,000 increase in private employment in the United States.

But with weekly unemployment claims reaching 237,000 in the week, the highest level since ending June 30th, falling to its lowest level since September 2024, ADP’s latest report is another blow to the broader US job market, and perhaps Bitcoin is also increasingly visible in the short term.

“The year started with strong employment growth, but the momentum is being whipped up by uncertainty,” said Dr. Nella Richardson, ADP chief economist. “A variety of things can explain slower recruitment, including labor shortages, skittish consumers, AI disruptions.”

Market Metric Overview

Bitcoin traded at $110,122.90 at the time of reporting, down 1.59% per day and down 2.25% over the past week. CoinMarketCap data shows that cryptocurrencies have been trading between $109,347.23 and $112,297.39 over the last 24 hours.

(BTC Price/Trade View)

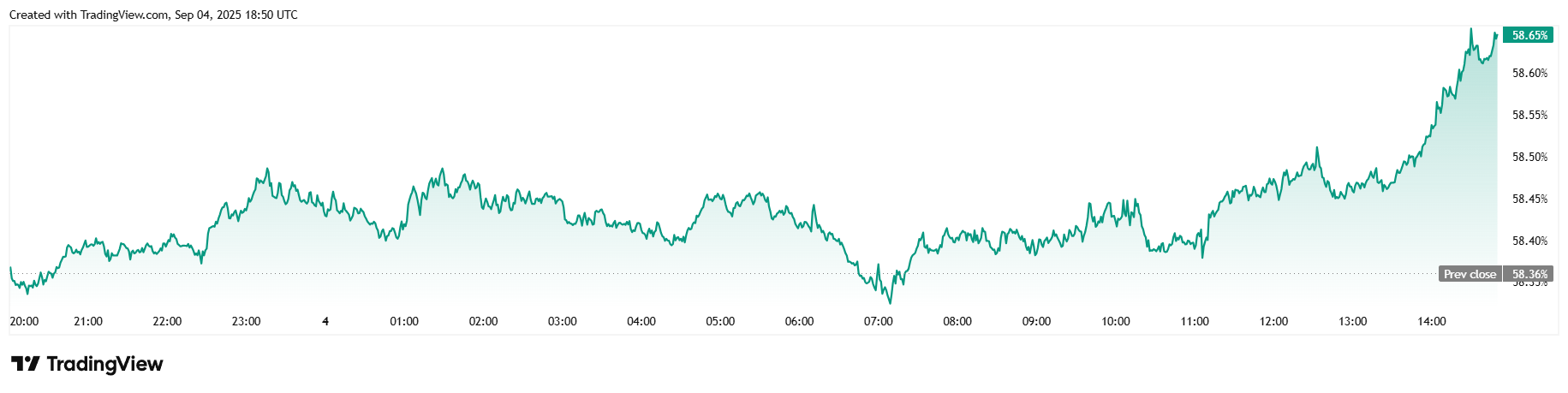

The trading volume for the day fell 8.77% at the time of writing to $57.755 billion. Additionally, the market capitalization fell 1.55% to $2.19 trillion, while Bitcoin’s advantage rose 0.48% to 58.65%.

(BTC dominance/trade view)

Open interest on total Bitcoin futures fell 1.53% over 24 hours to $79.95 billion, with Coinglass showing Bitcoin liquidation totaling $4,285 million. Most of that figure was a long liquidation, $38.8 million, with shorts remaining $4.05 million.