After a rapid rally to a local high of $122,000 earlier this week, Bitcoin prices have entered the consolidation phase, trading nearly $117,300 at the time of writing. The broader trend remains bullish, but some technical signals in the lower time frame indicate fatigue. The Bulls need to defend the $115,000-116,000 zone to avoid a deeper setback.

Bitcoin Price Prediction Table: July 17, 2025

What will happen to Bitcoin prices?

BTC price dynamics (Source: TradingView)

On the daily charts, BTC has rejected its long-term rise wedge cap, with the latest candle forming a potential top wick of nearly $122,000. This zone coincides with the resistance formed by the upper trend line of the wedge, marking a third attempt at closure beyond the band between $121,500 and $122,500.

The 4-hour chart now brings prices back to EMA cluster support. The 20 and 50 EMAs are close to $117,496 and $115,454, respectively. The candle is formed with lower highs and lower closures after a failure from the upper bollinger band. Bitcoin price action has entered the typical volatility squeeze zone.

BTC price dynamics (Source: TradingView)

In the Smart Money Concepts Chart, BTC printed a new Choch (Change of Chocle) for around $117,000 after breaking its previous structure, suggesting a short-term change in trend bias unless it is recovered quickly.

Why is Bitcoin price dropping today?

BTC price dynamics (Source: TradingView)

The short-term revision of Bitcoin prices today is driven by both divergence and derivatives positions. The RSI on the four-hour chart brought a bearish fleeting at the top of $122,000, confirming a weaker buy strength, even as prices hit new highs. The RSI is currently at 51.34, approaching the neutral territory.

The MACD also turned red in the histogram bar and twitched the bareshes that passed under the signal line. These confirm the short-term loss of bullish momentum.

BTC price dynamics (Source: TradingView)

The 30-minute chart parabolic SAR and VWAP indicators show BTC transactions under session VWAP ($117,297), a SAR resistance point printed on the candle, and a downward pressure downward. A persistent denial from the $117,500 VWAP zone could open the door and do more downside probing.

