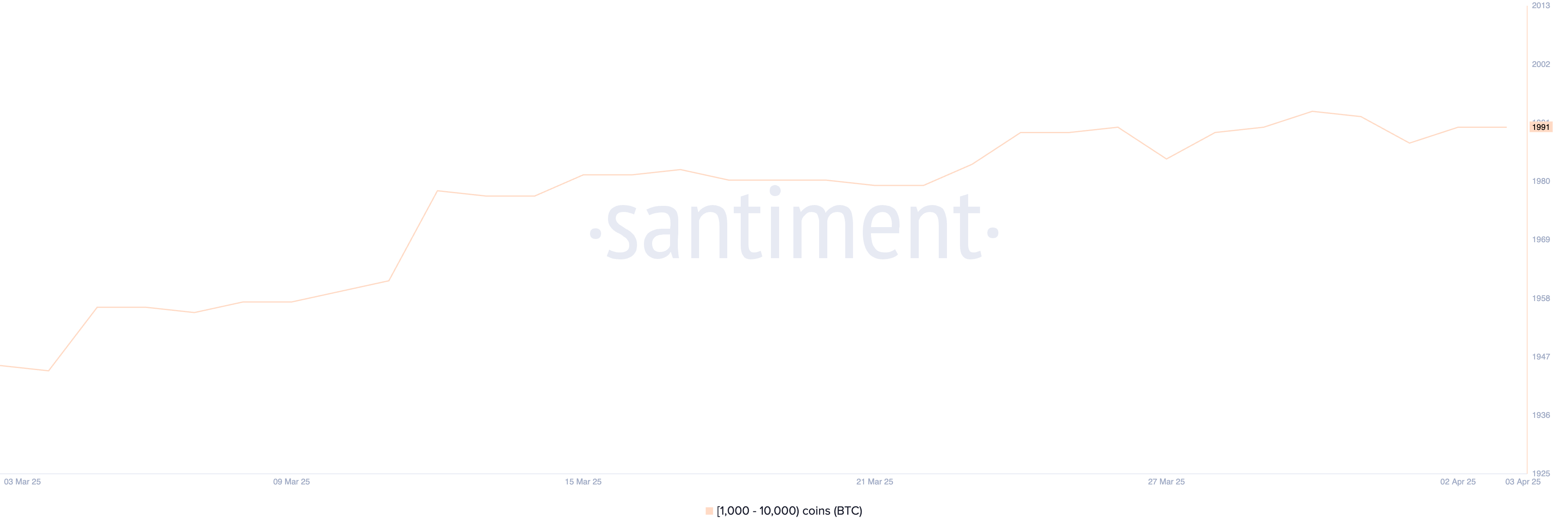

Bitcoin (BTC) continues to be in a state of uncertainty as both whale activity and technical indicators point to markets where strong beliefs are lacking. Large holders have been inactive for more than a week, and since March 24th, the number of whales holding 1,000-10,000 BTC has been stable at 1,991 at 1,991.

On the other hand, technology charts like Cloud and EMA Lines on the other hand provide a mixed outlook, reflecting hesitation in both bullish and bearish directions. As BTC trades closer to key support and resistance levels, the coming days could determine whether April will bring a breakout or a deeper fix.

Bitcoin jellyfish has not accumulated

The number of bitcoin jelly holding 1,000-10,000 BTC is 1,991, a significantly stable figure since March 24th.

This level of consistency in large-scale holder activities suggests that key players are not actively accumulating or offloading positions.

Given the size of these holdings, even small changes in whale behavior can have a major impact on the market. This stability is particularly noteworthy given recent volatility across the broader crypto market.

Bitcoin jelly. Source: Santiment

Tracking Bitcoin Zilla is important as these large holders often have the power to influence price actions through buy and sell decisions.

When whales accumulate BTC, they can demonstrate confidence in future price increases, but large sales could indicate downward pressure in the future. The fact that whale numbers have remained stable for the past 11 days may suggest a consolidation period where large investors are waiting for a more clear macro or market signal before making the next move.

This could mean that key players will consider the current BTC price as fair value, leading to a tighter price action in the short term before breakouts in either direction.

