Bitcoin has just collapsed to $80,000, sweeping over $200 billion from Crypto Market in one of the worst day crashes of the past year.

Ether too It crashedtrading at $1,992, below $2,000. This is a level I’ve never seen in over six months. The sudden sale comes after Donald Trump signed an executive order on Thursday to formally launch a strategic Bitcoin Reserve.

Source: Jai Hamid/TradingView

Friday’s White House Script Summit was scheduled to be a major event, but Trump threw a curveball by announcing the reserve before schedule. Traders were betting on bullish rally, but instead, Bitcoin fell from $90,000 to $85,000 within minutes of the announcement.

The market response was cruel, as options traders rewind long positions, sparked volatility spikes and acquired demand as traders scrambled to hedge against deeper flaws according to data from Coinglass.

Trump’s Bitcoin Reserve Causing Selling in place of a rally

The executive order confirms the US government’s plan to stockpile Bitcoin, but there is a catch. There is no new funding for the purchase yet. The initial reserve is constructed using Bitcoin seized from criminal or civil assets forfeiture. In other words, there is no immediate demand pressure.

Treasury Secretary Scott Bescent and Commerce Secretary Howard Lutnick were given the job of figuring out the “budget-neutral” way of adding Bitcoin to the reserve without spending taxpayers any costs.

That wasn’t something the traders wanted to hear. The market was looking for aggressive government purchases as well as old holdings relationships. Without it

Signs of new demand, the sale gained momentum.

As trading company QCP explained in its telegram notes on Friday, the reversal of risk in the crypto market has been overturned. In other words, traders have begun pricing at a more negative risk than the possibility of an upward that only exacerbated the crash.

The fear of the recession and the US debt crisis burns

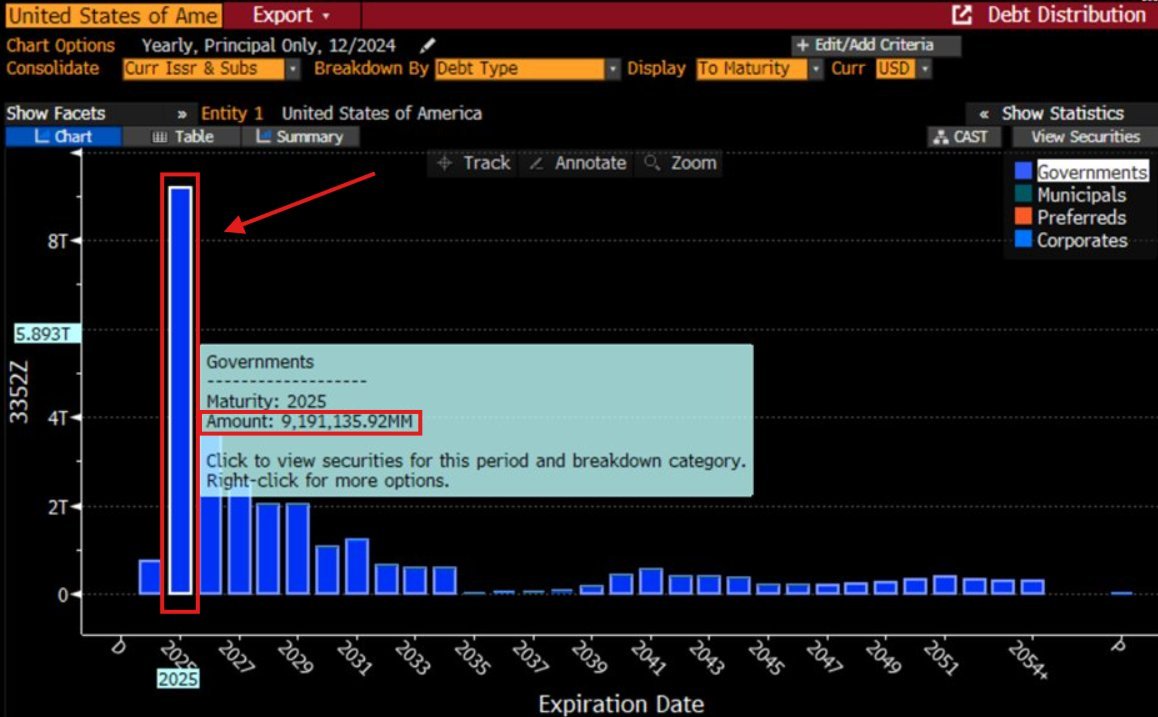

Meanwhile, the wider economic situation has deteriorated by that day, and traders are blessed with a recession. The US has stared at the $9.2 trillion debt refinance problem in 2025, with most of that debt matured between January and June. The government needs lower interest rates.

What is the easiest way to get them? recession.

Over the past two months, financial yields have declined by 60 basis points over the 10 years. This is an indication that the market is pricing for economic trouble.

Elon Musk’s Office of Government Efficiency (DOGE) is working hard to cut spending with a $2 trillion goal, but those people aren’t working fast enough to solve their debt problems.

President Donald Trump has pushed for lower oil prices to combat inflation and has even called on OPEC to lower prices. But what is the fastest way to kill inflation? A recession that crushes demand.

That’s why traders are focusing on the Atlanta Fed. This has recently reduced the estimate of GDP growth for the first quarter 2025 to -2.8%. analysis From Kobeissi’s letter.

The market expects the Federal Reserve to cut fees at some point in the first half of 2025, but inflation continues to get in the way.

Source: Adam Kobesi X / Twitter

U.S. consumer expectations for inflation jumped to 6.0% in 12 months, the highest since May 2023. This is the third consecutive month of rising inflation expectations, and is a question of rate cuts.

Trump doesn’t care about the stock market anymore. As cryptopolitan It has been reported On March 6, he said, “I’m not looking at the market,” but during his first term he was obsessed with it. It’s not just an off-hand comment, it’s a message. Wall Street is itself.

As liquidation risk increases, Bitcoin braces close at $75,000

Currently, with Bitcoin at $80,000, traders are already looking at the next risk zone, but it’s ugly. Things can get much worse before they get better, according to Arthur Hayes, co-founder of Bitmex.

“An ugly start of this week. It appears BTC will retest $78,000. If that fails, $75K is on the crossing. There’s a lot of open interest in $70,000 to $75,000. If it falls within that range, it’ll be violent,” Arthur warned in a post on X.

Meanwhile, encrypted data shows that the Bitcoin exchange reserve is falling rapidly. This means there is a potential supply shock, but it doesn’t matter now. If the market is free falling, the supply-side fundamentals take the back seat for pure panic sales.

However, while most traders are running for the exit, President Nayib Bukele is buying DIP. El Salvador, which is steadily accumulating Bitcoin, today bought five BTC from his usual one BTC daily purchase.

Now it’s rate reductions that save these markets, and the only way we can get is through the recession. Buckle up, people.