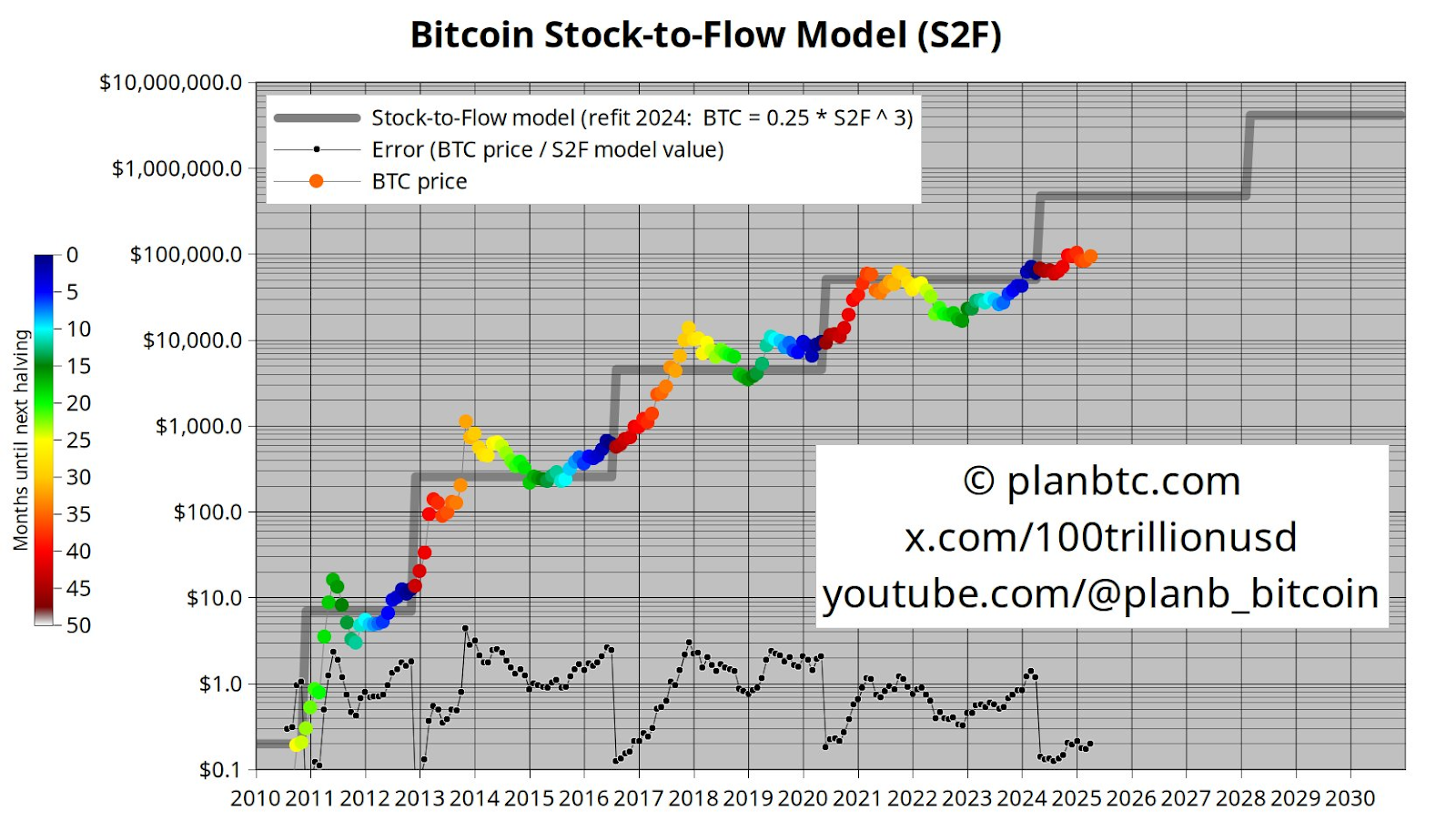

Bitcoin closed the April month at $94,181, according to data shared by Planb, creator of the Stock-to-Flow (S2F) model. The cryptocurrency rebound follows a sharp decline in April, at $74,000, forming what analysts described as a “V-shaped recovery.” This price transfer will bring Bitcoin back along with the long-term forecasts of the S2F model. The S2F model predicts prices based on the programmed rarity of Bitcoin.

PlanB’s “pre-pump dump” prediction has been verified

The April recovery is particularly consistent with the pattern PlanB highlighted on March 1, 2025. At that point, he called the end of Bitcoin’s February “dump before the pump” for $84,321, predicting the dip before the surge. That forecast unfolded afterwards, with Bitcoin falling in early April before surgening towards the end of the month at $94,181.

Planb’s Colored Dot Chart Plot Monthly Visually Closed, V-shaped Recovery is a recurring pattern of Bitcoin price history. This historical trend suggests that such sharp rebounds are not unusual, but rather a predictable feature of Bitcoin’s cyclical behavior.

Related: Bhutan’s $1.1 billion Bitcoin Reserve has CZ approved at Token2049

Bitcoin April performance and S2F alignment

The end of $94,181 in April represents a 27% increase from $74,000 from its low on April 7th. This important month of performance brings Bitcoin closer to its predicted S2F orbit.

It also strongly strengthens the relevance and accuracy of the S2F model in forecasts during the current market cycle

Bitcoin Bull is not running

Planb, a respected analyst in the space, rejected the incoming concept of a bare market in his previous analysis starting March 19th. He noted that Bitcoin’s 200-week arithmetic and geometric means have been closely aligned for over a year, with low volatility and a stable upward trend.

He suggested that this integration phase could pave the way for further growth, and could double the $80,000 to $160,000 in 2025. His market cycle analysis shows that the true bear market follows a strong bull rally.

Reaffirming his bullish outlook in April, Planb highlights that his on-chain indicators still reflect the bullish market stage, describing the recent revision as “normal bullish market dip” rather than a distribution or transition to the bear stage.

Related: Report: $31 trillion in US wealth locked out of Bitcoin ETF

On-chain data flashes to bullish signals

PlanB’s perspective, which supports GlassNode’s on-chain data shared by Crypto analyst Ali Martinez, reveals that Bitcoin’s MVRV ratio has surpassed a simple moving average for the year to form a “golden cross.”

Historically, this particular technology formation has consistently preceded a period of strong bullish momentum in BTC prices, referring to a potential change in broader market sentiment.

With Bitcoin price rebounds and technical indicators flashing bullish signals, Market observers are seeing the possibility of a rally extended over the coming months.

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.