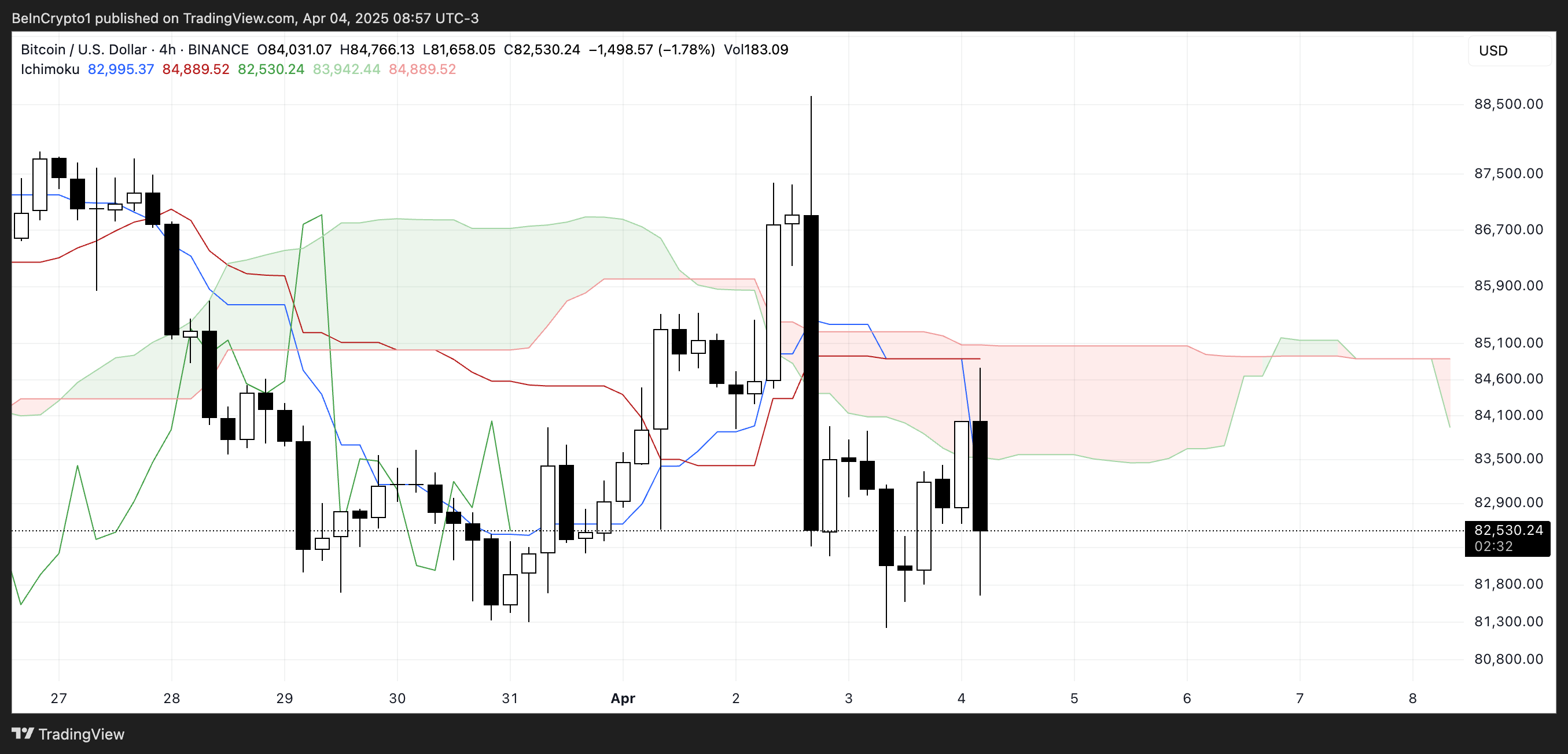

BTC Ichimoku Cloud shows complex images

Bitcoin’s current one-sided crowdsetup shows mixed but slightly cautious sentiment.

Recently, the price has been immersed under the red baseline (Kijun-Sen), and despite a short push to the cloud, it was rejected and retreated under it.

The blue conversion line (Tenkan-Sen) is currently heading downwards and crossing below the baseline. This often reflects the momentum of short-term bearishness. Meanwhile, the main span A (green cloud boundary) is beginning to flatten, while the leading span B (red boundary) remains relatively horizontal, forming a thin, neutral cloud.

btc icchimoku cloud. Source: TradingView

This type of thin flat cloud suggests market indecisiveness and lack of momentum for strong trends. Prices just below the cloud further strengthen the idea that BTC is in the integration stage rather than a clear trend.

If prices can go back to the cloud and maintain that level, they could indicate a new strength.

However, rejection in the cloud is continuous and pressure from the Tenkan-Sen decline could maintain BTC in a correct or lateral structure. For now, unilateral setups reflect uncertainty and no dominant trends have been identified in either direction.

Will Bitcoin return to $88,000 in April?

Bitcoin’s EMA structure still endures long-term EMA, which is still above short-term EMA. However, recent upward movements in the short-term EMA suggest that rebounds may be forming.

If this short-term strength develops into a sustained movement, Bitcoin can first test resistance for $85,103. Successful breaks beyond this level can indicate a change in momentum, opening the door to a higher target for $87,489. Recently, Standard Chartered predicted that BTC is likely to break $88,500 this weekend.

BTC price analysis. Source: TradingView

If bullish pressure remains strong beyond that point, Bitcoin’s price could push further and challenge $88,855. This is a level that shows a more convincing recovery from recent pullbacks.

“(…) After Wednesday’s volatility, BTC has rebounded over 4%, recovering steadily to $79,000, with a slightly higher daily exchange rate at $80,000, plus the Bitcoin ETF flow suggests a strong flow of invish and, colluckrin, comettori, collopton, comettori, coliph, comettori, coliph, comettori, coliph, comettori, coliph, comettori, colift eats. The department told Beincrypto.

However, if Bitcoin can’t build enough momentum for this rebound, the downside remains. The first important level to watch is $81,169 support.

As the trade war between China and the US escalated, below this level, the BTC fell into the psychological $80,000 mark, with its next goal at around $79,069. If this zone is lost, the bearish trend will be strengthened, sending BTC towards another $76,643.