After spending nearly eight weeks within the shooting structure, Bitcoin price today reached $118,000, marking its highest level since early April. The breakout is supported by the Federal Reserve’s prospects for third quarter interest rate cuts as ETF inflows resume and systemic profits recover. Currently, engineers are entering the high momentary phase of BTC, indicating that its potential target is over $120,000.

What will happen to Bitcoin prices?

BTC price dynamics (Source: TradingView)

On the daily charts, Bitcoin prices are neatly split from the wide descending channel, which holds price action between $100,000 and $111,000. The July 10th breakout candle features strong body swelling and follow-through volume, confirming bullish intentions. BTC also recovered the 20/50 EMA cluster, far surpassing the bull market support band currently at nearly $109,250-$108,420.

This reverse resolution overrides the previous range and pushes the BTC into the new structural leg. $111,000 was caught up in support, and broader trend biases became aggressively bullish. The breakout also coincides with long-term ascending trendlines, strengthening the bull market structure from March onwards.

Why is Bitcoin prices rising today?

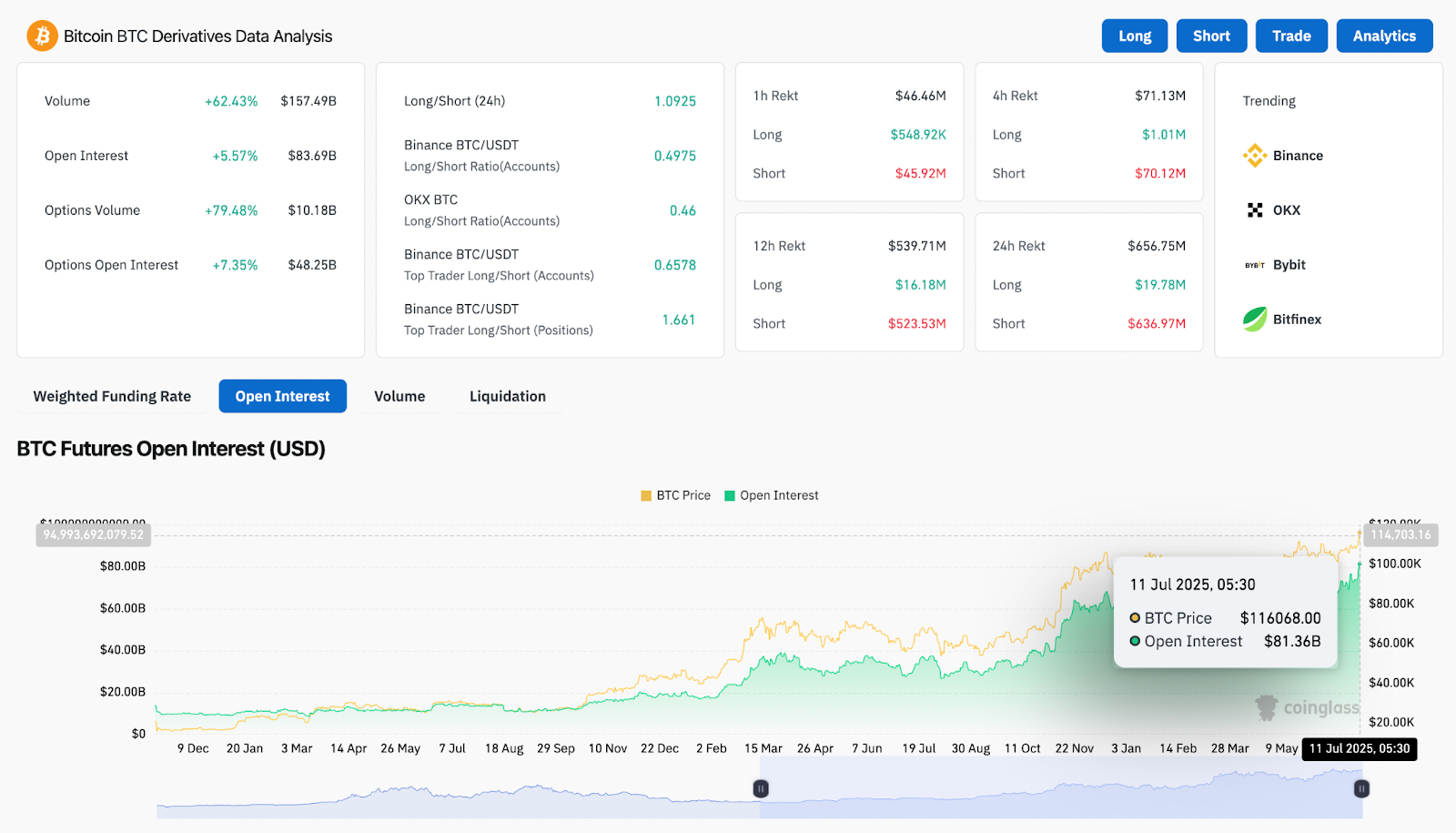

BTC Derivative Analysis (Source: Coinglass)

The main catalysts behind why Bitcoin prices are rising today are a combination of strong influx into spot ETFs, strengthened activity in the chain, and institutional purchase rights that anticipated the third quarter of the US Federal Reserve easing rate.

Derivative metrics show strong long biases. Open interest has increased by 5.57%, with 24-hour volumes increasing by 62.43%, and now totaling over $157 billion. Also, options volume has skyrocketed by nearly 80%, suggesting that traders are positioned for their continued advantages. The long/short ratio is skewed in favor of bulls beyond the binance (1.09), OKX, and bibit. Importantly, Binance’s top traders hold a long/short ratio of 1.66, indicating a conviction direction bet.

BTC price dynamics (Source: TradingView)

This bullish drive also appears on the Smart Money Concepts chart. BTC has broken structures above previous weekly highs (BOS), indicating a bullish macro transition. With liquidity currently being drawn out over $118,000, the next upward target could be between $120,000 and $125,000.

Continuation of momentum for Bollinger Band, RSI, and MACD signals

BTC price dynamics (Source: TradingView)

On the four-hour chart, Bollinger bands are actively expanding, pushing the upper band with Bitcoin prices close to $116,500. Prices are currently trading in a strong volatility expansion phase, often associated with trending breakouts. 20/50/100/200 Emma is all stacked below prices, with the nearest dynamic support coming close to $111,870.

BTC price dynamics (Source: TradingView)

RSIs are rising sharply on the 30-minute chart 79.6Not only does it indicate the conditions for over-purchase, but it also shows strong opposite momentum. The MACD is very bullish, with signal lines expanding aggressively and histograms printed green bars. There are currently no divergent signals. In other words, the momentum remains the same.

BTC price dynamics (Source: TradingView)

Meanwhile, VWAPs in the lower time frame have been collected and maintained, confirming that buyers controls exceed $116,500. The parabolic SAR and supertrend indicators are completely bullish inverted, with both the band and the dots placed far above each.

BTC price forecast: Short-term outlook (24 hours)

As long as Bitcoin prices exceed $116,000-$116,500, the bias remains. The immediate goal is $120,000, where psychological resistance could potentially create daytime volatility. A critical breakout above this threshold could open a path to $122,800 and $125,000 to match the weekly liquidity extension.

On the downside, support is at the previous range high of $111,000, followed by an EMA confluence zone between $109,000 and $108,000. Failures under this zone will disable breakouts and suggest a deeper retest.

Given current volume profiles, trend indicator alignments, and strong institutional support, BTC appears poised to hold breakout zones in the short term, but intraday pullbacks to support should be monitored for trapwick or resuspension zones.

Bitcoin Price Prediction Table: July 12, 2025

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.