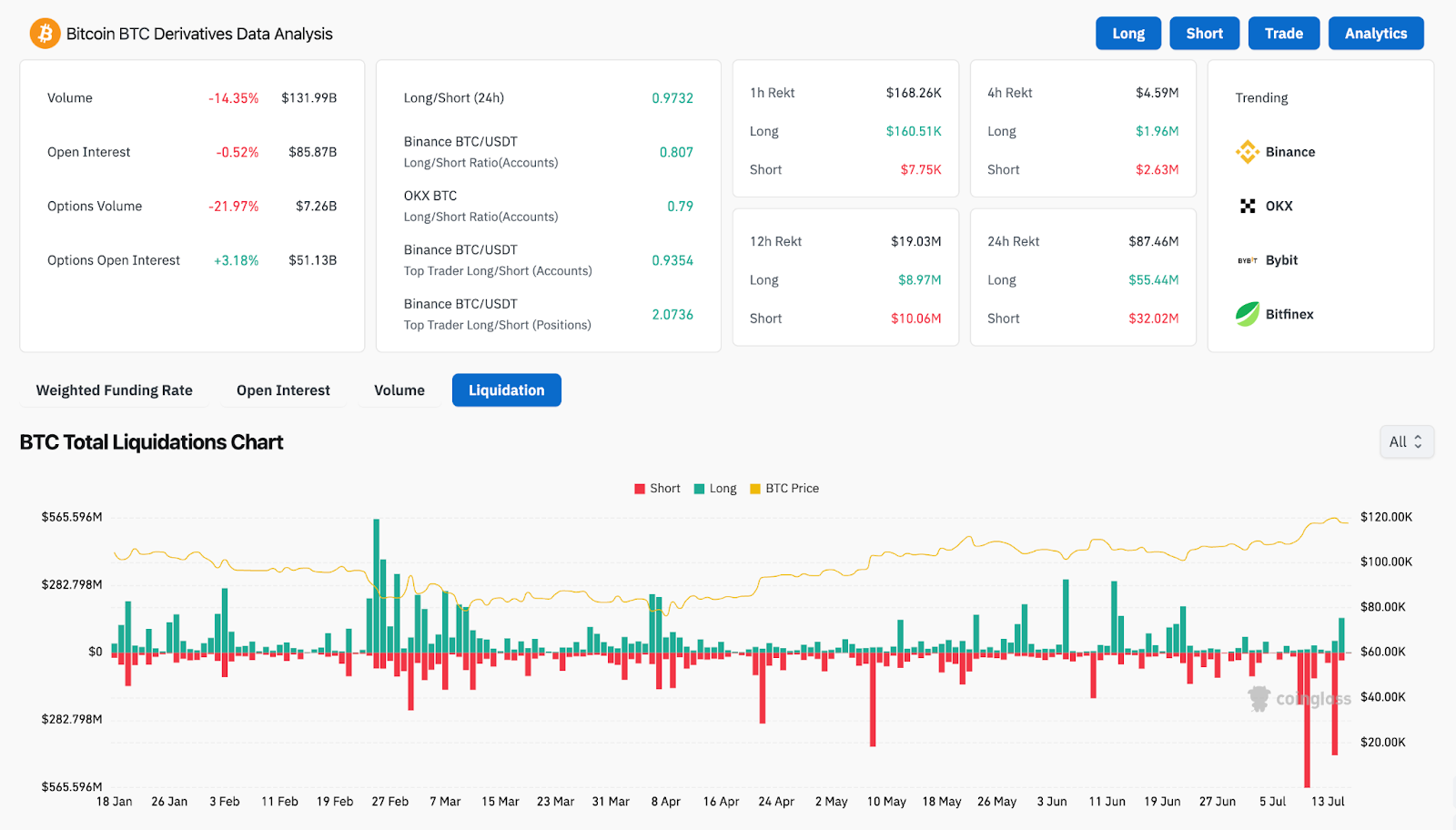

BTC Derivative Analysis (Source: Coinglass)

Meanwhile, derivative data reveals cooling emotions. According to Coinglass, the volume of total BTC options fell 21.97%, while open interest fell 0.52% over the past 24 hours. The long/short ratios across major platforms such as Binance and OKX are slightly skewed in favor of long, but the imbalance is reduced.

BTC option data (source: DELIBIT)

Options data for the July 25th expiration date show significant interest in the $117,000 and $118,000 strikes, suggesting a potential magnet zone.

Price indicators show squeeze setup and EMA retest

BTC price dynamics (Source: TradingView)

The 4-hour chart Bollinger band began compression after a failed breakout attempt. The BTC is currently sandwiched between the midband ($118,185) and the lower band nearly $115,098. This stricture setup will soon increase the chances of volatility expansion.

EMAS (20/50/100/200) shows a continuous bullish alignment, with prices still above 100 EMA ($112,767) and 200 EMA ($109,947). However, the candle has tested 20 EMAs from the bottom, indicating a trend towards weakening. If this area cannot be maintained, then the $114,000-115,000 zone will be exposed.

From a structural perspective, the rising wedge remains intact, but if it falls below $115,000 every day, the pattern is threatened and the bias shifts to neutral.

BTC price forecast: Short-term outlook (24 hours)

BTC Dominance Chart (Source: TradingView)

Bitcoin’s advantage is being pulled back from 64% after tagging the vertices of a multi-year triangle. Refusal suggests a short-term capital turnover into an altcoin. As long as the dominance exceeds 61.5%, BTC remains structurally strong. A breakout of over 66.5% confirms long-term leadership in the Bitcoin market.

For July 17th, Bitcoin prices could remain in the range between $115,000 and $118,500 unless a breakout or breakdown is confirmed in volume.

If BTC surpasses the $118,200 Bollinger midband in confirmation, the next resistance will be $120,500 followed by $122,000. However, failures in retrieval of VWAP and 20 EMA could invite a retest between $114,800 and $115,000. The breakdown from there is a risk of causing drops into demand blocks of $112,500, and even $110,000-$109,000.

BTC remains in an unstable retention pattern as MACD and RSI exhibit cooling bias and OI concentrations form nearly $117,000. Traders should monitor volume actions around the $116,800-117,500 zone for the next critical move.

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.