Bitcoin today’s price is near $117,968 hovering, sandwiched between the formation of a narrow triangle just before a potential breakout. Over the past 72 hours, BTC has been firmly integrated between $117,000 and $118,700, with traders preparing for increased volatility. The current setup shows important inflection points as the vertices of the pattern approach.

What will happen to Bitcoin prices?

BTC price dynamics (Source: TradingView)

The four-hour chart shows Bitcoin price trading in a converging symmetrical triangle with dynamic support of around $117,000 and resistance of $118,700. The triangle’s top resistance is aligned with the previous supply zone between $120,000 and $121,600, but the lower limit of the structure coincides with the recent higher bass formed since July 25th.

In particular, parabolic SAR dots remain above modern candles, indicating weakness in the trend. However, BTC is able to repeatedly defend trendlines in ascending order, suggesting that the bull is still active within this compression. This structure points to an imminent breakout before August 1st, and the breakout direction could define trends for the next few days.

Why is Bitcoin price dropping today?

BTC price dynamics (Source: TradingView)

The price of Bitcoin is declining today because of the reason for the failed attempts to rebalance liquidity and break the $118,700 level. The 30-minute chart shows prices recently rejected from the top VWAP deviation band, close to $118,099. The RSI in this time frame remained neutral at around 51.3, indicating a loss of momentum after the previous uptrembling, although neither extreme extreme nor sold out.

BTC Derivative Analysis (Source: Coinglass)

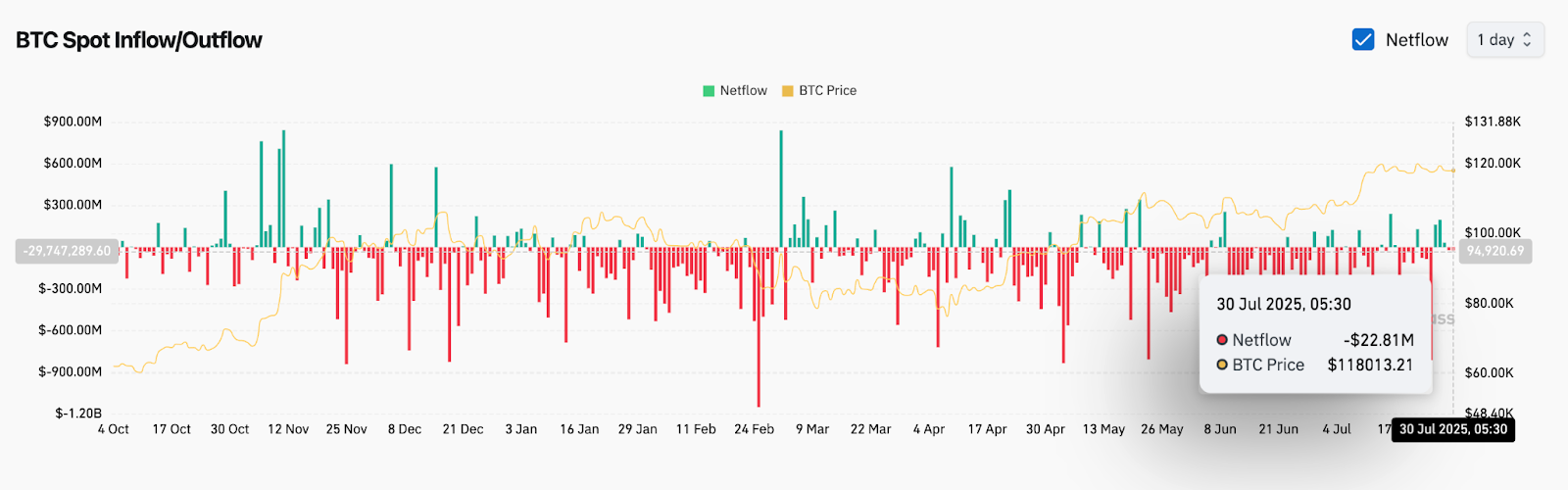

Furthermore, runoff pressure continues to control the chain. The latest Spot Netflow chart shows negative printing of $22.81 million on July 30, indicating that despite the price-holding company, capital is still ending its exchange. This difference suggests that retail or small institutional holders are profiting close to current levels of resistance, locking Bitcoin price action below $119,000.

Bollinger Band and Emma’s Signal Tightening Volatility

BTC price dynamics (Source: TradingView)

On the four-hour chart, Bollinger bands are beginning to squeeze prices, with the upper band at $119,393 and the lower band at $117,317. This compressed phase usually precedes directional movement. At the same time, BTC is sandwiched between 20 EMA ($118,150) and 100 EMA ($117,159), showing indecisive and balanced momentum.

All short-term exponential moving averages (20/50/100) remain clustered just below the price, indicating that trend support is not yet ineffective. The 200 EMA on this chart is $114,632, so it offers strong long-term support if the current triangle is split into negative aspects.

From a daily standpoint, BTC is still held above the last major breakout zone, close to $102,500, with the structure remaining bullish beyond the liquidity shelf of $114,000-$115,000.

BTC price forecast: Short-term outlook (24 hours)

BTC price dynamics (Source: TradingView)

Bitcoin prices are currently facing binary setups. Once the Bulls regain the $118,700 level with volume checks, they are rushing towards $120,500, allowing for a $121,664 resistance zone. On top of this, the next supply is close to $124,000. However, if you can’t hold $117,000, you could be exposed to $114,600 (200 EMA) and deeper liquidity zones to around $110,000-$112,000.

With volatility suppressed and RSI flats, and SAR pressure still above the head, we expect critical moves in the next 24-36 hours. Traders should monitor breakout candles that fall below $117,000 with volumes above $118,700, above $118,700 for clarity in direction.

Bitcoin Price Prediction Table: July 31, 2025

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.