What will happen to Bitcoin prices?

BTC price dynamics (Source: TradingView)

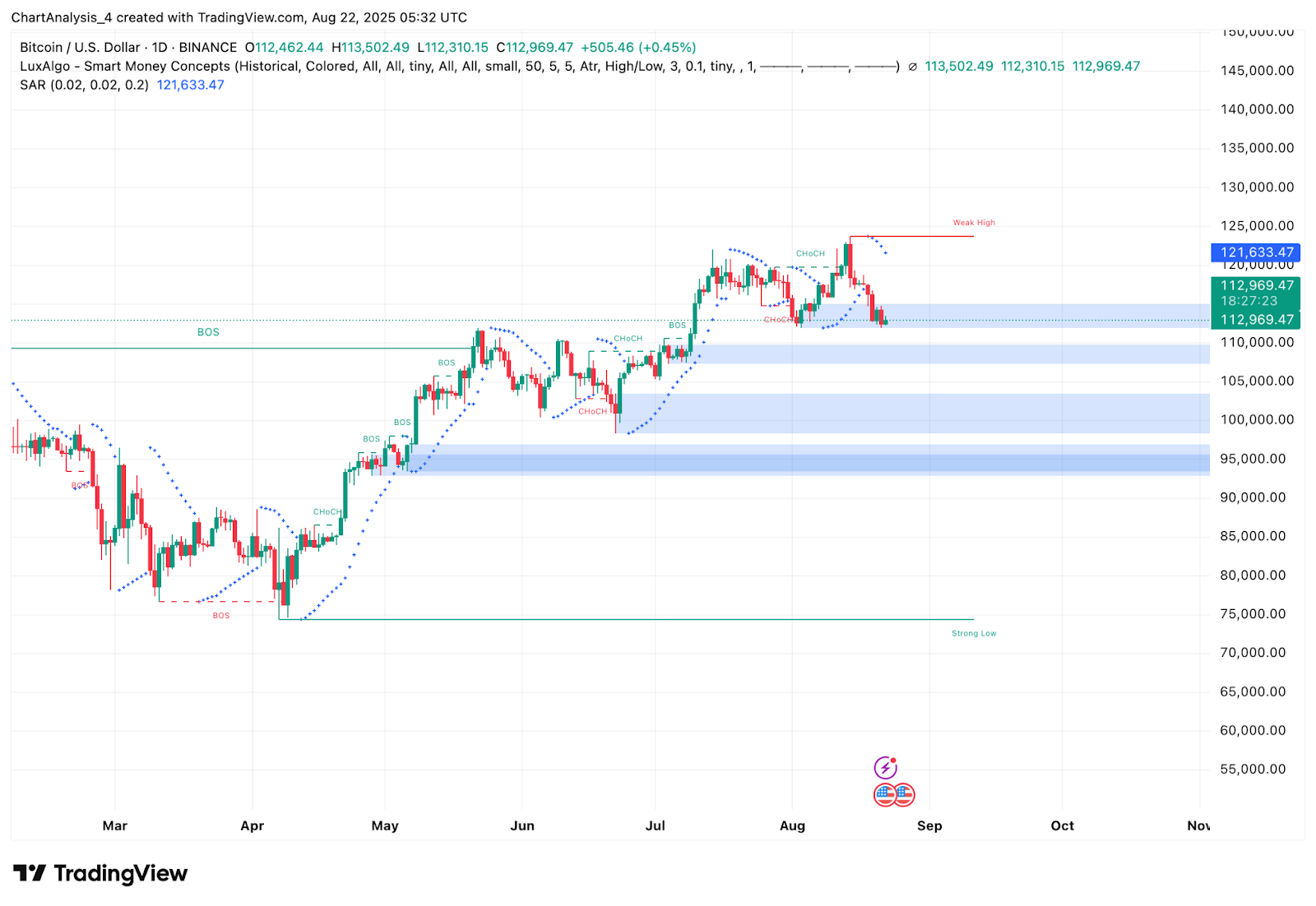

Bitcoin prices today are around $112,980, up just 0.1% after a volatile week in which the pair slipped off a high of nearly $121,000. The BTC is still in a parallel channel that rises in the daily time frame, but is currently testing the lower boundary of that channel. Since April, the channel floor around $112K has been a key area of demand. If the price breaks below it, it drops further to $108,000.

BTC price dynamics (Source: TradingView)

The Smart Money Concept shows a signal of repeated changes (chock) in the character (chock) around the $120K level, indicating fatigue at the top. Currently, prices are locked above the main liquidity zone between $111,800 and $113,200, suggesting limited momentum in the short-term stability.

