After a series of failed retests of nearly $116,000, today’s Bitcoin prices are held just above the short-term support zone of around $114,000. The broader trend remains within the upward channel, but prices have entered a phase of tightening volatility. Several indicators are flashing indecisiveness. With weaker momentum but unharmed support, BTC may be preparing for directional movement.

Bitcoin Price Prediction Table: August 6, 2025

What will happen to Bitcoin prices?

BTC price dynamics (Source: TradingView)

In the daily time frame, Bitcoin continues to trade within the broad upward channel structure formed since April. After peaking nearly $123,000 in July, Price was pulled back to the midline of the channel, and now floats just above the $114,000 zone.

The latest candles show that BTC is bounced back dynamic trendline support within the channel, indicating that buyers are still following this structure. However, prices close between $116,000 and $118,000 under the resistance trend line and horizontal supply zone.

This confluence resistance is added more weight as a breakout attempt of nearly $121,600 failed last week. Downside support is nearly $111,000, followed by $103,500. The latter coincides with the March breakout zone and Fibonacci retracement levels.

Why is Bitcoin price dropping today?

The reason for the price of Bitcoin is falling today is due to its weakening momentum beyond multiple daytime charts and sustained resistance.

BTC price dynamics (Source: TradingView)

The 4-hour chart shows price action narrowing downward trends. Parabolic SAR dots exceed prices of nearly $113,750, confirming short-term bearish pressure. Despite the integration, the volume remains sluggish, suggesting that traders are waiting for confirmation before committing to a new position.

BTC price dynamics (Source: TradingView)

The SuperTrend indicator flipped the bears at $116,155, creating a ceiling of short-term resistance. Meanwhile, the Directional Motion Index (DMI) indicates -DI reading while ADX is beginning to rise. This structure is usually in line with downward pressure.

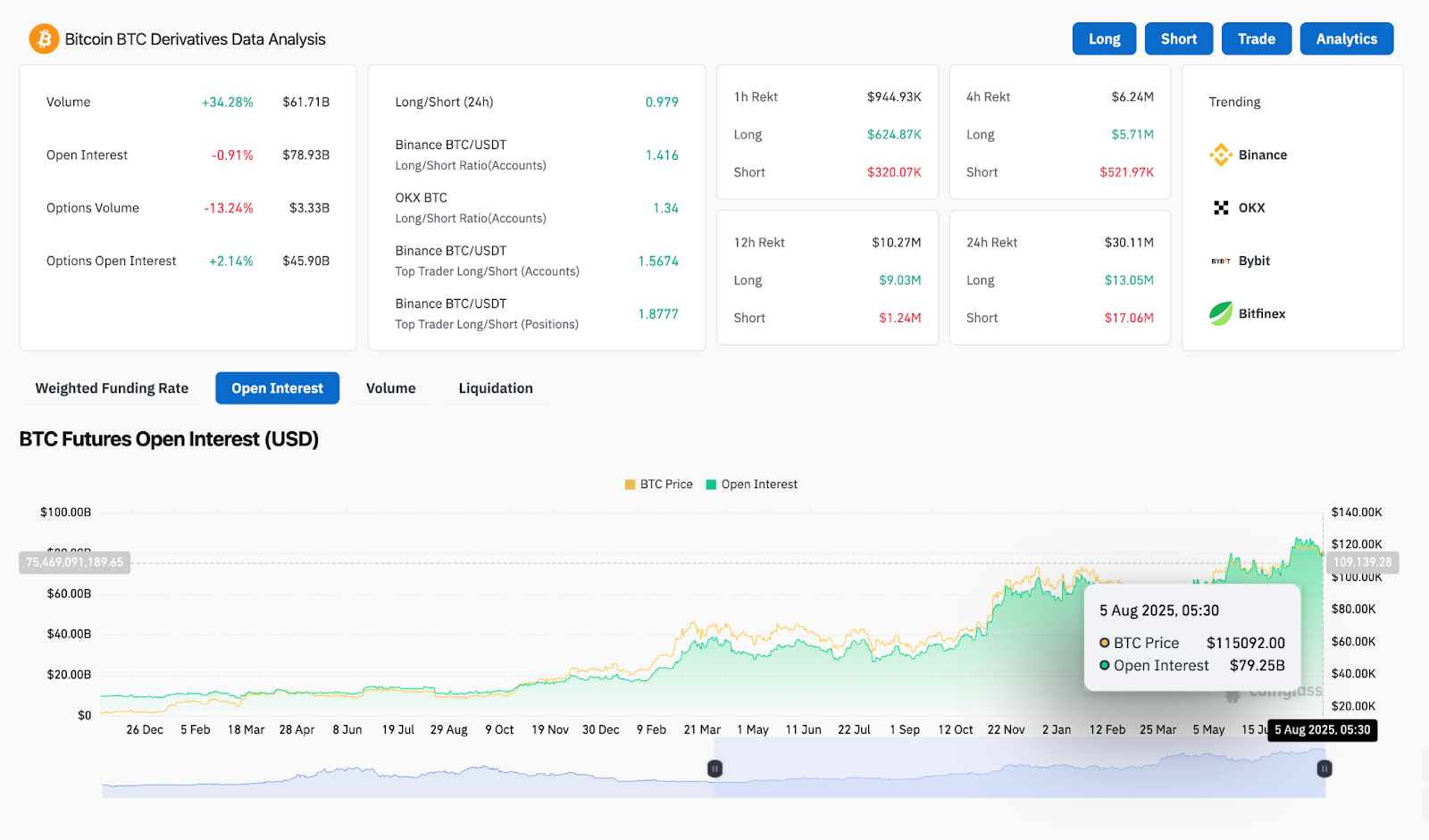

BTC Derivative Analysis (Source: Coinglass)

From a derivatives perspective, open interest has declined by 0.91% over the past 24 hours, while the amount of options has also decreased by more than 13%. This suggests a decrease in speculative activity. The 24-hour volume rose 34.28% to $61.7 billion, but the long/short ratio is below 1.0. Binance’s top trader position shows a long/short ratio of just 0.979, reflecting careful sentiment.

RSI, MACD, VWAP signal range bias before breakout

BTC price dynamics (Source: TradingView)

The 30-minute RSI is soaked in 41.8, below the neutral 50 level for the majority of the session. This indicates that the bear is still exerting control, but not a belief. MACDs on the same chart are in negative areas where histograms are reduced, further suggesting slow momentum.

BTC price dynamics (Source: TradingView)

The VWAP band is beginning to shrink again, with prices slipping under the midline at both the $114,665 and the upper envelope. This suggests a small denial close to $114,900, meaning that if sellers regain pressure, BTC could test the lower limit near $113,600.

The True Strength Index (TSI) is deep in red at -13.25, but is beginning to flatten. An upward cross can indicate base formation when confirmed by volume. For now, the strength of the daytime trend remains weak.

BTC price forecast: Short-term outlook (24 hours)

As long as Bitcoin is above the $113,500-$113,750 band, the short-term structure will remain neutral. However, without a clean landfill of $116,200, the Bulls risk losing control of the channel’s trendline drop.

If BTC falls below $113,000 on volume, the next logical support will be $110,000, following $111,976. A sharper breakdown could ultimately push the price to $103,500.

The advantage is that if Bitcoin clears $116,155 (Super Trend Flip) with a sustained volume, the price can revisit $118,000 and challenge a macro resistance of nearly $121,600. However, without momentum and substantial support, such a breakout will remain unlikely for the next 24 hours.

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.