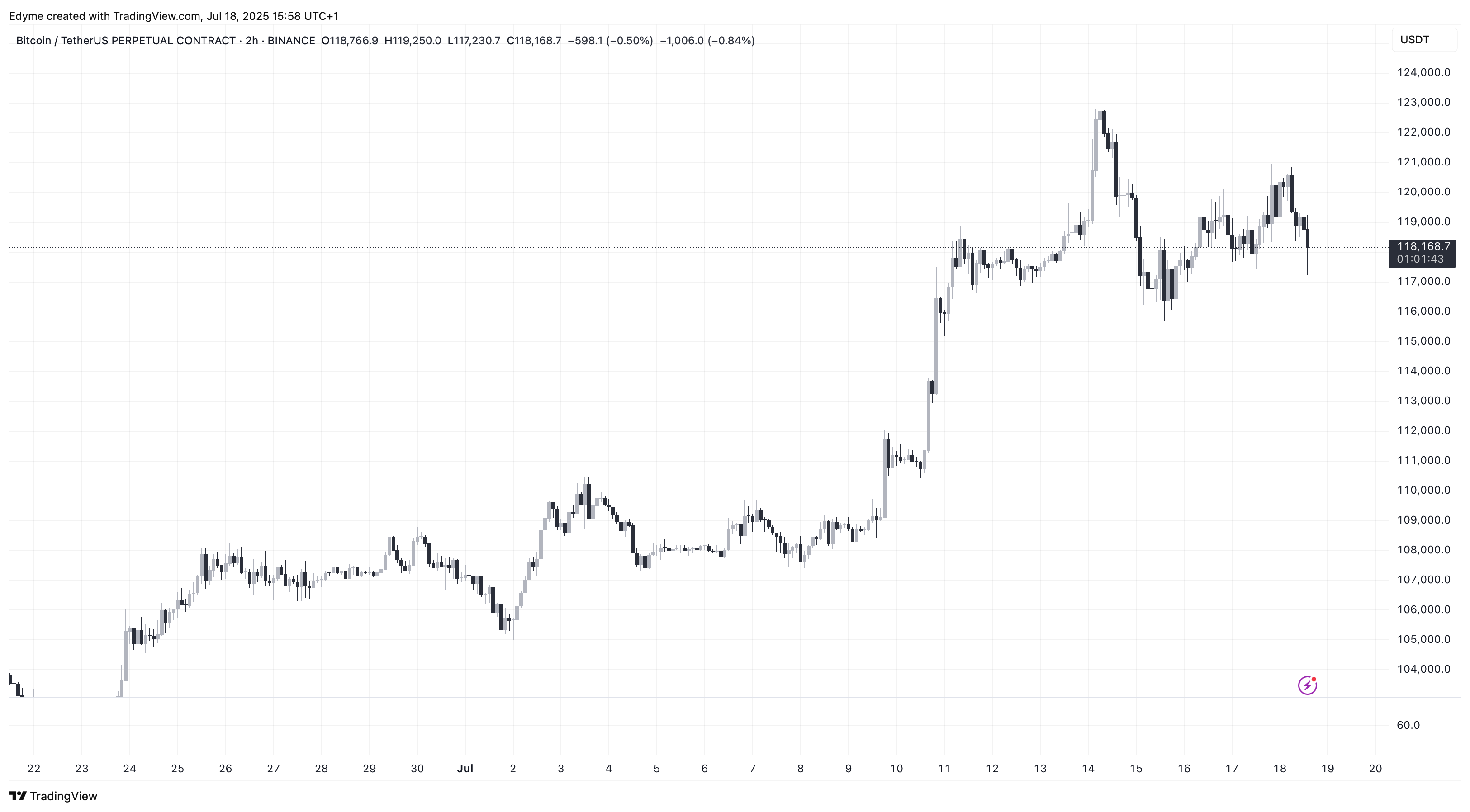

Bitcoin’s recent price measures continue on an upward trajectory as they are at a high above the $120,000 price mark in the last 24 hours. The move suggests sustained bullish momentum following a period that fell sharply earlier this week.

With the highest ever priced price close to the highest ever, On-Chain Data is beginning to draw a picture of solid transaction support behind price movements. In particular, analysts are beginning to highlight the differences between Bitcoin’s market value and its underlying network activity.

