Bitcoin prices faced strong bullish pressure as buying dominance increased. As a result, BTC prices have skyrocketed above the FIB level, maintaining momentum above the $88,000 level. Over the past 24 hours, Bitcoin trading volume has skyrocketed over 161%, bringing its total to $31.2 billion.

On a broader perspective, Bitcoin showed a downward trend on January 7th, falling below $100,000. It reached a low of about $89,397 on January 13th. On February 3rd, Bitcoin crashed again, reaching nearly $91,000. Recently, prices have faced an increase in volatility of less than $90,000. Over the past 24 hours, its total market capitalization has skyrocketed 3.6% to $1.74 trillion.

Bitcoin bullish pressure skyrocket

On Friday, Trump adjusted his tariff stance and showed that he could show greater flexibility regarding the “mutual tariffs” that will come into effect on April 2. Reports show that the Trump administration is unable to add separate sector-specific tariffs to certain countries being exempt from these planned tariffs and to products such as cars, pharmaceuticals, semiconductors and other sectors.

However, the current suspension of tariffs on many products in Canada and Mexico will also expire on April 2nd. This means that even if Trump opts for a softer overall approach, tariffs on various imports will increase significantly from that day.

Federal Reserve Chairman Jerome Powell recently commented on tariffs, suggesting that this year is likely to cause a temporary increase in inflation, but will not lead to long-term inflationary pressures. Additionally, Powell hinted at a potential interest rate cut of half points later this year.

As a result, Bitcoin Price witnessed a strong comeback with its momentum. This led to prices exceeding $88,000 in just a few hours.

Recent data from Coinglass reveals that Bitcoin has seen a total liquidation of nearly $108 million over the last 24 hours, with buyers liquidating $14 million and sellers roughly $94 million, indicating a significant increase in short liquidation.

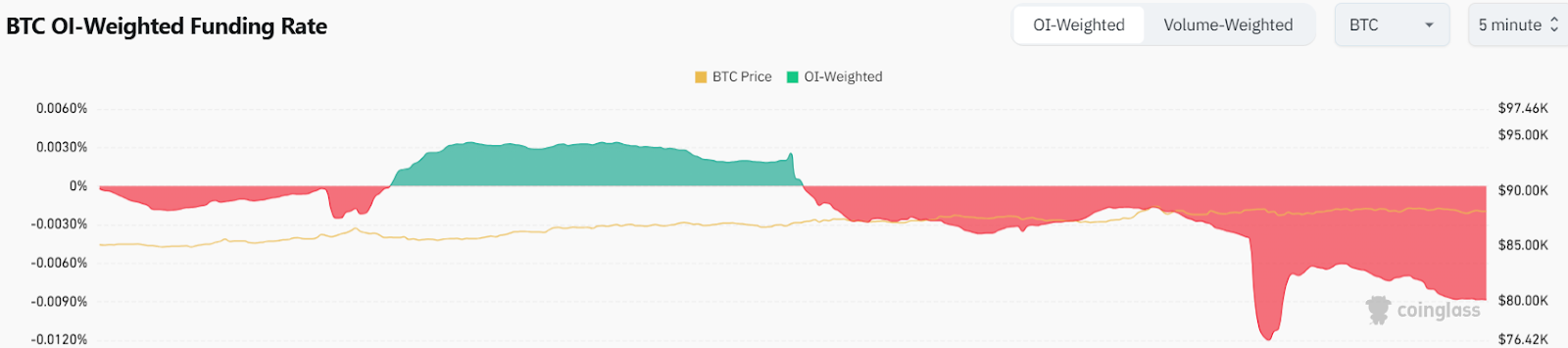

Additionally, Bitcoin’s public interest has skyrocketed 9.1%, reaching around $586.9 billion in the last 24 hours. However, Bitcoin’s funding rate is trading at -0.0088%, indicating that sellers could soon gain control. This helps sellers prevent ongoing purchase momentum.

Bitcoin Price Prediction: Technical Analysis

Bitcoin has gained strong buying momentum as it surged beyond its critical FIB level and surged beyond $88,000. Currently hovering at $88,520, a profit of around 4% over the last 24 hours, Crypto King has temporarily tested $88.7K to verify further profits.

Sellers will continue to push aggressively, aiming to lock BTC under a critical level of $90,000. However, buyers are not retreating easily and are preparing for another attempt to regain this critical threshold.

The Bulls push Bitcoin back past $90K could surge confidence, potentially paving a clearer path to the expected $95,000 milestone.

On the back, if buyers fail to gather convincingly in this critical zone, the BTC risks sliding even further, opening the door to a potential pullback to the $81,000-$85,000 area.

Bitcoin Price Prediction: What to expect next?

short term: According to BlockChainReporter, the BTC price may be aiming for $90,000. If you spike past that level, you may see $95,000. Meanwhile, $81K-$85K is in the lower range.

Long term: According to Concodex’s current Bitcoin price forecast, Bitcoin is expected to increase by 36.22%, reaching around $118,986 by April 23, 2025. Cincodex’s technical indicators reflect current neutral sentiment, but not in the last 30 days. Based on these predictions, CONCODEX suggests that it is currently a good time to buy Bitcoin.

Bitcoin investment risk

Investing in Bitcoin can be dangerous due to market volatility. Investors:

- Perform technical and chain analyses.

- We assess their financial situation and risk tolerance.

- Consult with your financial advisor if necessary.