Technical data suggests that the latest BTC rally is dominated by buyers as Bitcoin (BTC) reached a new all-time high of $111,980 on the Binance Crypto Exchange yesterday. If this trend continues, BTC may see further price increases in the short term.

Buyers regain control of the Bitcoin Spot Market

According to a recent Cryptoquant Quicktake post by Crypto analyst Ibrahimcosar, buyers appear to dominate the BTC spot market. Analysts observed that Bitcoin’s Spot Taker Cumulative Volume Delta (CVD) has returned to the green territory.

For beginners, Bitcoin Spot Taker CVD sells the difference in taker buying and taker sales volumes over time, with spot exchanges. The rising Spot Taker CVD shows offensive buyers dominating the market, showing potential bullish momentum.

BTC Spot Taker CVD Turning Green is important. Most notably, buy orders regain control after a long period of time when sell orders led the market. Over time, bulk purchase orders suggest that Bitcoin’s current bullish momentum could last.

As shown in the chart shared by Ibrahimcosar, the CVD remained mostly red for the most part of the first quarter of 2025, showing strong sales pressure. This sales action was in line with BTC’s price action, with assets falling from ATH before January to around $76,000 in April.

The fact that BTC’s Spot Taker CVD is green makes this trend particularly noteworthy while the assets set fresh asses. This indicates that buyers are willing to accumulate BTC even at historically high prices.

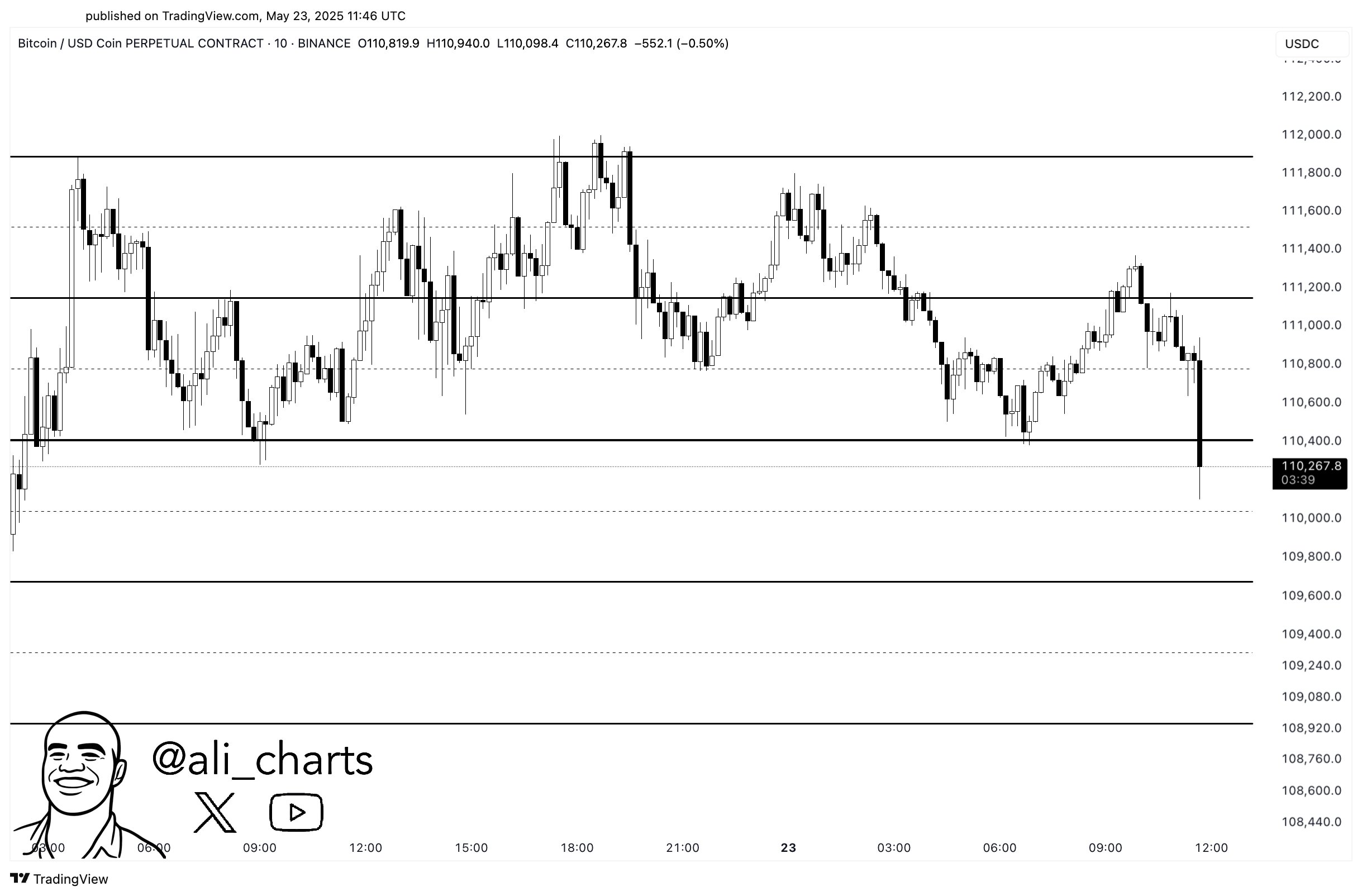

That said, recent price action could temporarily suspend BTC’s momentum. In an X’s post, Crypto analyst Ali Martinez suggested that BTC could quickly break down from its current range of $110,400 to $111,100.

Another type of gathering

Normally, BTC hits a new ATH, usually with a wider market happiness, leading to a sudden drop in price that most investors acquire outside of their guard. However, experts say the current gatherings are different from previous cycles.

Recent analysis by encrypted contributor CrazzyBlockk I’ll suggest New and short-term BTC investors are sitting in substantial unrealized profits and showing no signs of panic sales amid the price of cryptocurrency surges to new highs.

Similarly, whales’ responses to BTC’s bullish price trajectory are mixed. New whales are making great profits during ongoing gatherings, but older whales I resisted It sells shares held and shows minimal sales activity.

Finally, neutral funding rate of BTC futures market Enhancement The idea that the present gatherings are more organic than the past and not speculation. At the time of pressing, BTC is trading at $108,553, a 2.6% decrease over the past 24 hours.

Featured images from charts on Unsplash, Cryptoquant, X and tradingView.com