Why is Bitcoin price dropping today?

BTC price dynamics (Source: TradingView)

The combination of technical and on-chain signals is to blame for the recent decline in Bitcoin prices. BTC has been increasing bearish control with its supertrend indicators below $115,500 on the four-hour chart. The Directional Motion Index (DMI) indicates that the -DI line is well above the +DI line, indicating that ADX is rising.

BTC price dynamics (Source: TradingView)

At the same time, the 20/50/100 EMA on the 4-hour chart is stacked above the price, with the 200 EMA serving as a $116,200 ceiling. The Bollinger band has confirmed this pressure, with the candles hugging the low band between $111,800 and $113,000.

BTC on-chain analysis (source: Coinglass)

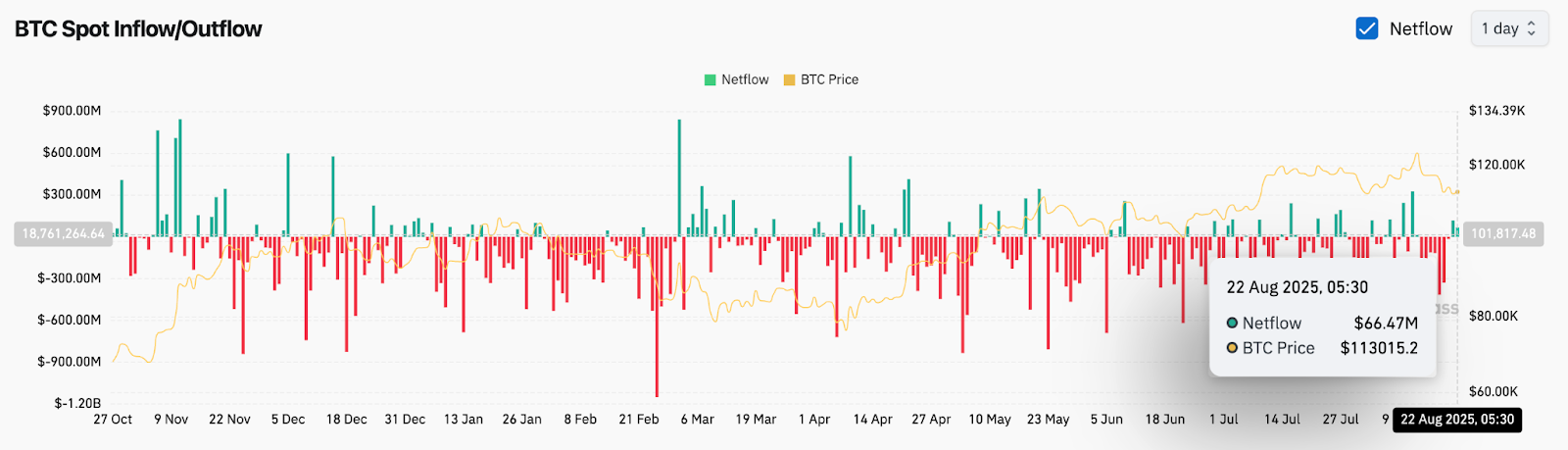

On-chain flow also shows that people need to be aware of it. Data shows a positive net inflow of $66 million on August 22nd. That means more money is being deposited in exchange. In the past, rising inflows when prices were falling were a sign of potential sales pressures.

The key indicator signals the compressed phase

BTC price dynamics (Source: TradingView)

The 30-minute daytime action on the chart shows that it integrates BTC under a descending trendline of nearly $113,200. RSI refers to neutral momentum after soaking at under 40 early in the session, recovering slightly to 52. The VWAP is closely aligned with the price, at $112,981, suggesting equilibrium.

This compression structure can precede sharp movements. A breakout over $113,500 can pull the aperture back to $115,000, but if you don’t hold $112,000, the slide opens towards $110,000 and potentially $108,500.

BTC price forecast: Short-term outlook (24 hours)

Over the next 24 hours, the Bitcoin Price Action will depend on whether the Bulls can go beyond the $112,000-$112,500 range. The stability here could result in rebounds of $113,800 and $115,500, but bearish adjustments at EMA and SuperTrend levels are in favor of sellers in the short term.

If BTC loses its $112,000 level, the next support will be $108,500, followed by a $110,800 cut in the stronger demand cluster. Conversely, a day closure over $115,500 disables short-term bearish bias and reopens to $119,000.

Bitcoin Price Prediction Table: August 23, 2025

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.