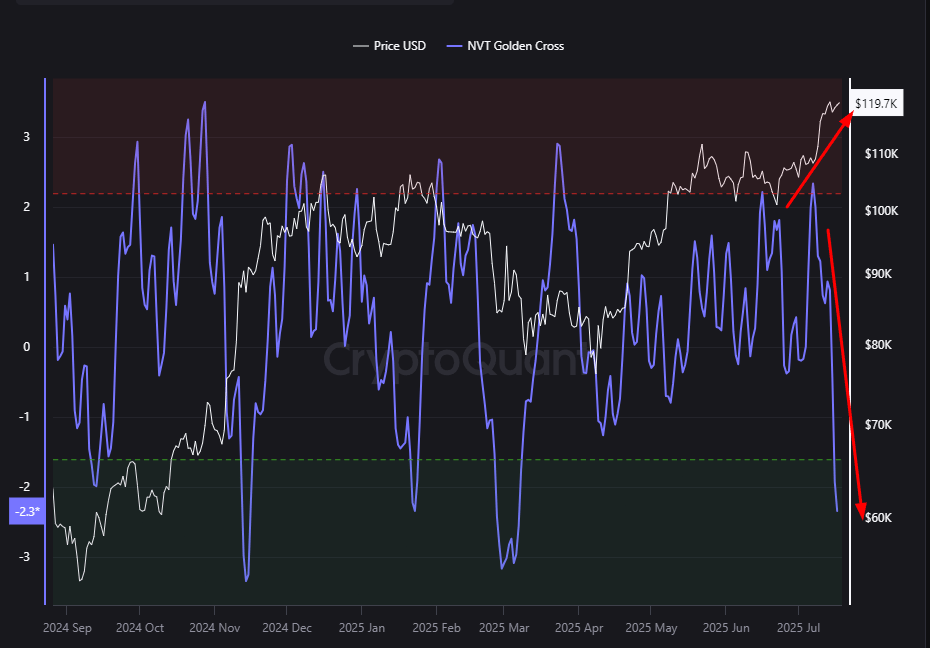

One such observation comes from Cryptoquant analyst Sunflowr Quant, who shared his insights in a recent Quicktake post examining the abnormal behavior of the NVT golden cross indicator.

This metric is generally expected to increase prices and tandem due to its function as a ratio of market capitalization to transaction volume, and we believe it is now attributable to a significant increase in activity in the chain.

The growth of Bitcoin-on-chain suggests underlying network strength

According to Sunflowr, this inverse correlation between rising BTC prices and falling NVT Golden Cross could indicate that current gatherings are more driven by actual use and actual transactions on the Bitcoin network rather than speculative transactions.

“A decrease in the NVT ratio during price increases means that the volume of transactions is increasing at a faster pace than market capitalization,” he writes. “This can be interpreted as an indication that the assembly is supported by actual economic activity.”

This observation is consistent with the broader sentiment that healthy on-chain growth could serve as a foundation for more sustainable price increases. When trading volumes grow organically as well as derivative speculation, it suggests that user recruitment and financial utility contribute to price strength.

Investors who look closely at these metrics may find this a favorable environment, but they are taking care to suggest the dynamics of the market that other metrics evolve.

Holder rotation signals potential changes in market participation

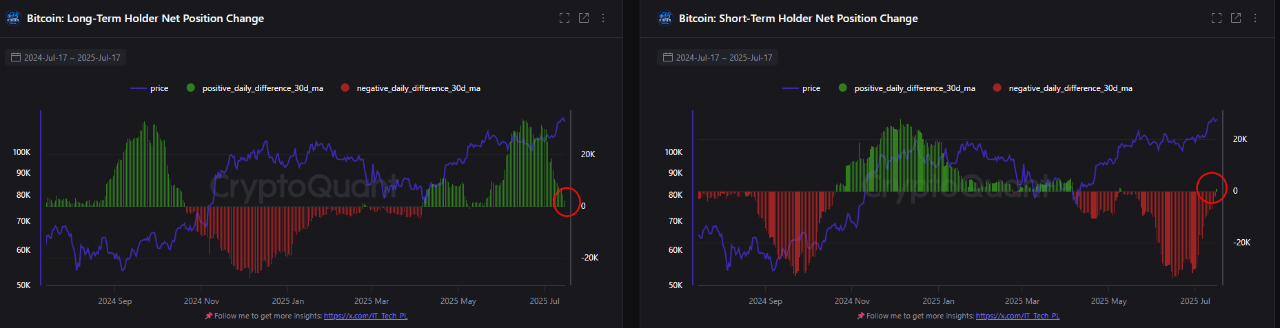

Another analysis from cryptographic analysts’ IT technology sheds light on another dimension of holder behavior, the current market structure for Bitcoin.

In a post entitled “Holder Rotation,” IT Tech means that long-term holders who have held BTC for more than 155 days have recently begun net distributions.

Conversely, short-term holders are once again showing net accumulation behavior. This is a dynamic that is common in late staged meetings. This shift between long-term and short-term holders has historically served as a warning signal.

Similar handoffs were observed in April 2021 and November 2023, both preceded the local top or cooling phase. This does not necessarily confirm a reversal, but emphasizes the need to monitor support metrics such as exchange inflows and funding rates.

“This is a pattern of getting classic benefits from veteran wallets, but new market participants may be in due to price increases,” writes Tech.

Special images created with Dall-E, TradingView chart